https://www.youtube.com/watch?v=gAJnh-rqDsw

Who is Mitchell Stillman (CRD#:1015970)?

Mitchell Stillman is a Managing director of investments at Well Fargo Advisors based in Scottsdale, a title reserved for advisers who are qualified to assist with sophisticated and demanding financial planning demands due to their knowledge, experience, and unique skills.

Wells Fargo Advisors assist our clients with asset management as well as retirement planning, estate planning, philanthropic plans, and other wealth management techniques.

In addition to performing fundamental analysis in addition to technical analysis, Mitchell Stillman also manages portfolios and provides investment management consultancy.

Mr. Mitchell Stillman is a Portfolio Manager with Private Investment Management (PIM), having received his bachelor’s degree in finance from the College of Cincinnati. He donates to several regional nonprofits within the Phoenix area.

About Wells Fargo Advisors:

A division of Wells Fargo, Wells Fargo Advisors is based in St. Louis, Missouri. With $1.9 trillion in retail client assets under management as of June 30, 2021, it is the third-largest brokerage firm in the United States.

Prior to May 1, 2009, the subsidiary was legally known as Wachovia Securities. This name change followed Wells Fargo’s ownership of Wachovia Corporation.

History

Wells Fargo Advisors was founded in 1879 and has grown via acquisitions with many of the company’s local and national firms. Wachovia Securities, A. G. Edwards, and Bache & Co. are among them. Sol Gindi is the current President.

Wells Fargo Consultants balances the expertise of an enormous national organization with the ethos of the local businesses that it grew from. A solid commitment to supporting the firm’s Financial Advisors’ relationships with their clients is key to that culture. Wells Fargo Advisor provides a wide range of services to their customers, which are outlined below:

Credit & Lending

Wells Fargo Advisors may offer numerous options through affiliates that can assist their clients in building and preserving assets as well as managing their borrowing demands.

The extensive range of Investment

The client’s investments should complement one another to help them achieve their financial objectives. Wells Fargo Advisor provides you with access to a wide range of investment products and services.

The mission of Wells Fargo Advisors

To provide clients with objectives and individual counsel, the company combines the organization’s tradition and strength with our associates’ concern, knowledge, and competence. It also offers services that will assist customers in meeting their long-term financial objectives.

If you are a shareholder in need of competent financial assistance, call the company’s office instantly. We relish the opportunity to assist you in achieving your financial objectives. We want to continue assisting you for several decades to come.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Mitchell Stillman Disclosures: BrokerCheck, FINRA, And SEC Reports

Client grievances and mediation, enforcement activities, employment dismissals, filings for bankruptcy, and either civil or criminal legal proceedings must all be disclosed by anyone who has been allowed to offer stocks and provide financial advice. Their clients have made two claims against Mitchell Stillman.

(1) The client claims that Fa wasn’t getting involved in his bank account when they were losing “Thousands of Dollars” in spite of her orders to sell. The estimated loss is greater than $5000.00. (12-06-2006)

(2) The Arizona resident claims that her spouse bought stock on leverage and “Aggressive Investments” in their shared account in or around May 2000. FA believes she should have been consulted if her husband intended to pursue this activity in their shared account. Claims suffer a $93,000 loss.

FINRA’s BrokerCheck

individual_1015970.pdf (finra.org)

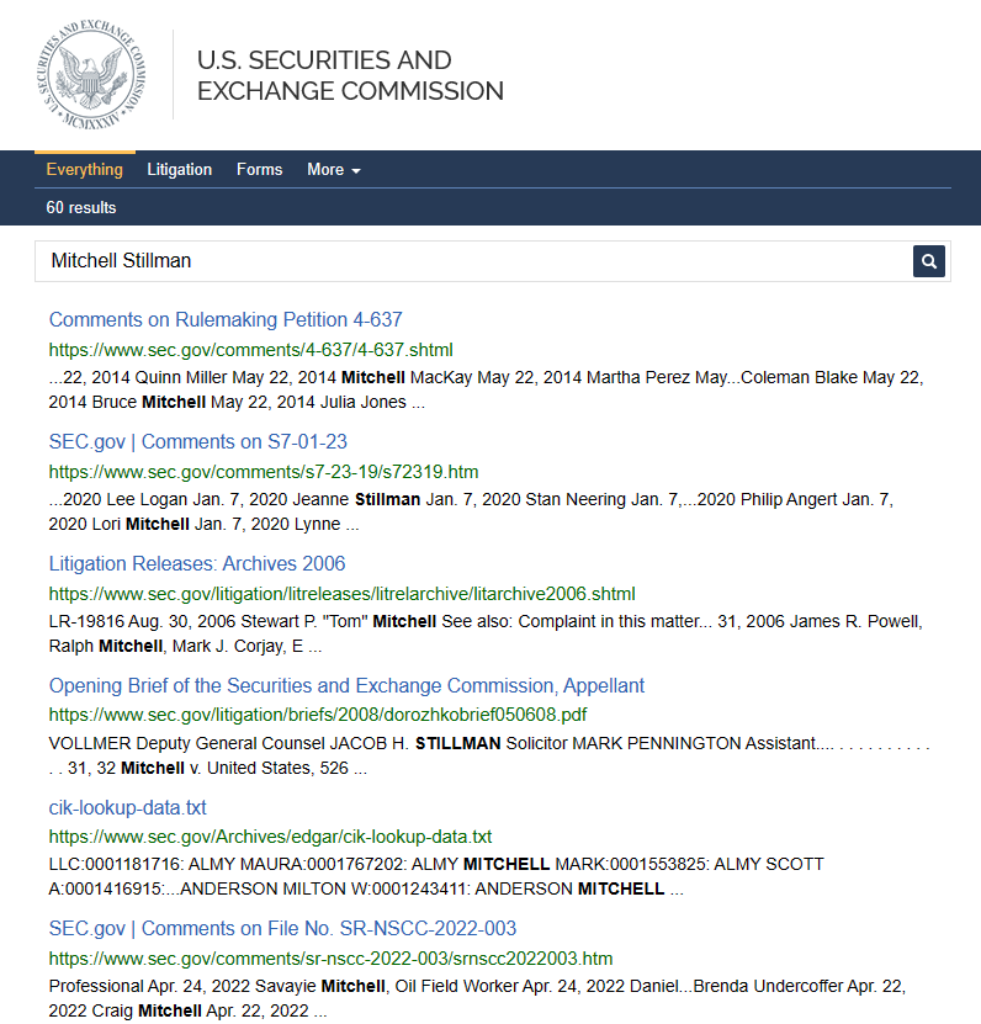

SEC Litigations & Forms

Source: Mitchell Stillman – SEC Site Search Search Results

Mitchell Stillman Lawsuits, Legal Battles, & Disputes

CourtListener, UniCourt, Law.com, Justia, Trellis Law, and Law360 save the majority of court cases filed in the United States of America. If Mitchell Stillman was ever part of a dispute, you can examine the relevant documents by clicking on the links given below.

There might be more pending lawsuits against Mitchell Stillman which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Mitchell Stillman on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis. law

Justia

Mitchell Stillman Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Mitchell Stillman using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Mitchell Stillman or any financial advisor.

Frequently Asked QuestionsFind the answers to your most common questions related to Mitchell Stillman & Wells Fargo Advisors

Where is Mitchell Stillman located?

What are Mitchell Stillman’s qualifications

Is Mitchell Stillman facing any lawsuits?

Has Mitchell Stillman been charged by the SEC?

How do I contact Mitchell Stillman?

Does Mitchell Stillman have any disclosures?

Which Firm does Mitchell Stillman work with?

What is Mitchell Stillman’s CRD Number?

Better Alternatives To Mitchell Stillman (By Experts):Find the top 3 alternatives to Mitchell Stillman

1:2 advisor/client ratio

Reputed

High overall rating