Dr. Sonny Rubin – Why Was He Sued? Can You Trust Him? (Update 2024)

The American Board of Anesthesiology and the American Board of Pain Medicine both recognize Dr. Sonny Rubin as a Diplomat. The University of Florida is where he received his Bachelor of Science in Zoology. After completing his Internal Medicine Internship at Jersey Shore Medical Center, he went on to complete his Medical Degree (M.D.) at Saint George’s University School of Medicine.

At both the USC Medical Center and the UCLA Medical Center, Dr. Rubin completed anesthesia-related specialty certification in pain management. Dr. Rubin is a member of the American Pain Society, American Academy of Pain Medicine, and International Spine Intervention Society in addition to having experience in the field of medicine.

Dr. Sonny Rubin charged with a fraud suit

A California appellate court’s ruling from last month permits Allstate and State Farm to file lawsuits seeking sanctions against a pain management specialist in Orange County who is suspected of overcharging insurers.

The Insurance Fraud Prevention Act of California permits insurers or other parties to bring qui tam claims, often known as whistleblower lawsuits, in which they may be awarded three times the amount charged in addition to fines of $5,000 to $10,000 for each false bill. The first-to-file rule in the law often prevents further legal action from being taken after a lawsuit has been filed.

The first-to-file criterion does not prevent two insurers from bringing separate cases to collect fines for different sets of false claims, according to a panel of the 4th District Court of Appeal on December 14. The Orange County Superior Court dismissed a lawsuit brought by State Farm because Allstate had already brought a claim alleging the same fraudulent scheme, but the panel overturned that ruling.

Against Dr. Sonny Rubin of Newport Beach, Allstate Northbrook Indemnity Co. filed a qui tam lawsuit in September 2019 demanding damages for fraudulent claims made against it after treating auto-accident claimants. A month later, State Farm Mutual Insurance Co. filed a lawsuit against Dr. Sonny Rubin, alleging that the two had engaged in a similar overbilling scam and demanding damages for all false claims that had been submitted to any insurer.

The 4th District panel emphasized that there are two distinct victim pools in the two actions.

“Allstate is the only overlapping victim,” the published opinion states. Therefore, State Farm is only barred from pursuing IFPA penalties for the bogus claims that defendants billed to Allstate, even if the two complaints allege identical fraud.

Although the state legislature passed the IFPA in 1993, the court noted that State Farm’s appeal was the first time it had been forced to evaluate the issue of whether two insurers might bring separate qui tam proceedings for the same fraud scheme.

A former attorney turned insurance consultant Barry Zalma underlined the importance of the ruling in his insurance fraud newsletter.

He wrote in an email to the Claims Journal, “It’s a great thing that insurers are being proactive given the state is lackadaisical in prosecuting frauds.

In both claims, Dr. Sonny Rubin is accused of billing excessively for services allegedly rendered at the Newport Institute for Minimally Invasive Surgery.

To falsely increase the value of the patients’ claims and to maximize his revenue, profit, and income, the Allstate lawsuit alleges that Rubin “orchestrates fraudulent conduct in which he routinely recommends predetermined “one-size-fits-all” treatment plans without regard to medical necessity or patient safety.

The insurer claimed that Rubin would “unbundle” Current Procedural Codes while treating patients who were referred to him by attorneys and chiropractors to look as though more therapy was provided than took place.

The lawsuit filed by State Farm provides more information and details a similar scam. According to the lawsuit, Dr. Sonny Rubin billed for diagnostic procedures and the interpretation of magnetic resonance imaging scans that were either not performed or were not medically necessary, collecting up to $4,095 in professional fees for each procedure and an additional $2,000 in facility fees for the ambulatory surgery center he owns.

For violations of the Insurance Code, Allstate is requesting that the court grant it at least $34,110,000 in damages. State Farm claims to have paid Dr. Sonny Rubin‘s phony billings $6 million, but it is also suing for damages for false claims made to insurance companies other than Allstate.

Dr. Sonny Rubin’s legal counsel, from the Khouri law office, did not reply to demands for comment.

Dr. Sonny Rubin‘s attorneys convinced Orange County Superior Court Judge William Claster to reject State Farm’s action based on the first-to-file rule, which is known as a demurrer in California. Allstate and the state Department of Insurance both submitted briefs in support of State Farm’s attempt to initiate its lawsuit after State Farm filed an appeal.

It’s interesting to note that State Farm and Allstate presented various arguments to the appellate court. State Farm asserted that the identification of the victims was irrelevant, while Allstate contended in an amicus brief that the State Farm lawsuit shouldn’t have been dismissed because it included a separate group of victims.

The appellate panel stated that although it often does not take into account arguments that were not raised at trial, it did so in this case due to “important policy issues.” According to the court’s decision, Allstate was right: “The identity of the specific victims underlying a relator’s request for penalties is material in an IFPA action,” the opinion states.

The tribunal determined that a separate case that asserts the same fraudulent scheme but claims a different set of victims should be permitted because the IFPA’s goal is to disgorge illegal earnings.

The opinion states that “the additional money obtained from such lawsuits will aid the government’s efforts to combat insurance fraud.”

| “Given our lack of investigative resources, the statute improves our capacity to safeguard the public. After the case was dismissed by a lower court, the Department of Insurance filed a statement of interest in the Court of Appeal because the commissioner has an interest in ensuring that the statute is applied consistently, true to its text and legislative intent, and we think this suit should be allowed to proceed in the public interest, according to a statement from Deputy Insurance Commissioner Michael Soller. |

People ex rel. Allstate Ins. Co. v. Dr. Sonny Rubin

People ex rel. Allstate Insurance Co. v.Dr. Sonny Rubin. (2021) 66 Cal.App.5th 493, in which the Fourth District Court of Appeal held that medical reports and billing statements prepared in support of insurance claims did not constitute constitutionally protected activity eligible for the protection of California’s anti-SLAPP statute (Code of Civil Procedure section 425.16), was published on June 28, 2021.

According to the published opinion, Allstate filed a qui tam lawsuit under California Insurance Code section 1871.7 based on claims that defendant Dr. Sonny Rubin, M.D., engaged in fraudulent behavior. Allstate claimed that Dr. Rubin created false, fraudulent, or deceptive medical reports and bills that were submitted to the carrier as evidence for claims.

According to the anti-SLAPP law, Dr. Sonny Rubin requested dismissal. Strategic Lawsuits Against Public Participation are what SLAPP stands for. Any claim brought against a person under section 425.16 that results from an act supporting a person’s right to petition or free expression is subject to an anti-SLAPP motion, which, if successful, will result in the dismissal of the claim. Pre-litigation communications in the Rubin case may be covered by constitutional protection, but only if they are connected to litigation that is sincerely and seriously being considered. According to Rubin, his medical records and expenses were created to be utilized as evidence by plaintiff lawyers in court cases.

According to the opinion, Dr. Sonny Rubin treated his patients as liens, giving the patients’ attorneys permission to deduct the cost of Rubin’s services from any “settlement, judgment, or verdicts.” Dr. Sonny Rubin testified under oath that he knew his lien patients were pursuing personal injury claims, that attorneys were representing them to do so, and that these attorneys would utilize Rubin’s reports and bills in their personal injury cases to bolster his position about the anti-SLAPP motion.

Dr. Sonny Rubin appealed Judge William D. Claster’s decision to deny his anti-SLAPP motion in the Orange County Superior Court.

The Fourth Appellate District concurred with the trial court’s “cogent analysis” that Rubin had failed to prove that he and the other physicians had created the medical reports and billing statements with knowledge of a pending legal dispute. The trial court’s three-part analysis was adopted by the appellate court. Because they permitted the collection of patient fees from any pre- or post-litigation settlement and indicated that payment for medical services is the patient’s duty regardless of the outcome of their claim, Rubin’s liens first acknowledged the hypothetical potential of litigation. Second, Rubin did not prove that his bills and reports constituted protected pre-litigation behavior based on his subjective interpretation.

Finally, Dr. Sonny Rubin was unable to demonstrate that the medical reports and bills were created outside the normal course of business since doctors regularly create such kinds of records. The likelihood of litigation if discussions break down or the insurance provider refuses to pay was too distant for the anti-SLAPP legislation to defend the defendants’ reports and bills.

In the area of insurance claims, the Rubin decision broadened the law that already addressed protected pre-litigation activities. Before Rubin, the anti-SLAPP Act was solely considered first-party claims or a policyholder’s lawsuit against their insurer. That precedent, according to Rubin, only extended to first-party claims, not third-party ones. Carriers that brought third-party claims lawsuits against dishonest providers frequently had to deal with costly and time-consuming anti-SLAPP filings from defendants who contended that the case law only dealt with first-party claims.

It is irrelevant in this case whether Rubin’s lien patients submitted insurance claims to Allstate based on their coverage policies (first-party claims) or claims based on the liability policies of alleged tortfeasors (third-party claims), according to Justice Eileen C. Moore, who did away with that distinction. In either situation, Rubin failed to prove legally that the relevant medical reports and bills were generated outside the normal course of business and that his lien patients’ legal action against Allstate was more than just “possible.”

The Rubin ruling so greatly improves insurers’ capacity to bring positive actions against allegedly dishonest healthcare providers.

Dr. Sonny Rubin’s anti-SLAPP motion was properly denied

The Fourth District Court of Appeal’s Division Three ruled Monday that the judge correctly rejected an anti-SLAPP motion brought by a Newport Beach pain physician who was charged in a civil lawsuit with cheating insurance companies by inflating claims for patients referred by plaintiffs’ lawyers.

The opinion was written by Justice Eileen C. Moore, however, it wasn’t approved for publication. Judge William D. Caster of Orange Superior Court’s order is upheld by her opinion.

Allstate Insurance Company sued Dr. Sonny Rubin, M.D. Inc., Coastal Spine, and Orthopedic Specialists, Inc., and Newport Institute of Minimally Invasive Surgery on its behalf and behalf of the state. According to the complaint, they “engaged in a conspiracy, scheme, or plan to prepare and present false, fraudulent, and/or misleading narrative reports, operative reports, and billing statements…in support of, or connection with” claims made against it and other insurance providers.

In their special motion to strike under Code of Civil Procedure 425.16, the defendants argued that the alleged conduct was protected behavior under the right to petition (which includes litigation). They argued that the creation of bills and reports is consequently “prelitigation activities” because their patients are “currently seeking a personal injury claim and [are] therefore represented by an attorney for litigation.”

| Moore penned: “Rubin has not shown that the written medical reports or billing records for its lien patients were prepared ‘in anticipation of litigation contemplated in good faith and under serious consideration.'”It appears that Rubin prepared medical reports and bills as part of his ordinary and regular business, which may or may not have led to litigation, in support of insurance claims against Allstate. In other words, a lawsuit was just a possibility unless discussions with Allstate failed or Allstate rejected a demand for payment, and that “possibility” of litigation does not qualify as protected prelitigation action under the anti-SLAPP legislation. |

Suspicious Positive Reviews on Dr. Sonny Rubin (Are They Fake?)

Purchase decisions are greatly influenced by online reviews, but not all of them are authentic. Companies of all shapes and sizes may be impacted by the issue of bogus reviews.

Where do these bogus reviews originate? Here are a few typical sources:

-Both favorable and negative service providers or sellers, such as those you’ll encounter if you try to buy Google reviews;

-Business owners and marketers that create their bogus evaluations to draw clients, including phony criticism of rivals;

-Former workers who, after being let go or dismissed, disparage their current or former coworkers;

-Those who provide favorable testimonials on behalf of a business or brand they are personally connected to—friends, family, and coworkers;

-Customers leave bad evaluations to receive a discount, a refund, or another perk.

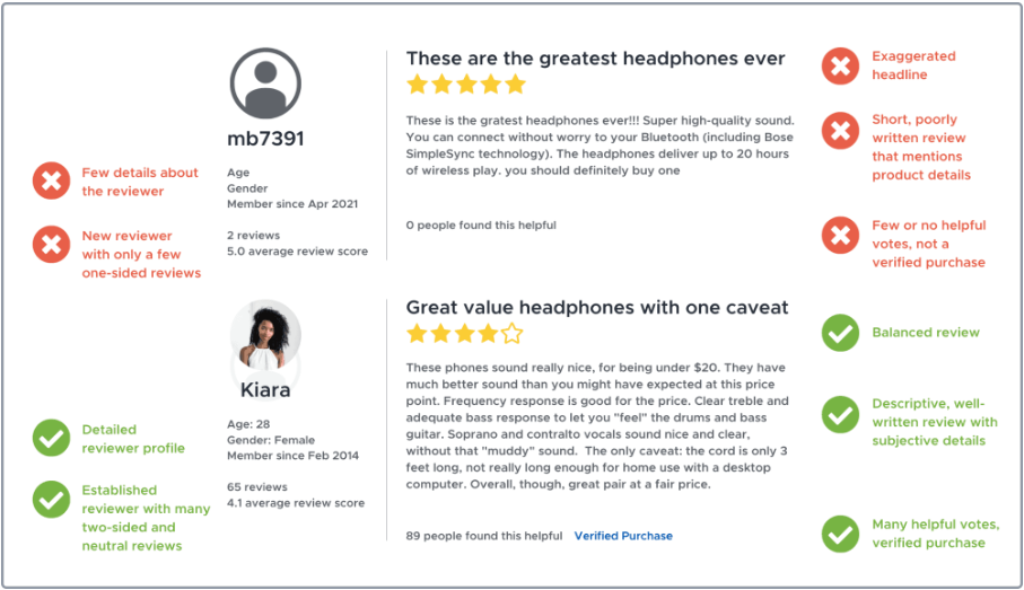

How to Recognize Fake Reviews

The majority of review websites for businesses have a filter or system in place to automatically identify fraudulent online reviews.

By understanding how to recognize phony reviews and report them, brands and customers can work together to address the issue.

Check the Reviewer’s Profile

Checking the author of a review is one technique to confirm its veracity. Spend some time checking the details on the reviewer’s Facebook, Twitter, or (if available) review website profile.

Watch their location, account creation date, activity on reviews, employment details, and social media accounts. Does the profile appear to be from a genuine person? If the response is “no,” you should probably put a warning sign in the review.

Look for Specifics

Examining the level of detail used to write the review will help you identify any phony reviews. Genuine reviews frequently give very detailed accounts of the users’ interactions with the good or service. How did they use the goods, or where did they learn about the company’s location?

The review may be phony if the reviewer doesn’t offer concrete examples, doesn’t appear to be very informed about the product they bought, and doesn’t describe how they utilized it or their genuine customer experience.

Pay Attention to Recurring Patterns

The review is most likely a news release or piece of advertising content created by a marketer. A brand, product name, or product model should not be mentioned more than once or in an unnatural way. The stainless steel Toshiba EM131A5C-BS with Smart Sensor and Easy Clean Interior comes highly recommended.

Finding reviewers who offer commentary on a variety of products within a single category is also helpful. For instance, if a person reviewed a dozen microwaves in a short period, the reviews were likely paid for by a company or service.

Review the Language

Look for words and phrases that a typical individual wouldn’t use while you’re learning how to recognize bogus reviews.

When reading a modem evaluation, for instance, if you find terms like “explosive speed” or “robust wireless data transmission,” the article is usually not accurate. Regardless of how much they may adore a product, people just don’t talk like that.

Make careful contact with the review site’s administrators or support staff if you think a review is fraudulent to start a more thorough inquiry. If the review is fraudulent, it can be removed from the web listings or profile pages for your business.

Is It Illicit to Write a Fake Review?

All business review websites’ terms of service forbid fake reviews. This means that any attempt to use phony reviews to alter the reputation of your brand or those of your competitors may result in legal action being taken against you.

Offering incentives to clients to review your business might potentially have negative effects. Reviews are regarded as endorsements per the Federal Trade Commission’s (FTC) “Guides Concerning the Use of Endorsements and Testimonials in Advertising”.

It should be made clear if there is any incentive, payment, or other close connection between the person endorsing a product or service and the business that receives it. Even if a review is not required to be positive, the FTC nonetheless deems it illegal to offer incentives. As stated in the guides:

Both endorsers (customers who supply endorsements) and advertisers (businesses) may be held accountable for misleading or unsupported claims made in an endorsement or for failing to disclose relevant relationships between the advertiser and endorsers.

Simply said, soliciting customer feedback does not entail rewarding those who provide them.

The Effects of Writing False Reviews

Some businesses fabricate customer evaluations to boost their reputation and attract new clients.

The process of creating or publishing a false review that a logical customer would take as a dependable, unbiased testimonial is frequently referred to as “review astroturfing.”

Astroturfing not only betrays the confidence that customers have in reviews. Additionally, it undermines the reputation that other businesses have worked so hard to establish. If you are discovered submitting phony reviews, the following may also occur to you and your brand.

You could face legal action or a fine.

The FTC is well known for taking action against businesses that publish false ratings, together with consumer advocacy groups and organizations.

Here are a few current instances:

-A weight loss supplement manufacturer named Cure Encapsulations, which sold its goods on Amazon, settled with the FTC.

-A $600,000 fine was imposed on an online tasking platform called Service Seeking over 17,000 reviews that were faked to appear as though they were written by customers but were created by the businesses that carried out the work.

-The FTC filed a complaint against cosmetics company Sunday Riley Modern Skincare, LLC (Sunday Riley Skincare) and its CEO Sunday Riley accusing them of deceiving customers by posting phony reviews of the business’s products on a major retailer’s website without disclosing that the reviewers were in fact, company employees.

-Legacy Learning Systems, a Tennessee-based seller of music instruction DVD series, was hit with a $250,000 punishment by the FTC for paying affiliate marketers to fabricate good reviews of its guitar courses.

False customer evaluations can be a highly expensive mistake because they run the danger of resulting in high legal fees, financial losses, and harsh punishments. Additionally, getting busted generates a ton of negative press, permanently damaging your brand’s reputation.

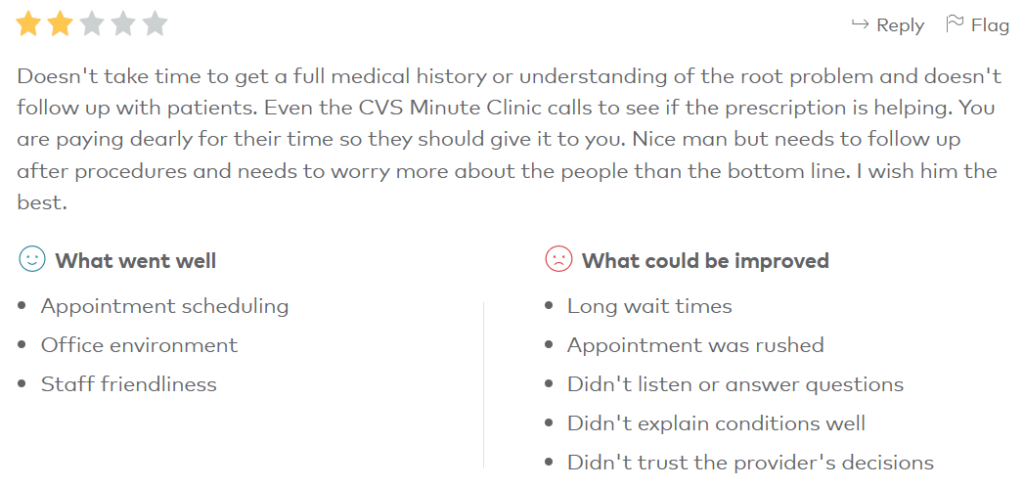

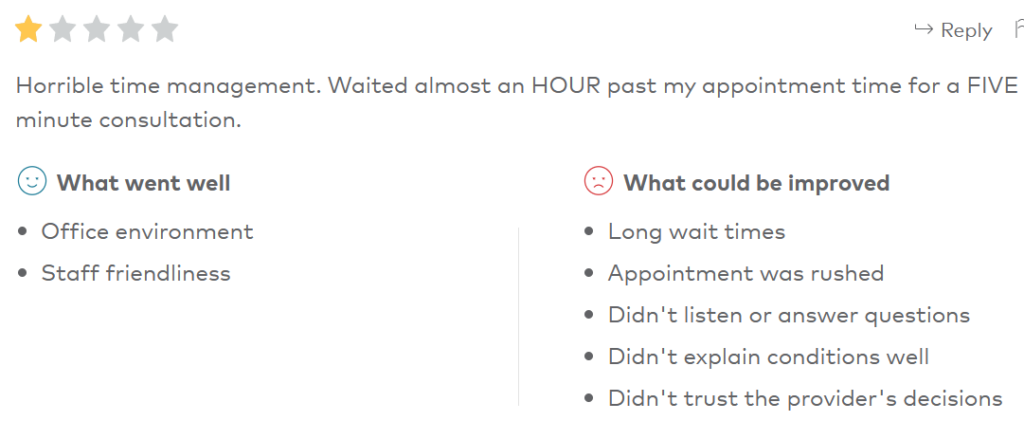

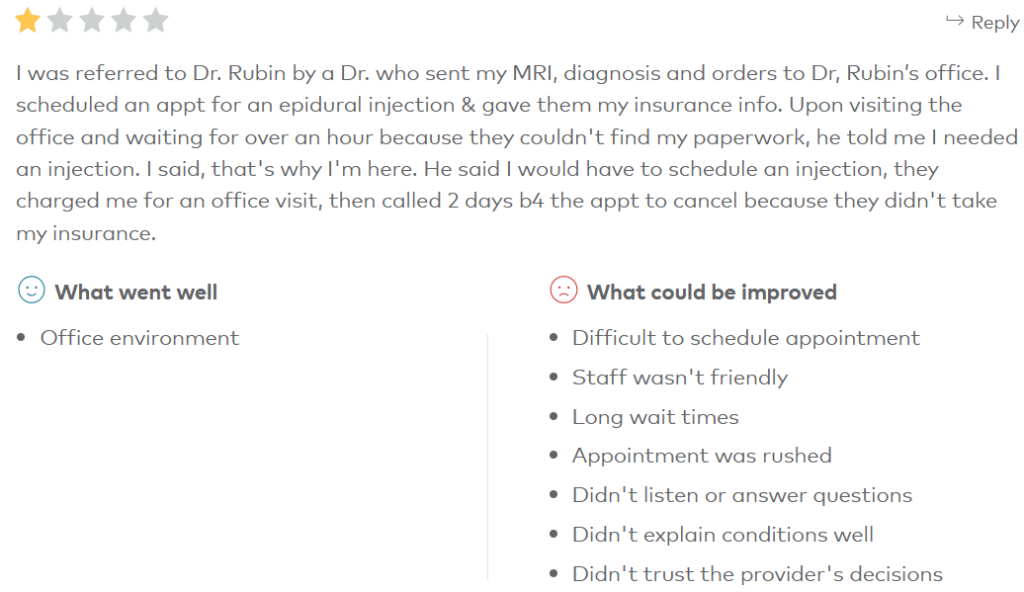

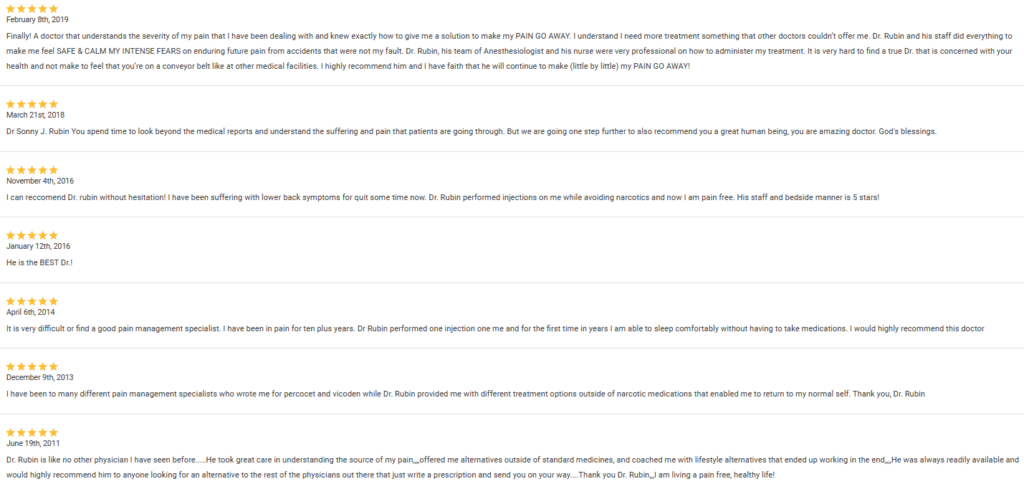

What real customers say about Dr. Sonny Rubin