Who is Jennifer Garcia (CRD#: 2266576)

Jennifer Gracia, a Private Wealth Financial Advisor with over 25 years of experience, has established her practice around advising successful people, wealthy families, and private foundations. Jennifer Gracia and her team help high-net-worth customers plan and implement strategies to meet their financial and personal goals through a long-term investing approach.

Jennifer Gracia and her strategic partners both take a multi-generational approach to wealth management, working with clients for decades to ensure that short-term, long-term, and legacy considerations are addressed, planned for and changed as needed over time. Most importantly, Jennifer Gracia will work with you through any life changes or major events that necessitate a reconsideration of the strategies you have in place.

Jennifer Gracia is dedicated to constantly expanding her knowledge and skills to meet the ever-changing and increasingly sophisticated needs of high-net-worth investors. Jennifer Gracia earned a Bachelor of Science in Finance from California State University Northridge, as well as the College for Financial Planning’s CERTIFIED FINANCIAL PLANNERTM (CFP®) and Accredited Domestic Partnership AdvisorSM (ADPA®) professional qualifications.

Jennifer Gracia is a proud and dedicated member of her community, sitting on the Board of Directors for Discovery Cube Los Angeles, which delivers science-based events and exhibits to engage young minds. In addition to previous non-profit board involvement, she is an active participant in her son’s band development program.

She also serves as a mentor and leader in the wealth management industry, heading Wells Fargo’s Private Wealth Advisory Council since 2019, and is a regular panelist for various industry-related summits, including the 2020 Barron’s 100 Panel and Wells Fargo Advisors Women’s Summit Panel, the 2022 Forbes Top Women Advisor Summit, and the CA Women Lead Annual Conference hosted at the UCLA Luskin Center.

Jennifer Gracia’s opinions and observations have been featured in media channels and publications such as Financial Planning magazine, MarthaStewart.com, Forbes.com, and Yahoo Finance.

Jennifer Gracia resides in Santa Clarita, California, where she enjoys spending time with her family and exploring the local area. She enjoys going to the mountains and the ocean, and she spends her free time reading and staying active outside.

About FIRM: Wells Fargo Advisors

Wells Fargo & Firm is a multinational financial services firm headquartered in the United States with a major global presence. The corporation is present in 35 countries and services more than 70 million clients globally. The Financial Stability Board has designated it as a systemically important financial institution, and it is one of the “Big Four Banks” in the United States, along with JPMorgan Chase, Bank of America, and Citigroup.

Wells Fargo is the outcome of a 1998 merger between the old Wells Fargo & Company and Minneapolis-based Norwest Corporation. While Norwest was the nominal survivor, the merged corporation adopted the more well-known Wells Fargo moniker and relocated to Wells Fargo’s San Francisco headquarters. At the same time, its banking subsidiary amalgamated with Wells Fargo’s banking subsidiary in Sioux Falls. With the acquisition of Charlotte-based Wachovia in 2008, Wells Fargo became a coast-to-coast bank.

The firm’s primary subsidiary is Wells Fargo Bank, N.A., a national bank that declares its Sioux Falls, South Dakota location as its main office (and is thus considered a citizen of South Dakota by most U.S. federal courts). It is the fourth-largest bank in the United States in terms of total assets and one of the largest in terms of bank deposits and market capitalization. It has a total of 8,050 branches and 13,000 ATMs. It is one of the most valuable bank brands in the world. Wells Fargo is ranked 41st on the Fortune 500 list of the world’s largest corporations.

Several regulatory inquiries have been launched against the corporation. On February 2, 2018, the Federal Reserve barred Wells Fargo from expanding its almost $2 trillion asset base further until the corporation resolved its internal flaws to the satisfaction of the Federal Reserve. Wells Fargo was fined again by the US Justice Department in September 2021 for fraudulent activities by the bank against foreign-exchange currency trading customers. According to Bloomberg Businessweek, Wells Fargo was the only major lender in 2020 to reject more home refinancing applications from Black applicants than it approved.

The United States imposed a $3.7 billion loan management penalty on Wells Fargo in December 2022. Wells Fargo cited a technology glitch in March 2023 for misstating customer account balances, in many cases wrongly declaring the consumers to have a negative bank balance. Following that, in 2023, prison sentences were handed down for employee-directed money laundering and illegally funneling cash to Mexico via bogus accounts.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Jennifer Gracia Disclosures: BrokerCheck, FINRA, And SEC Reports

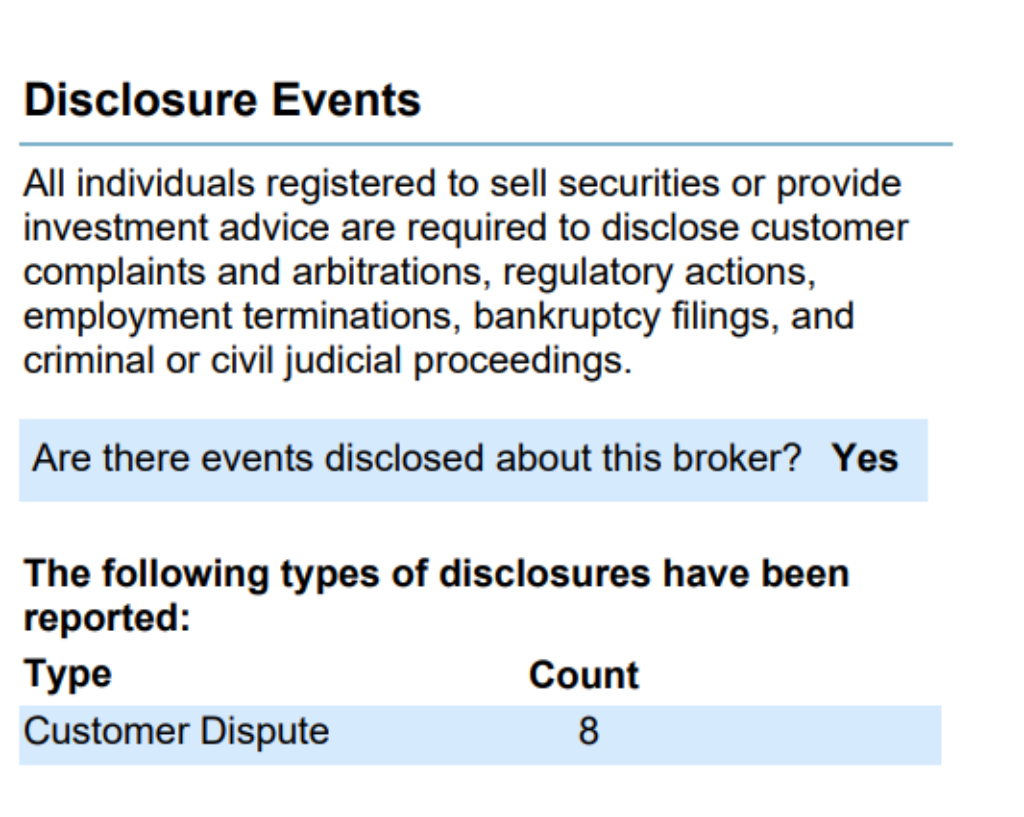

There is eight disclosure named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

FINRA’s BrokerCheck

individual_2266576.pdf (finra.org)

SEC Litigations & Forms

Source: Jennifer Garcia – SEC Site Search Search Results

Jennifer Gracia Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Jennifer Gracia that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Jennifer Gracia on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Jennifer Gracia Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Jennifer Gracia using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Jennifer Gracia or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Jennifer Gracia (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management