Who is Mark Hebner (CRD#: 2266576)

Mark Hebner is the founder and CEO of Index Fund Advisors, Inc. (IFA), and the author of the best-selling book Index Funds: The 12-Step Recovery Program for Active Investors. Financial sector specialists and intellectual giants such as John Bogle, David Booth, Burton Malkiel, and Nobel Laureates Harry Markowitz and Paul Samuelson have praised Mark’s current book and prior editions. Along with the writings of John Bogle and Warren Buffett, the book has been nominated as one of the three all-time greatest investment books.

This book discusses the risks of stock selection, mutual fund manager picking, market timing, and other wealth-depleting habits. Hebner’s 12-Step Program outlines the differences between active and passive investing, as well as the emotional triggers that influence investment decisions, and provides an insightful education on evidence-based investing that may forever shift an investor’s perception of the stock market.

Mark Hebner is a well-known speaker, regular news contributor, and investing expert. His life goal is to “change the way the world invests by replacing speculation with education.” Hebner specializes in index funds, portfolio construction, and the research indexes created by Nobel Laureates Eugene Fama and Kenneth French. These indices serve as the foundation for Hebner’s cautious, evidence-based investment strategy for his IFA clients.

Mark Hebner is a Series 65 Wealth Advisor with an MBA from the University of California, Irvine, and a Bachelor’s degree in Nuclear Pharmacy from the University of New Mexico. For nearly 20 years, Mark Hebner was a member of the Young Presidents’ Organization, and he is now a member of the World Presidents’ Organization and the Chief Executives Organization.

Mark Hebner was President, CEO, and co-founder of Syncor International (formerly a public business – SCOR) from 1975 to 1985 until creating Index Fund Advisors in 1999. Cardinal Health paid around $850 million for Syncor in January 2003. It is the world’s top provider of nuclear pharmacy services as a branch of Cardinal Health.

About FIRM: Wells Fargo Advisors

Index Fund Advisors (IFA) is a registered investment advisor (RIA) based in Irvine, California, with representatives throughout the country. Mark T. Hebner, former president of nuclear pharmacy company Syncor International, founded the company on March 5, 1999, to provide online automated investment adviser services, with a personal touch as needed, as well as educational material about investing to the general public via the website IFA.com.

IFA provides an expanding range of consulting services to high-net-worth individuals, 401k plans, 403b plans, foundations, and endowments that are compatible with IFA’s passive management investing strategy. IFA advises clients to invest in low-cost index mutual funds, such as those offered by Dimensional Fund Advisors, Vanguard, or Blackrock’s iShares, after being heavily influenced by the works of Nobel Laureates Eugene Fama, Harry Markowitz, Paul Samuelson, William F. Sharpe, Merton Miller, Daniel Kahneman, and Friedrich von Hayek. Additionally, through its IFAsustainable.com and InvestingforCatholics.com websites, IFA provides advice on faith-based and sustainable investing.

IFA invented the Robo-Advisor concept when it launched its website on November 9, 1999, as indexfundsadvisors.com, then IFA.tv, and eventually IFA.com.[Cit Mark Hebner pioneered the low-cost online Registered Investment Adviser business concept, which would give an online algorithm-based risk capacity survey aimed to match individual investors with one of several index portfolios. These portfolios have always been built only with index funds. The process of becoming an IFA client has required no face-to-face interactions and has involved very little human intervention. IFA was one of the first RIAs to provide an online live advisor camera (streaming video and NetMeeting) as well as live chat.

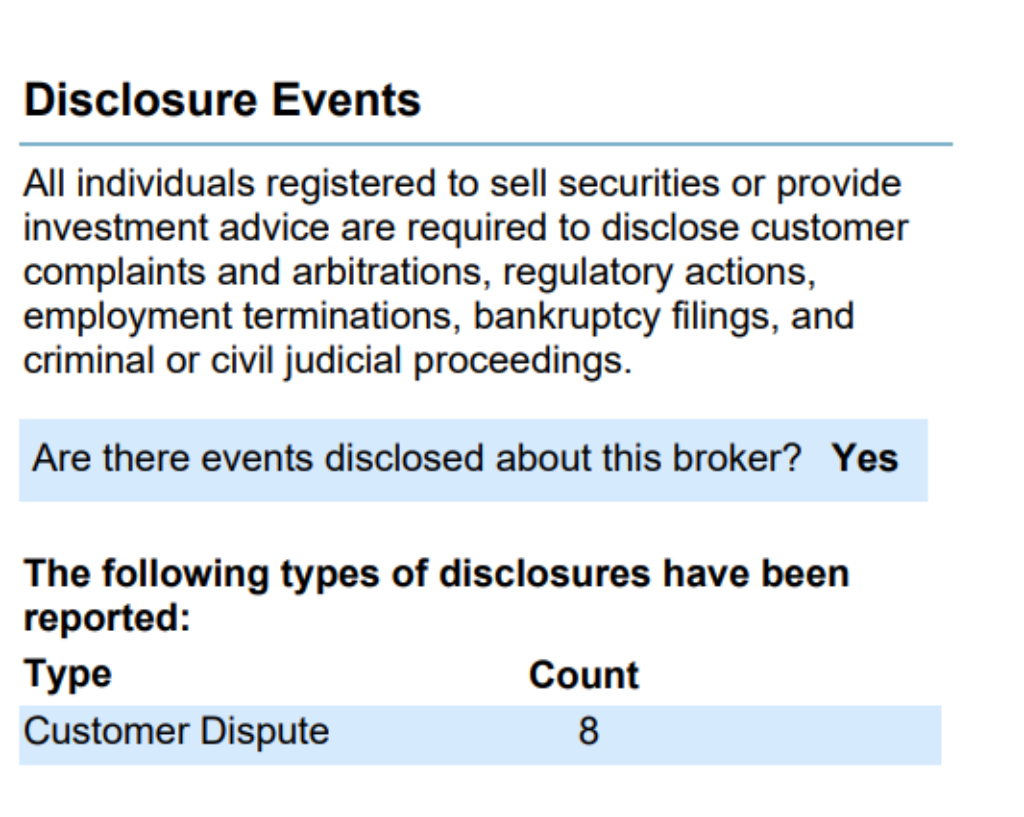

Mark Hebner Disclosures: BrokerCheck, FINRA, And SEC Reports

There is eight disclosure named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

FINRA’s BrokerCheck

individual_2266576.pdf (finra.org)

SEC Litigations & Forms

Source: Jennifer Garcia – SEC Site Search Search Results

Mark Hebner Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Mark Hebner that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Mark Hebner on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Mark Hebner Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Mark Hebner using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Mark Hebner or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Mark Hebner (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management