The Securities and Exchange Commission has achieved an arrangement with Akorn Inc., its previous chief accounting officer Timothy Dick, and its former controller David Hebeda in the civil action lawsuit filed against them in the United States District Court for the Northern District of Illinois. First, though, some background on Timothy Dick is in order.

Timothy Dick: A Brief Overview

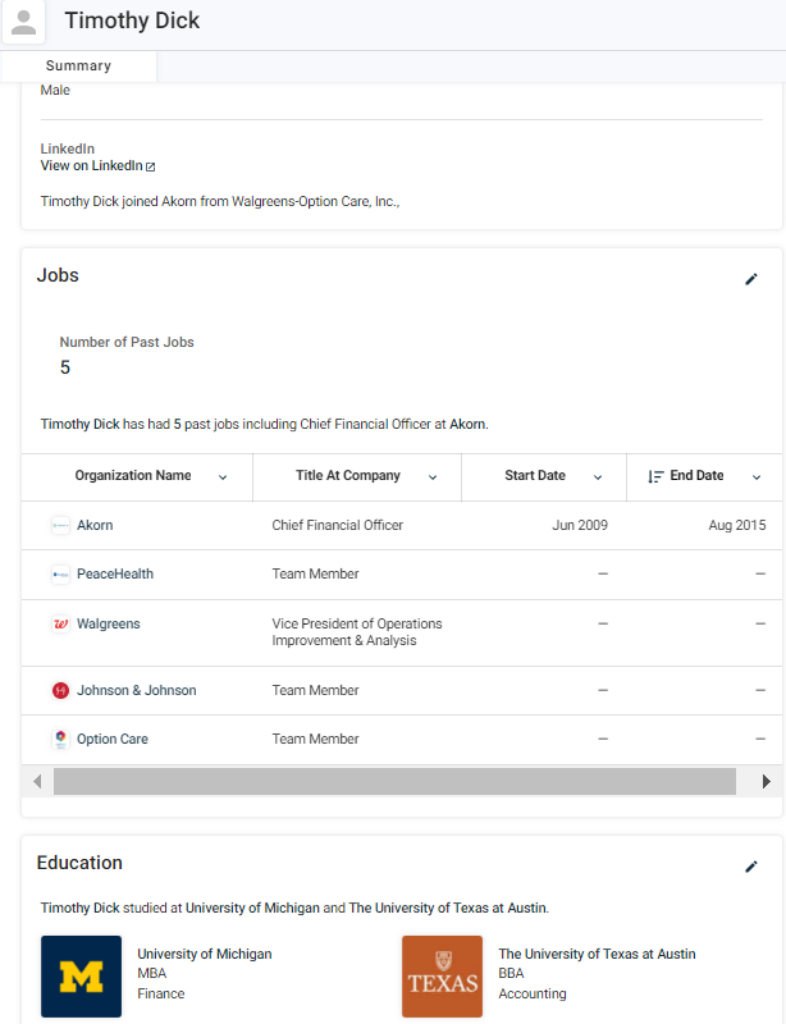

Timothy Dick is a highly accomplished professional who has dedicated most of his career to the fields of finance and accounting. He served as the Chief Financial Officer (CFO) at Akorn, Inc., a pharmaceutical company based in Lake Forest, Illinois, from June 2009 until August 2015.

During his tenure as CFO, the company faced criminal charges brought forth by the Securities and Exchange Commission (SEC), alleging violations related to financial reporting and internal controls.

As the head of the finance department, Timothy was responsible for ensuring the company’s compliance with all applicable laws and regulations. His role involved overseeing the financial operations of the company, maintaining accurate financial records, and implementing effective internal controls to prevent fraudulent activities.

Despite the challenges faced by the company, Timothy’s leadership and expertise helped Akorn, Inc. navigate through the difficult times and emerge stronger. Timothy Dick has worked as a member of the team at a number of different companies, including PeaceHealth, Walgreens, Johnson & Johnson, and Option Care, in addition to his position as Chief Financial Officer at Akorn.

Although particular details about these professions and the period of their employment are not supplied, it appears that the individual has had a variety of positions within the healthcare and pharmaceutical sectors.

Timothy Dick has a Master of Business Administration (MBA) degree from the University of Michigan, with a concentration in Finance. His educational background also includes a Bachelor of Arts degree from the University of Michigan.

This individual’s Master of Business Administration degree most certainly provided him with the skills necessary for finance and business administration in the corporate world.

Before going on to earn his master’s degree in business administration, he earned a bachelor’s degree in business administration (BBA) from The University of Texas at Austin, where he concentrated his studies on accounting. This education provided him with a solid grounding in the fundamentals of financial reporting and internal controls.

In a nutshell, the primary focuses of Timothy Dick’s professional life are in finance and accounting. During his tenure as Chief Financial Officer of Akorn, Inc., which coincided with legal concerns pertaining to reporting on finances and internal controls, he was particularly effective in addressing these issues.

His educational history includes higher education in accounting and finance, all of which he obtained from recognized schools, and his professional past includes numerous responsibilities in the pharmaceutical and healthcare sectors.

You might want to take a look at this site that I’ve mentioned, which will take you to some information regarding his fundamental characteristics:

Timothy Dick: Pharmaceutical Company and Former Executives Charged with SEC

A civil lawsuit against the pharmaceutical business Akorn, Inc., which has its headquarters in Lake Forest, Illinois, was initially brought forth by the United States Securities and Exchange Commission (SEC) in the month of March 2018. Timothy Dick, who had previously served as Akorn’s Chief Financial Officer (CFO), and David Hebeda, who had previously served in the position of Controller, were both named as defendants in the lawsuit.

This legal action was brought about as a result of violations committed by Akorn regarding financial disclosure, files and documentation, and internal accounting controls. These infractions pertained directly to Section 13(a), Section 13(b)(2)(A), and Section 13(b)(2)(B) of the Securities Exchange Act of 1934, in addition to Rules 12b-20, 13a-1, 13a-11, and 13a-13 that are governed by the same Act.

It is important to highlight that Akorn, Timothy Dick, and Hebeda decided to settle these accusations without admitting or rejecting the allegations presented by the SEC. This was done in order to avoid the possibility of further legal action.

The complaint that was filed with the SEC focused on a series of events that took place in May of 2016 when Akorn made the decision to restate its financial results for its financial year 2014. In this restatement, Akorn recognized that its internal supervision over financial reporting had serious flaws.

In particular, these flaws were connected to the controls that were associated with the company’s gross-to-net reserve accounts and projections. As a part of this restatement, Akorn announced that it had inflated its net revenue for the year 2014 by about 7 percent and its income from continuing operations before income taxes by approximately 136 percent.

Both of these figures are relative to the company’s previous financial statements. Importantly, these material shortcomings in Akorn’s internal controls continued throughout numerous reporting years, and they led to material inaccuracies that were included in the financial statements for the year 2014.

The complaint further alleged that in 2014, Timothy Dick, who worked as the CFO, and David Hebeda, who functioned as the Controller, had supervisory responsibilities involving various parts of Akorn’s internal accounting controls. Both men were named as defendants in the lawsuit. This covered a wide range of topics, including gross-to-net accounting for revenue and revenue recognition.

It was discovered that both Timothy Dick and Hebeda exercised a large amount of control over these tasks within the organization. As a consequence of this, the SEC filed a complaint against both people, charging them with controlling person responsibility under Section 20(a) of the Securities Exchange Act for the breaches that were carried out by Akorn.

The legal action resulted in certain agreements and fines for anyone who violated the terms of those agreements. Akorn has consented to abide by the terms of a permanent injunctive order that prohibits it from breaking the rules of the Exchange Act pertaining to financial reporting, records and documentation, and internal accounting controls. Additionally, in the cases of Timothy Dick and David Hebeda, both of them gave their agreement to the entry of orders.

The following are the two most important aspects of these orders:

- First, they issued a permanent injunction against both persons, which prohibits them from managing any person who may be accountable for violations of the provisions of the Exchange Act pertaining to financial reporting, books and documentation, and internal accounting controls.

- Second, as a condition of the resolution, each of them must pay a civil fine in the amount of 20,000 dollars.

Within the SEC, individuals with the names Michael Mueller and Timothy Tatman were the ones responsible for conducting the inquiry into these many concerns.

Timothy Dick: Case Settlement with SEC

Akorn Inc., its former Chief Financial Officer Timothy Dick, and its former Controller David Hebeda have made a settlement over claims that the generic drug maker released false financial statements in 2014. This deal was made public by the U.S. Securities and Exchange Commission (SEC).

As part of the deal, Akorn won’t have to pay anything. Instead, it consented to a court order that says it can’t break any more Securities Exchange Act rules about financial reports and internal accounting controls.

As required by the SEC, former CFO Timothy Dick and former Controller David Hebeda have agreed to pay each a $20,000 fine. The case has been settled, and all parties, including Akorn, Timothy Dick, and Hebeda, did not admit or reject any wrongdoing. Akorn and the lawyers for Timothy Dick and Hebeda have not said anything about this issue.

The SEC’s review showed that in May 2016, Akorn changed its accounting records for 2014 and admitted that its internal controls were very weak. The company’s handling of gross-to-net reserve balances and estimates led to these problems. Akorn also said that it overestimated its net sales for 2014 by approximately seven percent and earnings from ongoing operations prior to taxes by a large 136 percent in the same year.

During this time, both Timothy Dick, who was the CFO, and David Hebeda, who was the Controller, were in charge of Akorn’s internal financial controls. This means that they are responsible for the problems that the SEC found.

Notably, in April 2017, Fresenius planned to buy Akorn for $4.75 billion. The deal would have included a wide range of medical goods, such as creams, eye drops, and liquids for the mouth. But a month before, Fresenius CEO Stephan Sturm said that the company might not go through with the purchase if an investigation into Akorn’s data integrity turned up proof of wrongdoing.

Fresenius hasn’t said anything right away about these recent events, as of right now.

Conclusion

In the end, the SEC’s lawsuit against Akorn Inc., its former CFO Timothy Dick, and its former controller David Hebeda has been settled. The lawsuit was about claimed violations of financial reporting and internal control.

Akorn redid its financial records for 2014, which showed that its internal controls were not as good as they should have been and that its income and sales were overstated by a lot.

The settlement gives Dick and Hebeda lifelong bans and punishments, and Akorn agreed not to break the law again. This case shows how important it is for publicly traded companies to have correct financial reporting and good internal controls.