Who is John Perry (CRD#: 4409395)?

John Perry serves as a monetary counselor based in Carmel, Indiana, with 14 years of applicable expertise. Morgan Stanley has John Perry on its advisory board. John Perry has worked for Morgan Stanley Smith Barney Inc. during their career.

John holds Category 65 and Class 66 licenses, allowing him to act as both a commodities agent and a financial advisor representative in Illinois, Indiana, and Texas.

John is one of a select group of Financial Advisors who received Morgan Stanley’s Family Wealth Director designation, an industry-leading name that illustrates he met demanding and high standards for sending depth of expertise and broadness of understanding in money planning and investment guidance to the most wealthy customers.

John Perry holds a master’s degree in business administration from Butler University and a Bachelor of Science in Finance, Real Estate, and International Business from Indiana’s Kelley School of Business.

John now serves on boards that include the Goodwill Industries Organization, the Butler University School of Business Board of Visitors – Current Council Chair, and the Butler University Accelerator Advisory Panel. He also serves on the Advisory Board of the Students Managed Investment Fund.

About Morgan Stanley Private Wealth Management:History, achievements, leadership, lawsuits, & disputes

Morgan Stanley Private Wealth Management is an international monetary consulting firm headquartered in Purchase, New York. It employs 28,000 people and has branches in 930 locations.

It manages $1 trillion in assets across 2,233,188 user accounts, which makes it one of the largest corporations in the United States in terms of assets under management.

The firm advises 30,383 organizations and foundations on financial matters. Only 1% of its 2,233,188 customer accounts are held with high-net-worth people with a minimum of $1 million in investable assets.

Financial strategy offerings, portfolio administration for people and small enterprises, portfolio management for investment firms, portfolio management for financial institutions, pension advice, the selection of other experts, educational seminars, and other services are provided by the firm.

Morgan Stanley Private Wealth Management offers a comprehensive variety of financial services to address the diverse needs of its clients. Many services are as follows:

Management of Investments

Morgan Stanley Private Wealth Management, Inc. offers a wide range of investing options, including equities, bond investments, mutual funds, exchange-listed funds (ETFs), and others. Their financial planners work with users to develop personalized investment programs that match their specific financial goals and risk tolerance levels.

Financial Preparation

Morgan Stanley Private Wealth Management offers retirement planning, education tactics, wills and trusts, and other financial management services. Their financial advisors work with clients to understand their financial objectives and develop detailed financial plans to help them achieve those goals.

Annuities and insurance

Morgan Stanley Private Wealth Management offers coverage and annuity products such as life insurance, long-term care insurance, and annuity plans to help clients protect their financial future by providing financial stability and peace of mind.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

John Perry Disclosures: BrokerCheck, FINRA, And SEC Reports

According to the BrokerCheck’s report, only one disclosure has been made against John Perry. Clients say that from the fall of 2003 to the spring of 2004, Fa urged clients to make investments in a property based on misleading statements made by the broker. Fa emphatically disputes the consumers’ assertions. The customer’s complaints are for damages. As a result, the total investment was $1,000,000.

Brokers reacted by saying that after an investigation, the complaint was judged to be without substance and was refused.

FINRA’s BrokerCheck

individual_4409395.pdf (finra.org)

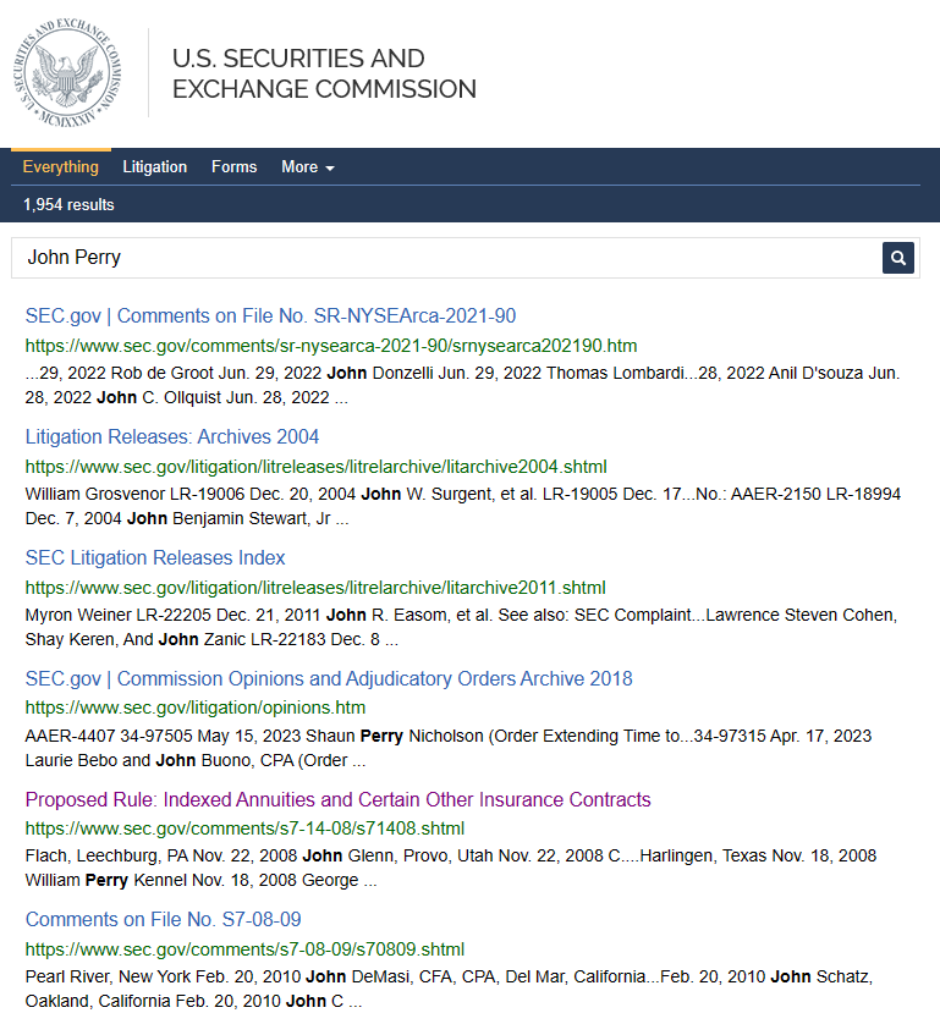

SEC Litigations & Forms

Source: John Perry – SEC Site Search Search Results

John Perry Lawsuits, Legal Battles, & Disputes

The great majority of court cases filed in the United States of America are saved because of CourtListener, UniCourt, Law.com, Justia, Trellis Law, and Law360. John Perry never be involved in a scenario, you can learn more about it by following the links supplied below.

There might be more pending lawsuits against John Perry which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against John Perry on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis. law

Justia

John Perry Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against John Perry using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with John Perry or any financial advisor.

Frequently Asked QuestionsFind the answers to your most common questions related to John Perry & Morgan Stanley Private Wealth Management

Where is John Perry located?

What are John Perry’s qualifications

Is John Perry facing any lawsuits?

Has John Perry been charged by the SEC?

How do I contact John Perry?

Does John Perry have any disclosures?

Which Firm does John Perry work with?

What is John Perry’s CRD Number?

Better Alternatives To John Perry (By Experts):Find the top 3 alternatives to John Perry

1:2 advisor/client ratio

Reputed

High overall rating