Who is Daniel Murphy (CRD#: 1033528)?Everything you need to know about Daniel Murphy and their accolades

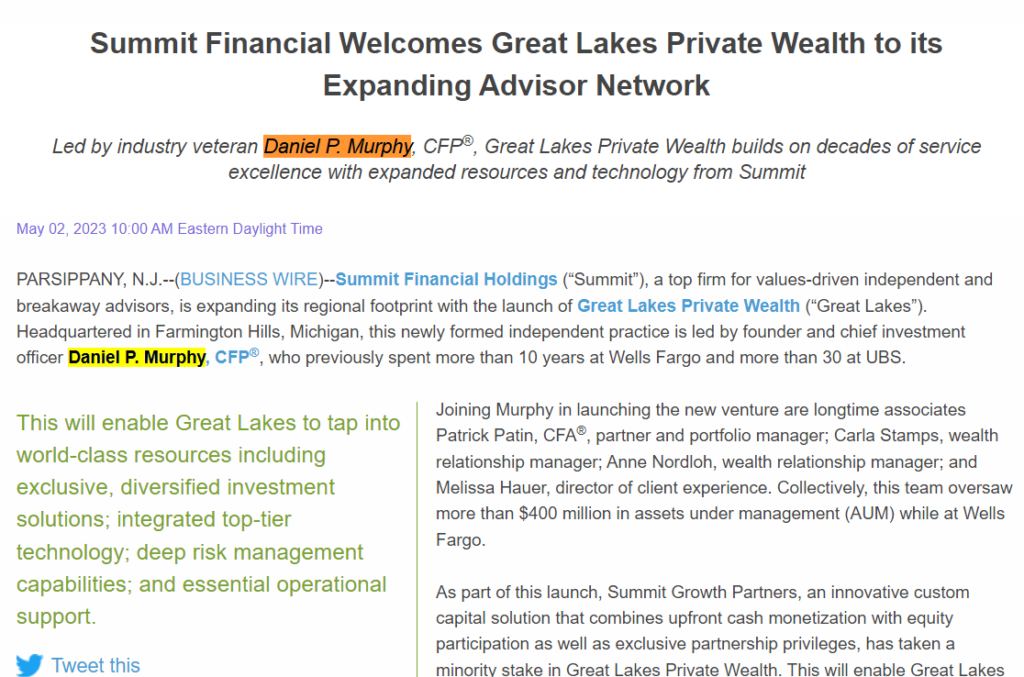

Daniel Murphy, the founder and chief investment officer of Great Lakes Private Wealth, formerly worked for Wells Fargo for approximately 12 years and UBS for more than 30 years. At the new company, he is joined by Melissa Hauer, director of client experience, Carla Stamps, wealth relationship manager, Anne Nordloh, wealth relationship manager, and Patrick Patin, partner and portfolio manager.

Daniel Murphy is the founder and chief investment officer of Great Lakes Private Wealth, a private company dedicated to safeguarding people and their families for the future. He has more than 40 years of experience in money management.

A five-person team has left Wells Fargo Advisors to launch their own independent practice with Summit Financial, a Parsippany, N.J.–based registered investment advisor. Summit has taken a minority, noncontrolling stake in Great Lakes Private Wealth, the Farmington Hills, Mich.–based practice that oversaw more than $400 million in assets under management while at Wells Fargo.

The firm will operate under Summit Financial’s Form ADV, which currently claims a little more than $6 billion in client assets. Murphy hopes to bring all of the team’s $400 million in client assets over from Wells Fargo.

Daniel is active in the neighborhood. He works closely with the Boys & Girls Club and a number of other charities, along with his wife Clare. One of the many lessons Dan learned while earning his Eagle Scout rank was the value of philanthropic service. He was born and reared in the Metro Detroit area, where he also raised his four children and is now a grandfather of two. Dan and his wife like playing golf, going on vacation, and just being together.

In this article, we will go deep into Daniel Murphy’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Great Lakes Private WealthHistory, achievements, leadership, lawsuits, & disputes

A registered investment advisor is Great Lakes Wealth, LLC. Great Lakes Wealth, LLC and its agents may only provide advisory services to customers or potential clients in jurisdictions where they are duly licensed or exempt from licensure. This website serves only as a source of information. Future returns are not guaranteed by past performance. Investments come with risks, including the potential loss of initial funds. Great Lakes Wealth, LLC is not permitted to provide advice without a client service agreement in place.

Services Offered by Great Lakes Wealth

There are various methods to achieve your financial objectives, and we are committed to assisting you in choosing the one that will bring you there promptly and safely. This might comprise:

- Financial & Retirement Planning

- Investment & Asset Management

- Banking & Insurance Solutions

- Document Safekeeping

- Concierge Client Service – 7 Days a Week

Financial Planning Process of Great Lakes Wealth

Our lives are considerably more than just straightforward transactions and returns. Similar to how financial planning involves more than simply a portfolio and a retirement plan. They approach financial planning from a broad perspective in order to create solutions that will keep you comfortable in the present while assisting you in achieving your short- and long-term objectives because you have a lot to prepare for right now, in the near future, and well into the future.

Their extensive services for goal-based financial planning include the following:

- Net-worth analysis

- Cash flow planning

- Strategic asset allocation

- Retirement planning

- Traditional IRAs

- Roth IRAs

- Qualified retirement plans

- Company retirement plan rollovers

- Education planning

- Education savings accounts

- 529 college savings plans

- Custodial accounts

- Trust and estate planning

- Insurance and annuities

- Liquidity and cash flow strategies

- Tax planning and liability management

Fees Under Great Lakes Wealth

At Great Lakes Wealth, experts provide a straightforward, fair flat charge based on the size of your portfolio. It is intended to be simple to comprehend and to prioritize your interests.

Annualized fees for their company are calculated on a pro-rata basis based on the value of your account on the last day of the previous quarter and are payable to you in advance of each quarter. Negotiable fees will be taken out of your managed account. On a case-by-case basis, exceptions to this pricing schedule may be offered. They very rarely consent to charge clients directly.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Daniel Murphy Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, and litigation against Daniel Murphy

The brokerCheck report of Daniel Murphy includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosures have been mentioned about Daniel Murphy.

FINRA’s BrokerCheck

individual_1033528.pdf (finra.org)

SEC Litigations & Forms

Source: Daniel Murphy – SEC Site Search Search Results

Daniel Murphy Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Daniel Murphy

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Daniel Murphy has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Daniel Murphy which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Daniel Murphy on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Daniel Murphy Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Daniel Murphy (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Daniel Murphy using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Daniel Murphy or any financial advisor.

Better Alternatives To Daniel Murphy (By Experts):Find the top 3 alternatives to Daniel Murphy

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management