Numerous claims have been made against Jayesh Shah Ravi Group about its line of business and numerous other client conflicts. The following is a detailed account of his issues and complaints:

With a really unique and practical idea, the Jayesh Shah Ravi Group is a Real Estate Building Company at the cutting edge of rolling in innovations in the real estate sector.

Amazing projects are being constructed in Mumbai, India’s Mira Road, Kandivali, and Thane using the latest technologies in some of the most prestigious locations.

We can say what they trying to assert to promote their name and business. They claim to offer a luxurious lifestyle while also ensuring attractive profits in the future.

Well, do you really believe that you can find something good to say about Jayesh Shah? Just wait, he and his business are listed with a number of accusations & negative feedback. And the tale will just cause you to reconsider.

Allegations Against Jayesh Shah Ravi Group

Jayesh Shah Ravi Group: Received a warning from HC

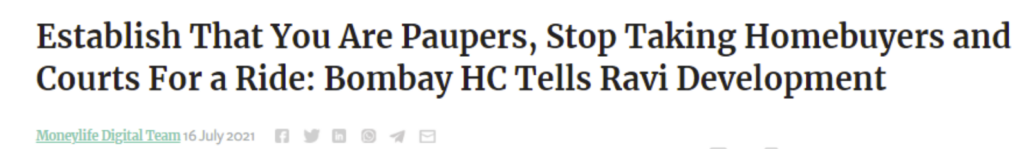

The Bombay High Court (HC) has issued a fervently stated judgment ordering Jayesh Shah and Ketan Shah, the directors of Ravi Group LLP. It was to demonstrate that they are ‘paupers’ by providing bank account records for both themselves and the company as well as information on their style of living.

The HC came down hard on the builder because it was upset about the builder for ‘taking a ride’ with the homeowners who had reserved units and paid the money.

In other words, they would have to prove that they are essentially penniless because they have no money in their bank accounts, and their style of living also supports this, the HC court said in their harsh ruling.

The was case related to April 2013, when the petitioner, retired pensioner Arun Parshuram Veer, signed a legally binding contract to buy a residential apartment with the address 504, “C” Wing, on the fifth floor of the Gaurav-Woods, Phase-II building, for a sum totaling Rs62.77 lakh from partnership firm Jayesh Shah Ravi Group. In total, the petitioner made payments totaling Rs. 61.58 lahks. But the building’s construction was unable to be finished.

The developer was ordered to repay the money paid by the petitioner, plus interest at a rate of 10.05% per year, as well as the Rs3.76 lakh and Rs20,000, paid for stamp duty and registration, by the Maharashtra Real Estate Regulatory Authority (MahaRERA), on May 23, 2018.

Mr. Veer was guaranteed possession in 2015 in accordance with the contract. However, he has not yet gotten the aforementioned flat or a return of the money he had already spent.

A recovery warrant under section 40(1) of the RERA Act was then issued after the petitioner again sought MahaRERA to carry out the earlier order. Later, in an attempt to have the execution order carried out, the petitioner went to the Thane collector, but to no avail.

The Bombay High Court was at last contacted by Mr. Veer. A full and final payment of Rs1.08 crore was agreed upon between the petitioner and the developer after they had both contacted each other in the meantime. On the first installment, however, the developer went into default, and in reality, nothing was ever paid.

In a petition submitted through Law Square attorney Nilesh Gala, the developer was pleading for the Thane Collector to act quickly to attach and sell their assets in order to recover unpaid debts after an executive decision.

The petition was heard by a division bench of Justices SJ Kathawalla and MN Jadhav, who ordered Jayesh Shah Ravi Group to provide information on its movable, encumbered, and unhindered assets, bank records (including personal accounts), as well as information on its standard of living, including electricity bills, credit card statements, and income tax returns for the previous three years.

You can help us put a stop to online scams before they grow too big and end-up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

The bench claims that in addition to misleading homebuyers and the courts by failing to deliver the promised flats, the developer also violated a number of undertakings made to the various courts.

The panel remarked that the Jayesh Shah Ravi Group has disobeyed court orders numerous times and has also neglected to make payments to other apartment buyers.

The offenders knew that assignments were constantly changing, and they tried to persuade the next judge to give them another extension to pay the fine, “which order would once again be breached with impunity,” the court stated.

At the court, Jayesh Shah Ravi Group’s attorney, Makarand Raut, argued that the developer can only afford to pay Rs. 25 lahks by August 2021 (next month). The bench then listed the matter for further adjournment on July 22 and instructed the developer to provide any relevant disclosures on its assets as well as the assets of its partners Jayesh Shah and Ketan Shah.

Unfortunate events led to the petitioner having a heart collapse shortly after this order was read, and he is now recovering in an intensive care facility.

What is a Red Flag?

A red flag serves as a signal or sign that there may be an underlying issue or danger associated with a company’s stock, financial statements, or news reports. These indicators can come in many forms and are often identified by analysts or investors as any notable undesirable trait.

Jayesh Shah Ravi Group Detained for defrauding flat buyers out of almost $12 million

The builder was taken into custody at his office in the Mumbai neighborhood of Kandivali, India, on suspicion of forgery, fraud, breach of trust, and violations of the Maharashtra Ownership of Flats Act.

An official stated on Saturday that the Mumbai police’s Economic Offences Wing (EOW) had detained a 59-year-old builder who was accused of defrauding 30 flat purchasers out of more than 12 crore rupees by failing to give them ownership of the apartments they had reserved.

An officer with the criminal section said that the accused builder, Jayesh Shah, had already been detained for a related offense in 2021.

He was detained by law enforcement until June 27, 2022. More than 100 people who reserved apartments in Jayesh Shah’s Oshiwara-based project in 2012 are allegedly the victims of fraud, according to the police.

He was taken into custody from Arthur Road Prison in 2021 as a result of an FIR filed by Avadh Shah and four other people.

According to the official, 30 persons who paid Jayesh Shah 12.41 crore to buy homes but never received ownership filed a new FIR.

Chargesheet filed against Jayesh Shah Ravi Group, don for threatening builder in Mumbai, India

According to a chargesheet produced by the Crime Branch, builder Jayesh Shah Ravi group collaborated with gangster Chhota Shakeel and his brother-in-law Arif Abubakar Bhaijaan to intimidate a developer into settling the property issue with Shah and giving him 50,000 square feet of land as well.

Shah and Arif Bhaijaan were charged with threatening, extorting, and criminal conspiracy on Wednesday in a 350-page chargesheet submitted by the Crime Branch’s anti-extortion unit.

According to Gyaneshwar Ganore, senior inspector of the Crime Branch’s anti-extortion squad, police have already detained Shah and Bhaijaan and have identified Chhota Shakeel as an evading suspect.

The contents of a Hindi telephone conversation between Bhaijaan and the builder were incorporated into the charge sheet. He said in his conversation that “ I made you an offer; he doesn’t understand, do you? If you don’t give the Jayesh Shah Ravi Group $5 million and 50,000 square feet of property, you and your family will vanish, and you already know who I am. I am CS’s in-law’s brother. Next time, I won’t talk; bullets will do it,” the developer was allegedly informed by Bhaijaan.

Sohail Arbiwala, a south Mumbai antique trader, filed a complaint in October alleging that he paid Meenabai Raut, Bahmini Patil, and others $4 million in 2012 to sell him a five-acre plot of land on Mira Road.

He came to a decision a few months later. The property developer discovered that the builder Jayesh Shah Ravi group had negotiated terms with the previous owners of the plot. He decided to sell the plot after becoming anxious. Sohail had also gone to Jayesh Shah Ravi Group, but he would not entertain him.

Sohail remarked that now “Hajisaheb’s” (referring to Chhota Shakeel) would make him understand. Bhaijaan first appeared in 2018 thanks to estate agent Shyam Ozha. Bhaijaan advised him that if he wanted the property to be cleared, he should offer Jayesh Shah Ravi Group Rs 5 crore and 50,000 sqft of his project as security, or “Shakeel will take care.”

A couple of days later, Bhaijaan messaged Sohail and inquired as to his decision. Sohail objected. According to the police, Bhaijaan warned him about severe consequences.

Criticisms of the Jayesh Shah Ravi Group

At this point, I want to call your attention to the unfavorable reviews left by Jayesh Shah Ravi Group clients. You can evaluate this company’s performance based on the comments that follow.

#1. Flat cancellation refund – Gaurav Crest

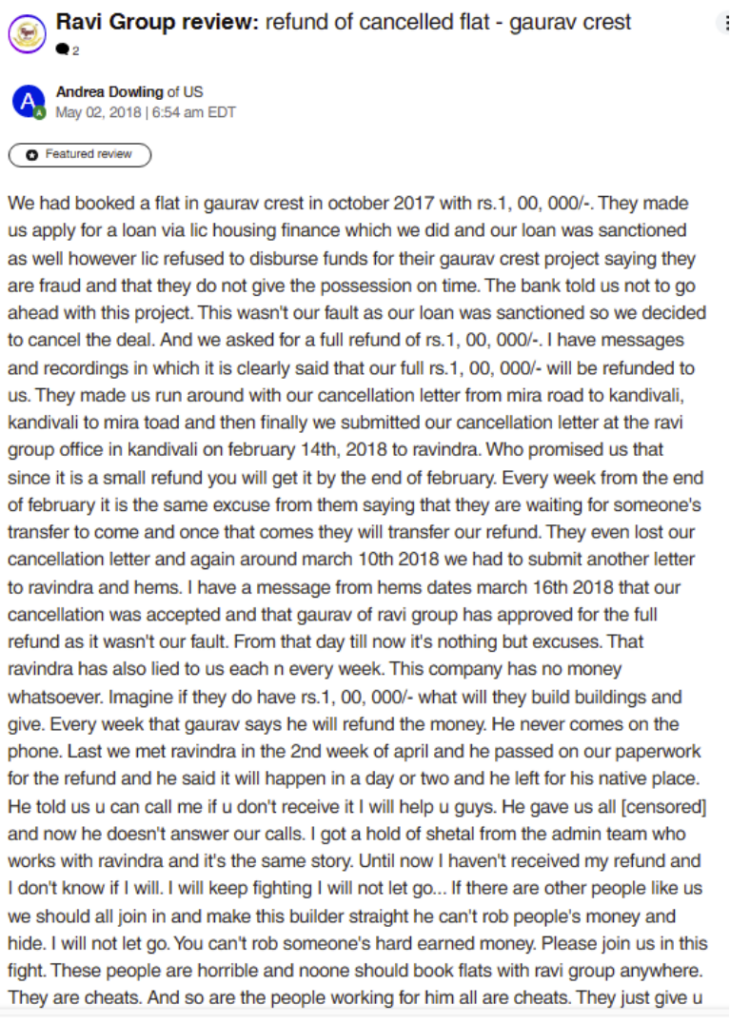

With Rs. 1,00,000, the client reserved a unit in Gaurav Crest in October 2017. They forced them to submit an application for a loan through LIC Housing Finance, which they did and resulted in the approval of their loan as well.

However, LIC refused to release funds for their Gaurav Crest project, claiming that Jayesh Shah Ravi Group is a fraud and that they do not provide possession on schedule.

They were advised by the bank not to proceed with this project. Since their loan had already been approved, it was not their responsibility; thus, they canceled the agreement.

They also demanded full reimbursement of Rs. 1,000,000. There is a clear statement in emails and recordings that their entire Rs. 1,000,000 will be refunded to them.

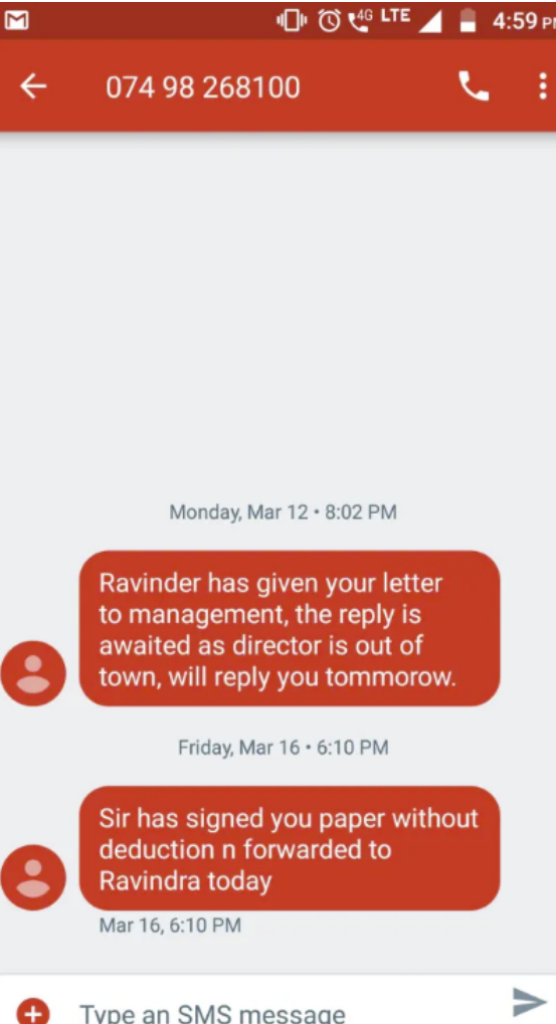

On February 14, 2018, they forced them to run through with their cancellation notice from Mira Road to Kandivali, Kandivali to Mira Toad, before ultimately handing it to Ravindra at the Jayesh Shah Ravi Group office in Kandivali.

Who assured them that while the return was minimal, they would receive it by the end of February. They have been using the same justification every week since the end of February, claiming that they are awaiting the arrival of someone else’s transfer and would transfer their return when it does.

Even our cancellation letter was lost by them, thus we had to send another letter to Ravindra and Hem’s around March 10th, 2018.

Hems responded to the customer on March 16, 2018, letting them know that their cancellation had been received and that Gaurav of the Jayesh Shah Ravi group had approved a full refund because it was not their fault.

Since then, nothing but justifications have been provided. Ravindra has also lied to us every single week, according to him.

This company is totally bankrupt. Imagine what they would do if they genuinely had Rs. 1,000,000. Every week, Gaurav has pledged to refund the money. He never picks up the phone.

In the second week of April, when they last saw Ravindra, he provided them with the paperwork for the return, let us know it would happen shortly, and then left for his own country.

They were instructed to call Ravindra so that he could assist them if he didn’t. The identical story was told to the customer when the admin team that works with Ravindra called. He still hasn’t gotten his return. If there are other individuals who feel the same way, they should all band together to force this builder to stop robbing people and running away with their money.

Finally, the client stated that it is not acceptable to steal someone else’s hard-earned money. He asked to take part in this combat with them. Nobody should ever reserve a flat through the Jayesh Shah Ravi group because these individuals are awful. They are con artists. And everyone who works for him is a thief. They merely offer you bull.

#2. The Jayesh Shah Ravi Group is fraudulent and unlicensed.

The comment that follows is very beneficial to you since it explains how you may protect both your finances and yourself in such a situation.

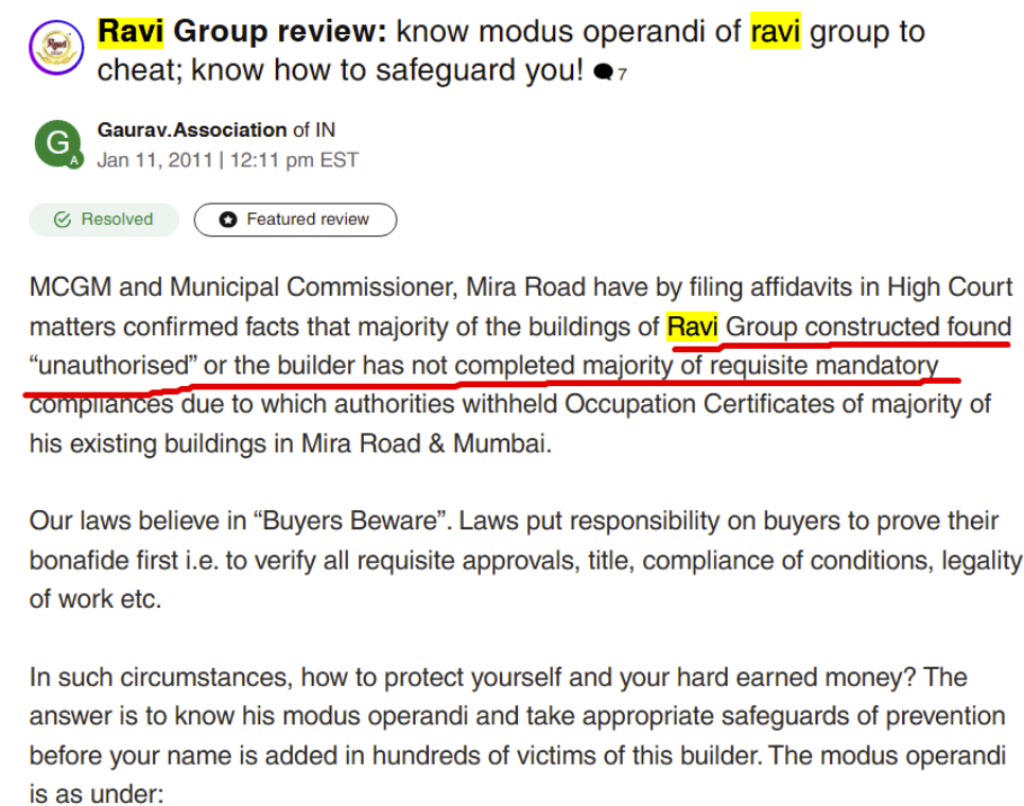

By submitting affidavits in High Court proceedings, the MCGM and Municipal Commissioner, Mira Road confirmed the facts that the majority of the buildings built by the Jayesh Shah Ravi Group were found to be “unauthorized” or that the builder had not met the majority of necessary mandatory compliances as a result of which authorities withheld occupancy certificates from the majority of his existing buildings in Mira Road and Mumbai.

Laws require buyers to first demonstrate their legitimacy, which includes checking for the necessary approvals, title, condition compliance, legality of work, etc.

How can you safeguard your finances and self in such a situation? The solution is to be aware of his methods of operation and take the necessary precautions to avoid becoming one of the hundreds of people who have fallen victim to this builder. The process is as follows:

1. You shouldn’t rely on bank approvals for projects. The explanation is that even banks rely on reports from valuers, architects, and attorneys, among others. Advocates are typically chosen from a panel that has been approved. It’s crucial to remember that most advocates who are unable to secure suitable employment perform such job part-time. They seldom ever check the items that are mentioned above and need for complete focus and concentration. If the Bank has hired competent professionals, they will still be happy and accept the project if the necessary CC and authorized blueprints are obtained.

2. To entice unsuspecting buyers, this builder runs massive marketing and offers extremely low prices. These adverts lure people who then buy apartments out of greed.

Therefore, avoid being swayed by commercials, no matter how large or widely distributed they are. Do not rely on articles that have been published in news publications since builders who have placed large advertisements are permitted to print their own articles under the names of News Paper staff members, for which they may occasionally charge separately. However, keep all of these flyers, publications, and adverts.

3. As a general rule, the developer must append a copy of the commencement certificate (CC) or bandhkam parvana (CC) for the floor where the flat is located in order for the Registration Authorities to register the flat sale documents. For instance, the Jayesh Shah Ravi Group registered the flat selling documents without the necessary CC by paying significant kickbacks. Their complaints nearly caused Mumbai authorities to halt this practice. They have evidence that the Mira Road & Bhayender Authorities still engage in this behavior.

The builder is now registering flat sale documents for Mira Road flats from Thane due to the recent spike in demand from Mira Road officers. The CC should clearly state that permission is provided up to the 14th level or higher floors, for example, if the flat number 1401 is on the 14th floor (we have documents).

You have the right to request a review of the IOD, CC, approved floor plan, NA order, approved layout plan, title documents, etc. before paying the token money. Insist on getting these records. No doubt, the builder will do an inspection.

4. Despite this, the builder is more intelligent than you are. He frequently connects the CC of other buildings as if it belonged to the same building whose flat is being registered or sold. While the builder keeps the names of the building and its wings separate in selling drawings, brochures, and flat agreements, he substitutes numbers when submitting designs for approval. How was this fraud discovered, anyway?

5. Never trust the assurances of Jayesh Shah Ravi Group, that he will buy TDR, that he has already arranged for TDR, or that more clearances are pending. According to past performance, the builder finishes the project whether or not the necessary approvals are granted. The best course of action in these cases is to hold out on buying the apartment or postpone your decision until you discover that the building’s full floors have gotten CC.

6. The title-related verification is the next step. Request a review of all title documents mentioned in the flat agreement’s recital, including the title certificate that is annexed to it. The MCGM denied the developer’s request to turn over the roads because the paperwork had not been registered, even though another department had already given the developer FSI credit for the use of road land. In the end, the MCGM gave the developer notice that all current structures would be deemed illegal if these compliances were not made.

Therefore, even if the developer managed to evade the requirement for registered paperwork at the time the project was approved, he was ultimately compelled to do so once more at a later time.

The distinction is that in the interim, he sold out entire apartments, built structures, and transferred ownership. MCGM’s declaration that the constructions are “unauthorized” doesn’t disturb him any longer. It is a fact.

Further, Conveyance will never be obtained by the structure. A stipulation stating that flat buyers are responsible for paying deficit stamp duty at the time of conveyance can be found at the end of every agreement for this developer’s flats. Unregistered documents are prohibited by law from being used as evidence in court.

Please refer to the Revenue records, such as the property register card and 7/12 of the property. Instead of the developer’s name appearing, you will discover that other people’s names will. In order to better understand how the property was passed from these people to others before being given to the developer, request all the documentation that demonstrates a chain of events.

In order to avoid placing any restrictions on rights, it is important to review the internal terms of each such document.

It is important to confirm that the developer received legal possession and that all payments referred to in the chain of papers are complete.

7. During talks, you’ll notice that the developer’s representatives will make a lot of promises or statements. Inquire as to whether the developer is prepared to make these commitments in writing.

8. Before submitting the token, please carefully read the proposed flat sale agreement’s terms and conditions and make any necessary corrections.

9. Check the track record—this is extremely significant. How can you expect the developer to adhere to his commitments and legal obligations in your project if he hasn’t in other projects where he was given full consideration?

This complaint and suggestion summary, which outlined all the ways that businesses like India’s Jayesh Shah Ravi Group might defraud customers, was really helpful in my opinion.

#3.The Jayesh Shah Ravi Group ideals have a history of deceit, fraud, and illegal conduct

The most illegal structures are those to which Jayesh Shah Ravi Group might claim. The List of Unauthorized Structures, where Work was Performed Without Municipal Approval.

In the majority of developments in Mira Road and Mumbai, the builder has broken the majority of the terms of ULC licenses and sold out the apartments set aside for transfer to the government.

The developer has built hundreds of buildings in Mira Road and Mumbai but has not yet completed a conveyance in favor of any society.

It is true that the developer hasn’t finished any projects on schedule. Jayesh Shah Ravi Group is notorious for defrauding hundreds of innocent buyers by selling apartments to several buyers. Even he is not afraid to register the same apartment’s paperwork in the names of many parties!

Jayesh Shah Ravi Group Review Conclusion

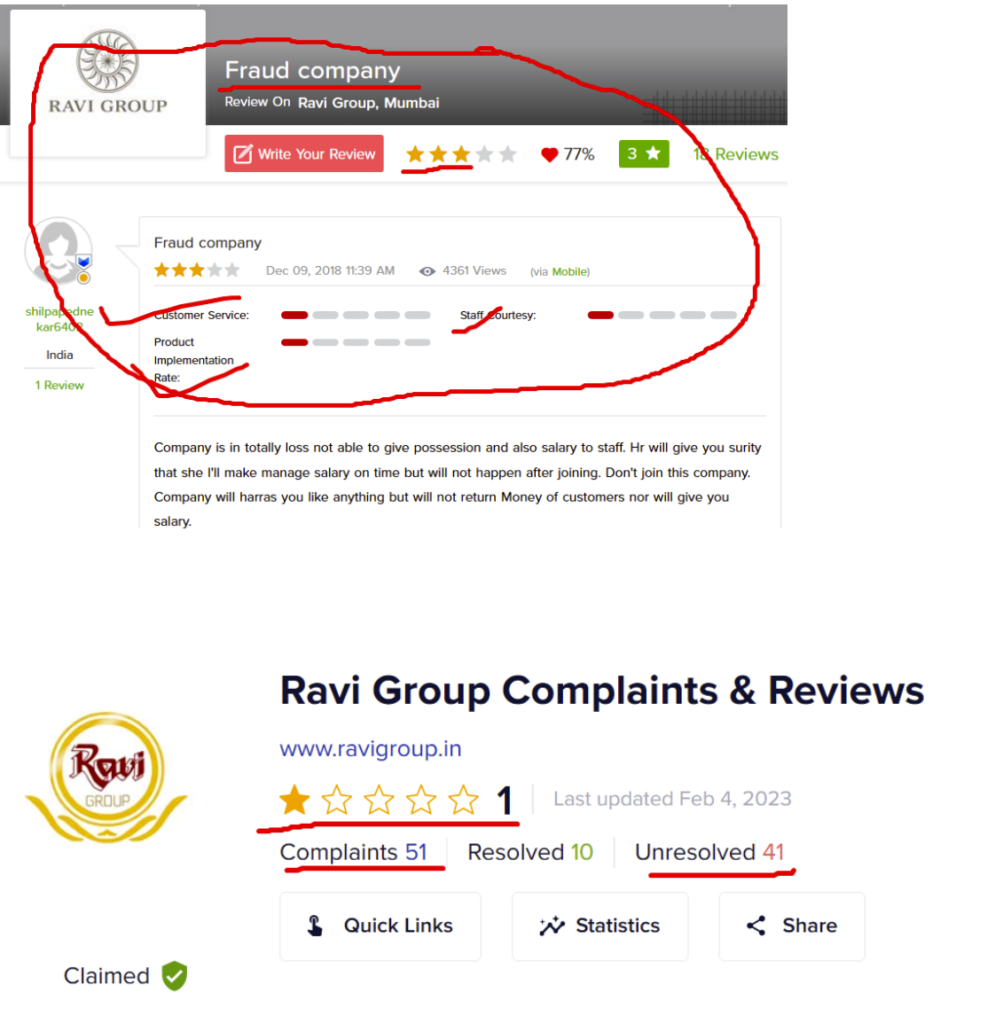

The last thing I want to say about Jayesh Shah Ravi Group is that he is operating a fraudulent business by defrauding numerous customers. Additionally, in my opinion, even after buying a flat with all the necessary paperwork and adhering to their terms and conditions, the buyer cannot be certain that the property is safe. What do you make of this, then? Jayesh Shah Ravi Group is also involved in unlawful and criminal activity, which makes them completely unsafe. So, before spending your money with this group, do extensive investigation. You can glance at the screenshots below, which represent their actual phase as described by reviewers.

These businesses can’t be beneficial for doing investments, as the owner of the Jayesh Shah Ravi Group had an illegal connection.

There are numerous allegations made by the people, that raise concerns firm’s reliability.

The rise could be seen in these cases, where people got scammed by these fraudsters.

If he violates the law of the country, then this guy not be tolerated in society, and liable for higher punishment.

What worries me, the most is that the regulatory authority of the country doesn’t know anything about these cases.

Defrauding customers, and earning money from them. These business needs to be stopped.