Who is Patrick Rush (CRD#: 2639709)?Everything you need to know about Patrick Rush and their accolades

Patrick Rush serves as the CEO of TRIAD Financial Advisors CFP®. As the company’s owner and CEO, Patrick is responsible for maintaining Triad Financial Advisors’ reputation as the top independent wealth management firm in the Southeast.

Although they have won numerous accolades for excellence from well-known publications like Forbes, Barron’s, and the Financial Times, our firm’s success ultimately depends on the success of the households they serve, their clients, and the team members.

In 1998, Patrick Rush started his profession as an investment advisor and financial planner. Much earlier, he began to comprehend the struggles with money that individuals have every day. Patrick had a comfortable upbringing.

He credits going to a pricey Montessori school in Chicago with giving him an advantage in the future. When he was younger, he questioned his father as to how the family could afford such a luxury. For a discount on Patrick’s tuition, his father said that he agreed to work as the school’s night janitor. He was humbled by and would never forget his parents’ selfless acts of sacrifice for him.

Later, he graduated from the Illinois Institute of Technology with a B.S. in Financial Markets & Trading and from the Stuart School of Business with an MBA in Finance. Following the completion of his MBA, Patrick worked his way up to the position of President of Independent Wealth Management.

He also assisted individuals and families at Merrill Lynch as a Vice President and Senior Financial Advisor. He grew to be a fervent believer in the necessity to hold all advisors to the fiduciary standard. He developed a philosophy of low-cost, evidence-based investment along with thorough financial planning to produce results for clients.

Patrick Rush currently holds the positions of CEO and CERTIFIED FINANCIAL PLANNER™ at Triad Financial Advisors in Greensboro, North Carolina. Forbes, Barron’s, and the Financial Times have recognized him as one of the nation’s top financial advisors, and the Invest in Others Charitable Foundation has named his company a “Charitable Champion.”

He is the author and instructor of Retirement 101, a course created to assist pre-retirees and retirees in the foundations of financial planning and investment management.

With his twin boys, Walker and Quincy, and daughter Havana, Patrick makes his home in Greensboro, North Carolina.

In this article, we will go deep into Patrick Rush’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Triad Financial AdvisorsHistory, achievements, leadership, lawsuits, & disputes

For more than 35 years, Triad Financial Advisors has provided fee-only financial planning and investment management services to individuals and families across the United States. Our goal is to support individuals in living intentionally, including clients, team members, and community members.

TFA is pleased to introduce you to our incredible group of CERTIFIED FINANCIAL PLANNER™ professionals, each of whom ultimately contributes significantly to your experience as a client. Making an intentional retirement and investing plan together is essential to your financial success.

Services offered by Triad Financial Advisors

Through the Intentional Planning System, they address a wide range of wealth management issues in order of importance. Almost all plans will have the following five components:

- Investing

- Retirement

- Estate

- Tax

- Insurance

Every person and household is different, and this includes planning. We also have expertise in the following fields, among others:

- Small business ownership

- Philanthropy and charitable giving

- Divorce planning

- Special needs planning

- Planning for widows and widowers

Financial Planning offered by Triad Financial Advisors

The first graduating class of CERTIFIED FINANCIAL PLANNER™ (CFP®) practitioners, on the other hand, graduated in 1973, marking the beginning of the profession of financial planning, which is only a few decades old.

Financial planning has advanced far more quickly than the actual financial industry. The National Association of Personal Financial Advisors (NAPFA), the exclusive organization of which TFA is a part, was founded in 1983. The NAPFA mandates that all of its members always act in their client’s best interests and never accept inherently conflicting sales commissions as part of their compensation.

Fee guidelines for Triad Financial Advisors

Simply put, they do not sell anything, and as a result, they do not make commissions on the sale of goods, which can impair their ability to provide you with advice.

Fiduciary, a term that costs ten cents, has a lot of significance attached to it: It is required of them by law to always operate in the customers’ best interests. Because many advisers represent themselves as “fee-based,” which simply means they receive fees for some services they render and commissions for others, the full-time position is crucial. They might remove their fiduciary hat to pitch you a product. On the other side, they always and only represent their client’s interests as fee-only fiduciaries.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Patrick Rush Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Patrick Rush

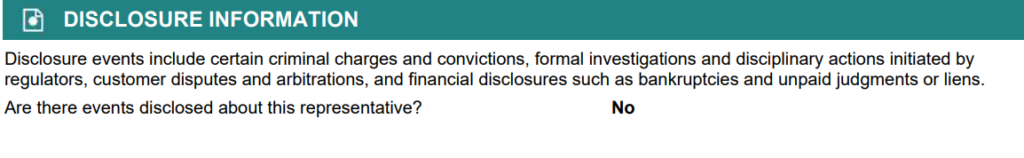

The brokerCheck report of Patrick Rush includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosure has been mentioned about Patrick Rush.

FINRA’s BrokerCheck

individual_2639709.pdf (sec.gov)

SEC Litigations & Forms

Source: Patrick Rush – SEC Site Search Search Results

Patrick Rush Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Patrick Rush

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Patrick Rush has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Patrick Rush which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Patrick Rush on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Patrick Rush Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Patrick Rush (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Patrick Rush using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Patrick Rush or any financial advisor.

Better Alternatives To Patrick Rush (By Experts):Find the top 3 alternatives to Patrick Rush

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management