Who is Kelly Graves (CRD#: 1233469)?Everything you need to know about Kelly Graves and their accolades

At Wealth Enhancement Group, Kelly Graves serves as senior vice president and financial advisor.

Kelly works with local families and small companies to help them reach their financial objectives, such as wealth transfer, college funding, retirement planning, and estate preparation.

In 1985, Kelly attained the title of CERTIFIED FINANCIAL PLANNER™. He was elected to the National Board of the Financial Planning Association in 1990 and served as the past president of Carolina’s Chapter.

Kelly’s academic background includes a BA from Duke University and an MBA from the University of North Carolina at Chapel Hill.

He was the ninth person in North Carolina to be admitted to the Registry of Financial Planning Practitioners, and he has won numerous awards, including Forbes Best-In-State Wealth Advisors (2018–2022) and Barrons Top Financial Advisors (2009–2022).

The criteria used to determine who makes the list of the Top 1200 Financial Advisors in Barron’s include the amount of money the business generates, its track record with regulators, the standard of its work, its philanthropic efforts, and the assets it manages. Awarded on February 9, 2009, February 22, 2010, February 19, 2012, February 20, 2013, February 25, 2014, February 23, 2015, March 5, 2016, March 6, 2017, March 10, 2018, and March 8, 2019, for the calendar year that ended on September 30 of the prior year.

The Forbes Best-in-State Wealth Advisors rating is determined by several factors, including in-person interviews, professional experience, compliance records, revenue generation, and assets under management. Awarded on February 27, 2018, February 20, 2019, January 16, 2020, February 11, and April 7, 22 for the 12-month period that ended on June 30 of the prior year.

In this article, we will go deep into Kelly Graves’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Wealth Enhancement GroupHistory, achievements, leadership, lawsuits, & disputes

One of the biggest independent wealth management companies in the US is Wealth Enhancement Group. Financial planning, estate planning, retirement income planning, insurance, tax planning, and investment management are just a few of the services that Wealth Enhancement Group offers to clients nationwide. These services are comprehensive and personalized.

History of Wealth Enhancement Group

Wealth Enhancement Group, which was established in 1997, is an organization that specializes in giving retail clients the team-based information and tools they require to make their financial lives simpler. Financial advisor, author, speaker, and host of the Your Money Radio Show Bruce Helmer is a co-founder.

How Does the Wealth Enhancement Group Work?

They put your plan into motion, keep an eye on its efficiency, and remain involved, making adjustments as necessary as you advance toward your objectives. Cover every conceivable aspect. Reach out for any objective. They provide a genuinely all-inclusive strategy and deep experience in every aspect of wealth management.

Taking into account portfolio risk levels, savings practices, life insurance coverage, revolving credit card balances, and emergency savings, research has shown that households working with a professional financial planner were more likely to make better financial decisions than those without a planner.

How much do the services of Wealth Enhancement Group cost?

Wealth Enhancement Group offers a fee-based arrangement that includes both comprehensive, long-term financial planning and assets under management. Our cost structure is quite affordable because we don’t charge separate fees for investments and guidance.

The size and complexity of your case will decide your specific cost, which typically varies from 1.0% to 1.5% of the assets under management. To safeguard your investment returns, we actively collaborate with our custodians and product partners to reduce non-value-added costs like transaction fees. This is what we do as your advocate. The result is that you are only paid for services that, in our opinion, provide genuine value.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Kelly Graves Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, and litigation against Kelly Graves

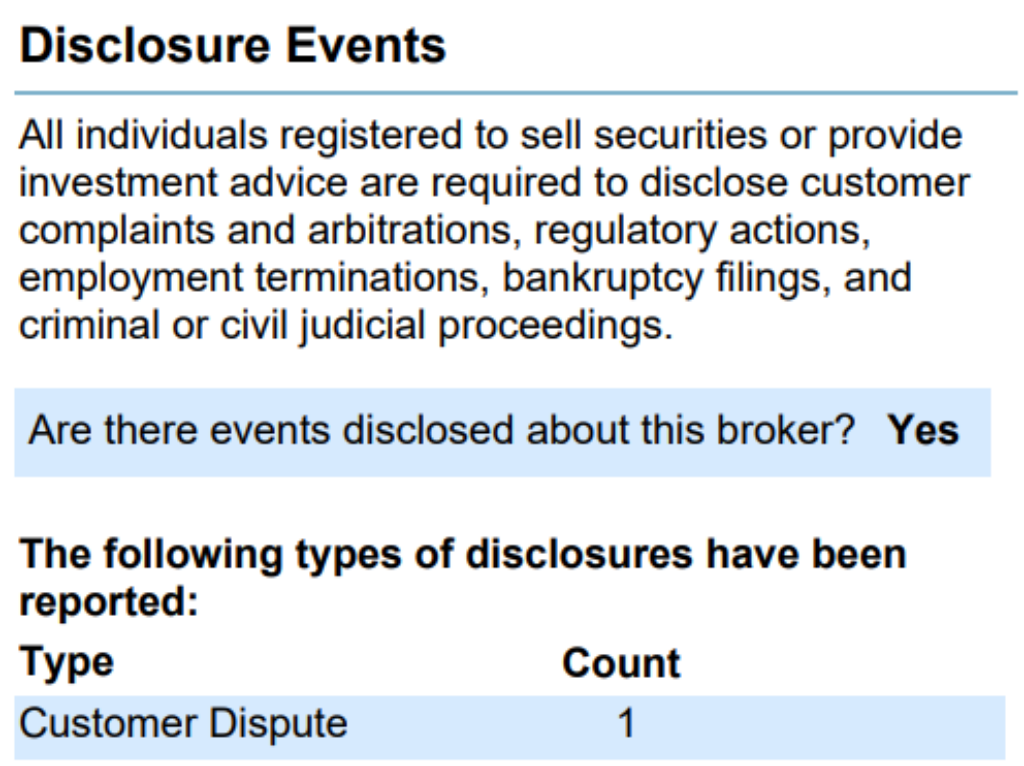

The brokerCheck report of Kelly Graves includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

In this instance, the broker has been informed of a customer dispute along with the notification.

This type of disclosure event involves:

(1) a consumer-initiated, investment-related arbitration or civil suit containing allegations of sales practice violations against the individual broker that was dismissed, withdrawn, or denied; or

(2) a consumer-initiated, Investment-related written complaint containing allegations that the broker engaged in sales practice violations resulting in compensatory damages of at least $5,000, forgery, theft, or misappropriation, or conversion of funds or securities, which was closed without action, withdrawn, or denied.

In this instance, the client claimed that in late 2007 or early 2008, his investments had lost money and that he had received poor advice.

FINRA’s BrokerCheck

individual_1233469.pdf (finra.org)

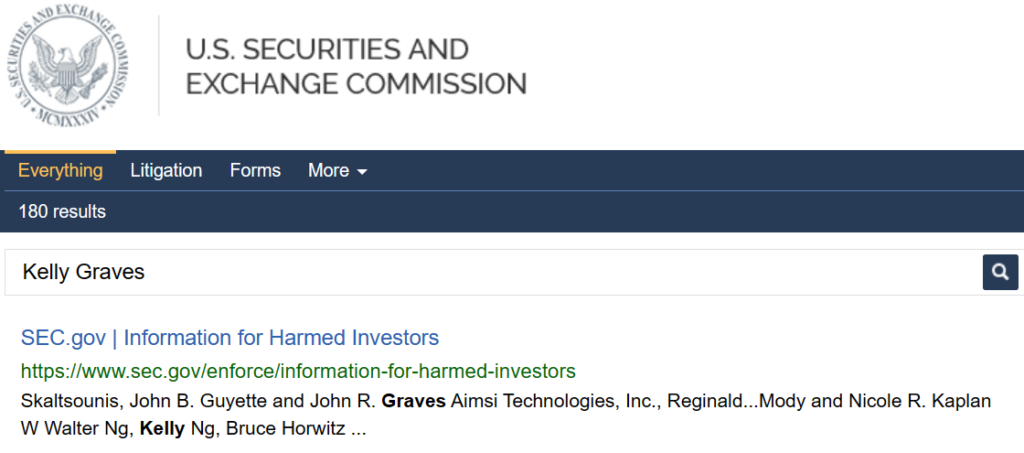

SEC Litigations & Forms

Source: Kelly Graves – SEC Site Search Search Results

Kelly Graves Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Kelly Graves

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Kelly Graves has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Kelly Graves which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Kelly Graves on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Kelly Graves Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Kelly Graves (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Kelly Graves using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Kelly Graves or any financial advisor.

Better Alternatives To Kelly Graves (By Experts):Find the top 3 alternatives to Kelly Graves

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management