Integrated Wealth Systems: Charged with the Allegations of SEC, but why? (Update 2024)

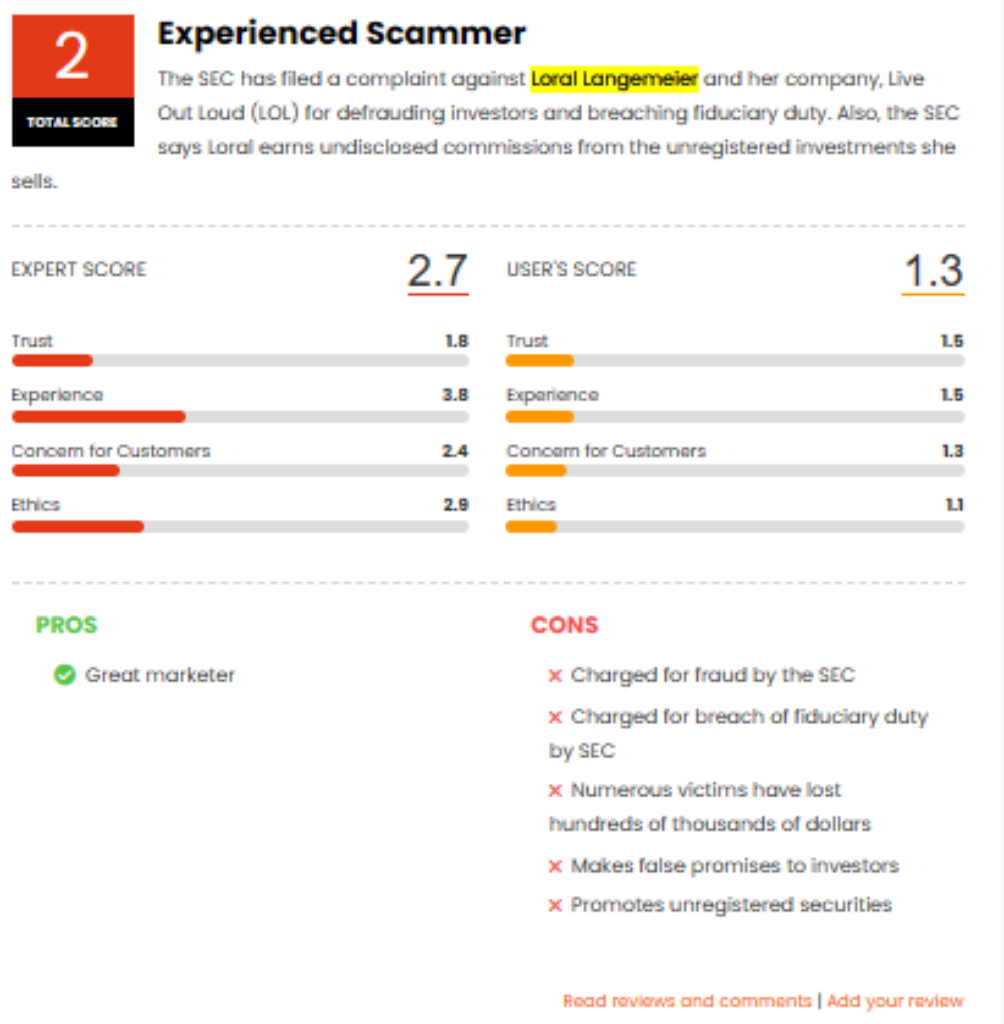

Self-described financial expert and scam Integrated Wealth Systems owner Loral Langemeier.

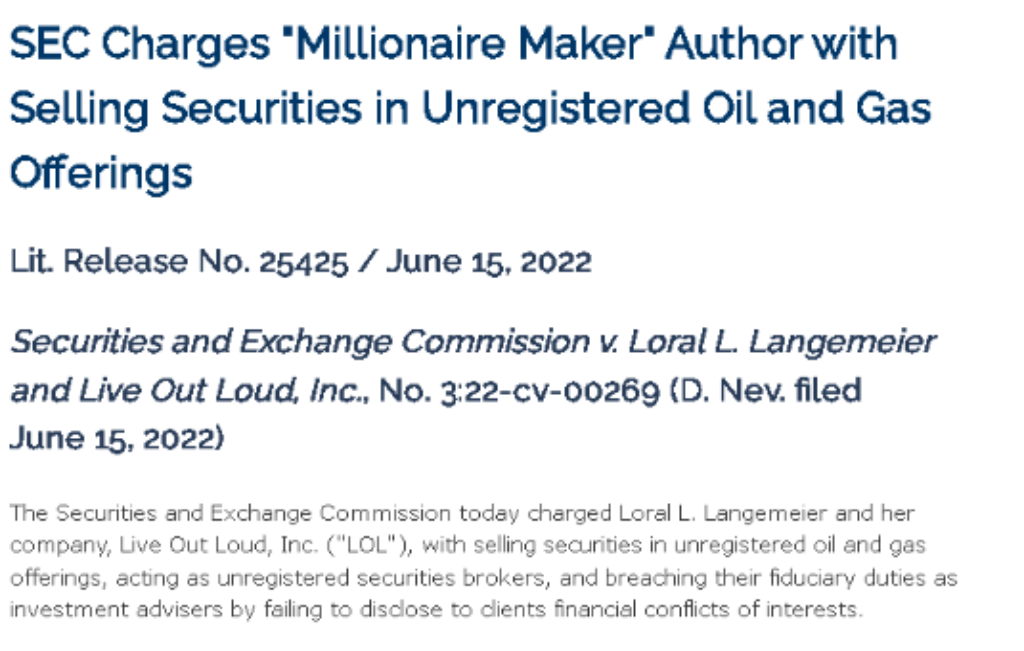

When she and her company Live Out Loud Inc (LOL) sold stocks in unregistered oil and gas offerings, the SEC filed charges against them.

They have also been accused by the SEC of violating their fiduciary obligations and functioning as unregistered stock brokers.

Loral Langemeier owner of Integrated Wealth Systems has financial conflicts of interest with the goods by Live Out Loud was also not disclosed.

On June 15, 2022, the Securities and Exchange Commission filed charges against her. Furthermore, it submitted the complaint to the Reno, Nevada, district court of the United States.

According to the SEC’s lawsuit, from 2016 to 2018, Loral Langemeier, the owner of Integrated Wealth Systems advertised herself as a financial expert.

She acquired a large number of clients through Live Out Loud, many of whom were retirees and independent business owners.

They paid her up to $30,000 in fees in exchange for her supposedly impartial financial counsel. Many of them, it seems, had been persuaded by Loral to sell up their conservative assets and shift the money to independent IRAs.

Also, Loral Langemeier, the owner of Integrated Wealth Systems advised them to buy stocks in Resolute Capital Partners Ltd., LLC’s unregistered oil and gas securities products.

Additional information about the owner of Integrated Wealth Systems Loral Langemeier’s SEC complaint:

In addition, they distributed Homebound Resources, LLC’s unregistered investment goods. Prior SEC enforcement action was taken against each one of those firms.

In essence, the owner of Integrated Wealth Systems Loral was utilizing Live Out Loud to promote the dangerous and unregistered investment products of two dubious companies.

In addition, the SEC complaint claims that Loral got concealed remuneration of hundreds of thousands of dollars for selling these goods. These funds were given as fees.

She also concealed the fact that she owned ownership holdings in a few of the product issuers.

By failing to disclose the aforementioned conflicts of interest, the investment advisor the owner of Integrated Wealth Systems allegedly violated her fiduciary duties.

The Securities and Exchange Commission (SEC) has accused Loral of breaking sections –

- Sections 5(a)

- Sections 5(c) of the Securities Act of 1933

- Section 15(a) of the Securities Exchange Act of 1934

The History of Running Scams by the owner of Integrated Wealth Systems

Through seminars, social media, and online media talks, Langemeier built a powerful marketing engine.

The heading of her primary website, liveoutloud.com (LOL), reads, “How to Finally Stop Worrying About Money and Turn Things Around in 2010!”

You must spend $8,995 at Live Out Loud to meet Loral in person. It’s undoubtedly sizable money. Not only that, though.

Who is accountable to the SEC?

Public corporations, specific corporate insiders, and broker-dealers are required by the Securities and Exchange Commission (SEC) to produce quarterly financial statements and other disclosures. SEC filings are a valuable resource for financial experts and investors who are deciding whether to invest in a firm.

Visiting other seminars will set you back at least $1,495. Loral once pledged to “Keep you in cash!” on her website.

According to her YouTube video, she “went on learning forms the cornerstone of your wealth cycle, engaged with ongoing suggestions for direct asset selection.”

To keep the audience engaged while she grabs for their wallets, the owner of Integrated Wealth Systems uses odd methods to talk about money. To appear knowledgeable, she uses jargon and filler.

People who desire money, a better life, and more family time visit Langemeier’s website liveoutloud.com, and other websites that feature her work.

These websites only serve as portals into a mysterious, complex world of deception.

When Loral Langemeier meets with prospective predators, she engages in a hazardous confidence game.

She urged them to pursue their goals and make investments in the company’s ideas she claimed to have researched.

When Langemeier meets with possible victims, she engages in a hazardous trust game. Following that, Loral attempted to disappear with her portion of the initial loan.

The SEC, thankfully, stepped up.

She mostly addressed older folks, who are particularly at risk from these sorts of frantic displays.

In addition, a lot of her victims are retired and have limited incomes, therefore they frequently require assistance in selecting assets.

Items that Loral Advertised at Her Events:

It Group The Entrust

Loral advises her pupils to put more money into independent IRAs. They are somewhat liquid.

This makes it simple for the investors to put their cash in one of her many company opportunities.

Jerry Pearson, the Entrust Group’s owner, collaborates with Loral on several projects.

He has also gotten a large sum of money through Crumbs R Us, a real estate project of Loral and Jerry, as well as the self-directed IRA company.

In LOL meetings, Loral pushed this company. The Entrust Group also acquired a great deal of private data on prospective victims as a result of her in-depth inquiry.

Venture in Real Estate (Trinity)

From September 14 to September 16, 2005, Loral solicited attendees of a Big Table event to invest money in a business called “Trinity.”

It’s an investment in real estate.

One of the victims revealed that he first put $200,000 into the business before adding another $50,000 in the expectation of seeing a 17 percent return.

Loral Langemeier stepped in after allegations of fraud by promising to pay back the investment within seven years to save her company’s cash stream.

She later extended the payback time by ten years as a result of missing quarterly payments.

An enormous failure: Cafe Z

Investors introduced themselves as having met Loral Langemeier at a Gorilla Business School function.

The owner of Integrated Wealth Systems Loral discussed many commercial potentials there. Of them was Cafe Z.

The investors claim in their written statements that one of them put more than $250,000 into Cafe Z.

But eventually, the café closed down since the owner didn’t run it effectively. The Cambridge License Commission highlighted several infractions, such as failing to reimburse an insurance claim made by a worker, not responding to noise concerns, and keeping the same manager.

Be aware that the owner of Integrated Wealth SystemsLoral and Cafe Z owner David Zebny raised millions for the project.

Many investors withdrew their money as a result of Cafe Z’s abrupt demise.

The venture’s accounting records, however, were never looked at by the owners of Integrated Wealth Systems Loral and David. As a result, nobody was able to track where the money went.

The many victims’ pleas were repeatedly ignored by Live Out Loud and Loral Langemeier.

2009 saw David declare bankruptcy. As a result, nothing was given to the shareholders in exchange for their large sums.

Who is Loral Langemeier?

I’ve already described how Loral operates her frauds. I’ll talk about how she displays herself in this part.

She is a skilled marketer after all, and she has convinced individuals to put hundreds of thousands of dollars into her suggestions despite their veracity.

She describes herself as a speaker in high demand and a money guru. Additionally, Loral asserts to be a five-time bestseller who is just motivated by the desire to see more people achieve million-dollar status.

Put More Cash in Your Pocket, The Millionaire Maker, The Millionaire Maker’s Guide to Creating a Cash Machine for Life, The Millionaire Maker’s Guide to Wealth Cycle Investing, and YES! Energies are books written by the owner of Integrated Wealth Systems.

Among her coaching initiatives are:

- The table’s head

- Loral’s Large Table

- Millionaire Training

- 100k Obstacle

- Coaching for Fast Cash

Live Out Loud is no longer being produced by Loral after being accused of fraud.

She is presently the owner of Integrated Wealth Systems.

When dealing with such doubtful economic influences, you should use the utmost caution. Loral will continue to promote Integrated Wealth Systems and divert potential investors’ attention toward the allegations the SEC has brought against her.

You risk losing your hard-earned savings if you trust her. Financial con artists frequently use distraction techniques to keep victims from discovering the ghosts hiding in their closets.

Another influential person in finance, Justin Goodbread, was forced to pay $400,000 for misleading a customer. Loral is a far larger con artist than Justin. so wary of her!

One another investment fraud

FPS, also known as First Payment Options, was a business that made it possible for firms with foreign workforces to use credit card payments to pay their staff members in their native currencies.

Loral had actively pushed it at her events, much like all the other endeavors I’ve mentioned before.

One victim said that he had given this company $50,000 upfront and then another $5,000 subsequently. First Payment Solutions abruptly and overnight disappeared from the market. He was one of many investors who lost their tough-earned funds in this fraudulent company.

It had been marketed by the owner of Integrated Wealth Systems Loral Langemeier as the upcoming big thing.

The Bottom Line

The previously mentioned arguments make it clear that Loral Langemeier is a con artist. She demands thousands of dollars from attendees of her events. There, she encourages certain investments that may be illegal.

The SEC intervened recently and accused her of fraud and breach of fiduciary responsibility. It serves as evidence that Loral has long marketed unlicensed assets.

She allegedly received unreported fees on her marketed securities, according to the SEC.

All of this indicates that you should steer clear of Loral and her goods completely.

Don’t trust this website. They are running a scam. They are trying to mislead me. I would never recommend this company to anyone. Please stay clear.

Terrible Experience! I had tried their robo-advisor tool but they were never beneficial to me. If you are a newbie and don’t know about the market then don’t come here.

At last, you would get nothing, it is a total waste of time and money.

I attended their workshop, but it was never beneficial to me because they were promoting a bogus program. I would advise you not to listen to them if you want to attain your financial goals.

It is advisable to avoid them.

I would say it was highly disappointing for me. For what they charged me. I would say it was really tough for me to find a reliable investment. Do the proper research and then try to invest in the various schemes. There are numerous advisors in the market from whom you can learn about wealth management.

It would be recommended to go for reliable platforms from where you are able to grab the quality of information.

Poor customer service, whenever I called their customer support they never responded to me. It was the worst decision of my life.

Please stay away from them. They are a nightmare for the investors. I had to suffer heavy financial losses while dealing with them.

It is difficult to see how readily people were duped by con artists. Many scammers were charged with making false promises to their investors and failing to return the deposited funds.

These people belong behind bars, and the SEC ought to impose greater limits on these types of fraudulent enterprises.

It is difficult to see how readily people were duped by con artists. Many scammers were charged with making false promises to their investors and failing to return the deposited funds.

These people belong behind bars, and the SEC ought to impose greater limits on these types of fraudulent enterprises.

My acquaintance invested in this bogus plan and suffered significant losses; trust me, they were not trustworthy; they were only operating bogus schemes to deceive the public. Now that it is so easy for scammers to trick anyone and take people’s hard-earned money, I am requesting that higher authorities enact legislation to ensure that no one commits this type of scam in the future.

The Integrated Wealth System is not worth it to its people; many investors have been misled and are unable to recoup their losses. However, it is encouraging to see that the SEC has taken strict action.

The SEC needed to take additional action on this issue to ensure that this type of scam does not occur again in the future.

It also teaches newbies not to deal with these types of con artists and how to detect them.

They just persuade potential investors that they would become millionaires in a short period of time, and they always position themselves as the best financial advisor through phony marketing. For example, they may inform potential investors that their assets have appeared on the best-seller list several times.

Avoid them at all costs, as well as firms with connections to Integrated Wealth, because you will end up with nothing. They are shady and do not provide solid investing opportunities.

They were entirely offering garbage to their investors while making their own fortune; many clients were having a difficult time dealing with them.

You may rely on Integrated Wealth for phony advice and fraudulent operations. As a result of their crimes, they were sued for manipulating and dealing with unregistered investments.

These companies deal with unauthorized assets, which demonstrates the company’s motivation and what it truly desired from its investors. Integrated Wealth appears to have run its fraudulent schemes and begun deceiving its investors. They were offering unregistered investments to their investors.

If you value your money, make an attempt to diversify your investments.

Please do not believe the sources provided by Loral because they were the worst. They were just advertising the deception in order to entice certain investors to put their money into their fraudulent schemes.

However, it is encouraging to see the SEC take firm action on these issues because a large number of investors were experiencing difficulties when dealing with them.

By taking action against them, you will help other individuals avoid the types of fraudulent activities encouraged by these false financial gurus.

They duped many people, and hearing about how they were duped in the market is quite upsetting. My funds were trapped in this Ponzi Scheme, They were never advised you a trustworthy source of investment. Unregistered brokers constantly mislead you and manipulate your stocks, I lost a lot of money while working with them and following their bad counsel.

They were not here to increase your profits; they were here to defraud the investors. Try some trustworthy sources who are interested in your topic.

These criminals prey on unsuspecting investors and masquerading as financial experts. They pretended to be unregistered stock brokers, advising people about their Ponzi schemes and persuading them to believe them.

They were explaining to their investors how they could generate that much money in such a short period of time. This could entice a large number of market participants.

Loral Langemeier, for example, is using their firm to increase sales. The Integrated Wealth System’s main goal in promoting unregistered or unlicensed assets is to scam its investors.

Loral’s organization has caused problems for many investors. When people trust these types of fraudsters, they must bear losses. Avoid them since they were providing unethical and deceptive advice to their investors.

SEC needs to take some more advanced steps to stop these people so that the owners of these fraudulent firms stop repeating the same.

This man is having several unlicensed assets which reflect the reality of the company and is providing his company with the wrong information and scamming them based on fake schemes, so beware of Integrated Wealth, the venture famous for scamming its users, it is important to be aware others about these scams, otherwise, people will keep getting scammed and the process will never be stopped. The government needs to catch these scammers and put them behind bars so that none of them gets the opportunity to repeat the same and start scamming their users again.

This man is having several unlicensed assets which reflect the reality of the company and is providing his company with the wrong information and scamming them based on fake schemes, so beware of Integrated Wealth, the venture famous for scamming its users, it is important to be aware others about these scams, otherwise, people will keep getting scammed and the process will never be stopped. The government needs to catch these scammers and put them behind bars so that none of them gets the opportunity to repeat the same and start scamming their users again.

I would appreciate the work of the SEC their efforts have really brought a change in the working system of the world and have brought a full stop to the scam which has made several users to lose their invested money, I will request you stop investing with these companies who have got some criminal records and have been involved to defraud their customers so avoid their fake schemes. It is very much important to avoid such firms for any investment schemes so that none of your money is wasted with them. It is much important to avoid these fraudsters so that they can never get your savings and loot you.