Although Joseph Patrick Roop believes he is one of the most well-known and competent brokers, what do you think makes him the greatest at what he does? Oh! We’ll get his true image after we learn more about his personality. The following provides more information regarding his tale:

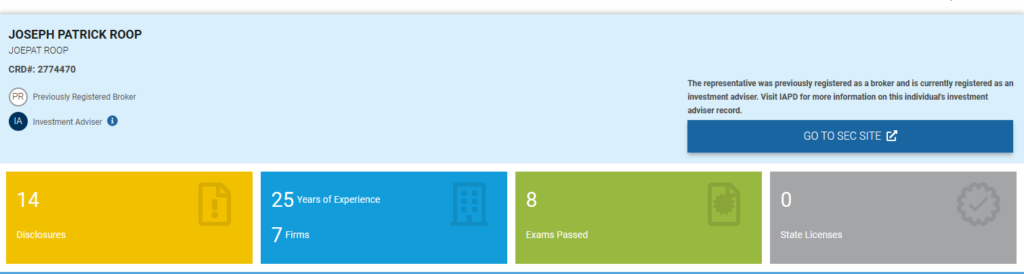

Joseph Patrick “JoePat” Roop, an experienced financial planning executive based in Charlotte, is the head of Belmont Capital Advisors and closely collaborates with high-net-worth customers. JoePat has devoted his career as a Financial Advisor with more than three decades of experience to assisting people and families in making financial plans and achieving their financial objectives.

You can help us put a stop to online scams before they grow too big and end up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

Joseph Patrick Roop places a high value on a balanced approach to portfolio management that includes securities like equities, bonds, mutual funds, annuities, and insurance services. Professionals in the field, he and his colleagues always look for tax-advantaged routes that increase income potential in retirement.

Joseph Patrick Roop claims to offer his clients excellent financial advice and feasible plans to ensure their financial futures because of his extensive expertise and experience.

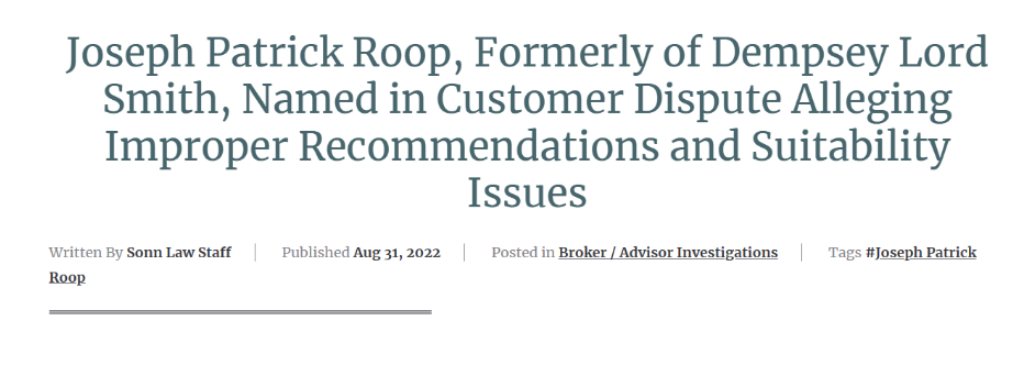

A customer complaint has been filed against Joseph Patrick Roop, a former broker with Dempsey Lord Smith, alleging inappropriate recommendations and suitability problems.

Joseph Patrick Roop: Disputes with Customers filed

Joseph Patrick Roop, a former broker at Dempsey Lord Smith, is the subject of a customer complaint citing inappropriate recommendations and suitability problems.

Between 2019 and 2021, Dempsey Lord Smith had Joseph Patrick Roop listed as a broker. From 2009 through 2019, Joseph Patrick Roop was licensed as a broker with Kalos Capital.

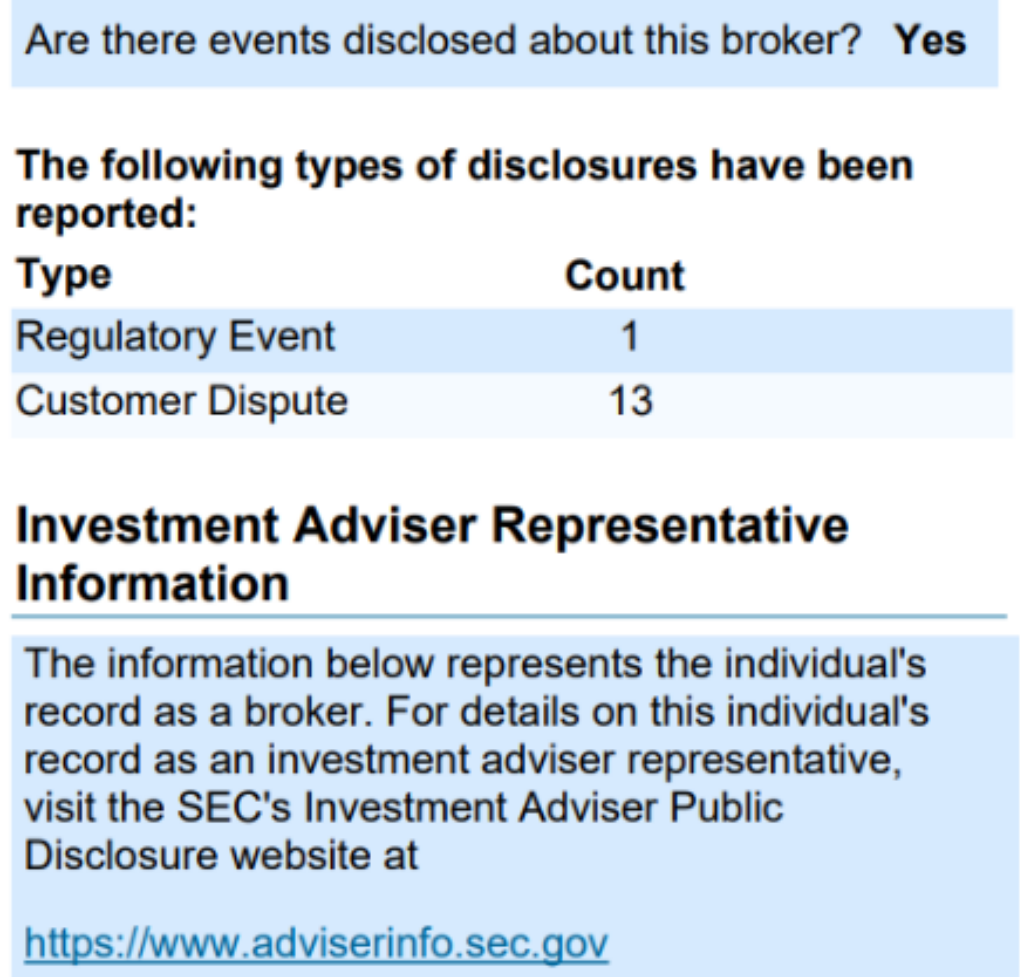

On his BrokerCheck report, Joseph Patrick Roop has disclosed fourteen issues. One customer complaint made against Joseph Patrick Roop was dismissed without any further action.

Disclosures of Joseph Patrick Roop

These kinds of disclosure events could include:

(1) a formal, final action taken by a regulatory entity (such as a state securities agency, self-regulatory group, federal agency like the Securities and Exchange Commission, or foreign financial regulatory body) for a breach of investment-related laws or regulations; or

(2) the termination or suspension of a broker’s right to practice law, work as an accountant, or serve as a federal contractor.

- December 2008-Here, it is claimed that the 2008 market crash caused the client’s portfolio to suffer significant losses. The client claimed that she was unaware of the risk.

Broker Comment: All necessary disclosures and documentation were in place from the time of the complaint. He claimed that despite asking what information Wachovia might require from him to support their defense of the complaint, they never did so. Joseph Patrick Roop refused to take part in it and begged not to be included in any conversations involving this matter.

Status- This case was settled for $56,000.00 whereas the damaged amount requested was $137,703.00

- February 2009-Client stated that improper options trades were executed in his account. Damages unknown but estimated to be more than $5000 (07/18/2008 – 01/20/2009)

Broker Comment: Tim Bershea (BOM) approved the proper papers and disclosures, which were in place. Joseph Patrick Roop was never asked for any correspondence or conversation addressing the issue. To be nearer to his CPA, the client asked for a transfer of his accounts to a different Wachovia broker in Birmingham, Alabama, in October 2008. Everything was done with the client’s complete knowledge, consent, and understanding. Joseph Patrick Roop called Wachovia several times but never received a response or information about this complaint or its status.

Status– This case was settled for $85,000.00.

- October 2009- The client alleged improper equity products from January 2005 to July 2008 were sold. Damages are undefined.

Broker Comment: He had accounts containing stocks, bonds, closed-end funds, mutual funds, and options while he worked with [Customer]. They frequently received in-person reviews multiple times a year.

They frequently spoke over the phone to exchange information about his accounts, earnings, and investment performance. While at BAI, my mgr [another business employee] spoke with [Customer] regarding his accounts and risk tolerance; [Customer] has not specifically accused anyone of wrongdoing but just laments that the value of his account has decreased.

Status- This case was settled for $38,000.00

- In August 2010, in the allegation, Clients opened an account with Joseph Patrick Roop in 2002, and throughout their five-year engagement, Joseph Patrick Roop worked for three different companies—Legg Mason, Banc of America, and Wachovia. The client makes claims of suitability, unsuitability, negligent misrepresentation, fraudulent misrepresentation, inducement fraud, breach of contract, and breach of fiduciary responsibility. Roop disputes every accusation.

Broker Comment: These clients had accounts that were made up of aggregated distinct shares during the period he dealt with them. At routine client meetings, the dangers associated with big individual holdings were covered. They also had options, closed-end funds, and mutual funds in their account. They spoke on the phone and in person. Sessions took place at their house, and on occasion, their CPA attended as well.

Weekly meetings with the customer were held during 2008’s most tumultuous period of the market, during which they received updates on the market and their accounts. The branch manager completed and approved all of the documentation. The branch manager also called the clients to confirm their familiarity with the accounts. ***Wells Fargo Advisors reached a $52,500 agreement. Bank of America remains unresolved. Bank of America settled for $135,000.***

We look at 34 different data points when analyzing and rating service providers. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

Status- This case was settled for $135,000.00 whereas the damaged amount requested was $750,000.00

- January 2014- Customers claimed major fact omissions, misrepresentations, and excessive trading between December 2004 and May 2008. Damage amounts aren’t mentioned.

Broker Comment: Since he hasn’t received a copy of the accusations, he can’t offer any commentary at this point.

Status- This case was settled for $25,000

- October 2018- Here in the case, the client claimed that representatives who were improperly registered in Alabama sold products and made unwise transactions. The approximate time frame for all investments was from January 2011 to July 2014.

Status- This case was settled for $90,000.00 whereas the damaged amount requested was $100,000.00

- January 2020 –Here, it is alleged that Mr. Roop failed to exercise reasonable diligence and gave investment advice that included speculative and inappropriate stocks as a result of major false statements and omissions made by Cottonwood and GPB Capital Holdings, LLC.

Broker Comment: Kalos Capital, Inc. decided to settle the case to avoid the time, interruption, and cost of a drawn-out arbitration proceeding. This decision was made based on the firm’s best interests.

Status- This case was settled for $17,500.00 whereas the damaged amount requested was $65,000.00

- September 2020-Allegations in an email to the representative, the client claimed that he was not informed that the transaction was illiquid. This complaint was made by email to the registered representative and was not made in writing to the company. November 2013 saw the purchase of the item.

Broker Statement: The representative suggests that he had many discussions with the client about the product being bought being illiquid. PPM and subscription documents were provided to the client & clearly stated that the product is non-liquid. Customers wanted income, & products gave it to them. Up until it stopped due to the current problem in April 2020, the product was paying dividends.

Status- This case was with the damaged amount requested of $10,000.00.

- December 2020-Recommendations that are inappropriate and excessively focused

Broker Comment: He had to use a joint representative number on every piece of business written by a registered representative in his office because he was the practice’s owner. He didn’t meet with this client or offer any advice.

Status- This case was settled for $25,000.00 whereas the damaged amount requested was $500,000.00

- May 2021 – Unsuitable investments, contract violations, failure to supervise, and fiduciary obligation violations are all alleged.

Status- This case was settled for $14,999.00

- August 2021- Here the Client’s complaints about inappropriate recommendations and suitability problems were made to the state of North Carolina.

Status- This case is pending.

- December 2021-Allegations: According to the Securities Division, there were violations of 18 NCAC 06A.1414(a) for failing to keep accurate records, conducting one or more transactions without the proper power of attorney, and getting commission for one or more transactions involving out-of-state clients. For failing to promptly update the U-4 with an OBA for a business that was not operating, the Securities Division also claimed a violation of N.C. General Statute 78C-18(d) and 18 NCAC 06A.1703.

Resolution: Achieved through an Order of Consent

Sanction: Fine(s) or Civil and Administrative Penalties

Broker Comment: To prevent further registration delays, Mr. Joseph Patrick Roop decided to settle this lawsuit. $95,000 was paid in total, consisting of the $12,500 penalty and the $82,500 in investigative costs.

- April 2022- Allegations range from August 2016 to March 2019 and concern violations of FINRA Rules of Conduct 2110, 2111, and 2120 by inappropriate suggestions, Roop’s proposals, misrepresentations, and misleading statements.

Status- This case was settled for $37,500.00 whereas the damaged amount requested was $200,000.00

- November 2022- Allegations of negligence, fiduciary duty violations, fraudulent misrepresentations, and contract violations.

Status- This case was with the damaged amount requested of $220,000.00. The case is pending.

Joseph Patrick Roop: Owner of Belmont Capital Advisors

Joseph Patrick Roop, of Belmont, North Carolina, a stockbroker registered with Dempsey Lord Smith LLC, is the subject of a customer-initiated investment-related FINRA securities arbitration assertion in which the client asked for $220,000.00 in damages based on claims that Roop was careless, breached his fiduciary duties, and made material misrepresentations.

The Charlotte metropolitan region is served by Belmont Capital Advisors, a financial advisory and retirement planning business in Belmont, North Carolina.

History of Belmont Capital Advisors

Belmont Capital Advisors has expanded as a stand-alone company since being founded in 2009 by Joseph Patrick Roop, claiming to offer services ranging from asset management to retirement planning. Working with individual investors embodies their firm’s core values in numerous ways. This is because they are a relationship-based organization, with deep, long-lasting ties that have been forged through generations by a sense of trust, integrity, and transparency. They are investors themselves, just like you, which is another factor. They share your goals of preserving, developing, and transferring a legacy of financial stability developed over a lifetime of arduous work.

Unsuitable property investment recommendations are made about Kalos Capital

An investment-related FINRA securities arbitration claim brought by a customer and settled for $25,000.00 in damages alleges that the customer received unsuitable real estate investment advice from Joseph Patrick Roop (also known as Joe Pat Roop), of Belmont, North Carolina, a stockbroker formerly registered with Kalos Capital Inc.

The stockbroker Joseph Patrick Roop (also known as Joepat Roop) of Belmont, North Carolina, who was formerly employed by Kalos Capital Inc. has been named in a written investment-related customer complaint that was settled for $17,500.00 in damages on January 29, 2020. The complaint was based on claims that Roop had advised the customer to invest in unsuitable real estate securities and direct investments while the stockbroker was working for Kalos Capital Inc.

The claim contends that the customer’s advised investment strategy was not adequately investigated. The claim alleges omissions and false statements about GPB Capital Holdings and Cottonwood securities that were bought for the customer’s account as part of the plan that Roop promoted.

Regarding allegations of his misbehavior when the stockbroker was working for securities broker-dealers such as Banc of America Investment Services, Wells Fargo Advisors, and Kalos Capital, Roop has been named in seven other customer-initiated investment-related disputes. According to the Financial Industry Regulatory Authority’s (FINRA) Public Disclosure, a customer-initiated investment-related arbitration claim regarding Roop’s behavior was settled for $52,500.00 in damages based on claims that Roop executed bad options and equity transactions in the Wells Fargo customer’s account.

Another investment-related complaint brought by a client against Roop was resolved for $25,000.00 in losses after it was claimed that the stockbroker had misled and omitted to inform the client about closed-end funds and options that were offered for sale by Roop while the stockbroker was affiliated with Banc of America.

Another customer-initiated investment-related arbitration claim involving Roop was settled for $90,000.00 in losses and was based on claims that Roop had recommended the Kalos Capital customer purchase securities of a business development company and that the transactions had taken place while the stockbroker was not registered in the State of Alabama. Awarded on February 4, 2019, FINRA Arbitration No. 18-03317.

On July 8, 2019, a different customer filed an investment-related arbitration claim against Roop in which they demanded $450,000.00 in damages. They claimed that Joseph Patrick Roop had misled the Kalos Capital customer into making alternative investments, such as real estate investment trusts and oil and gas securities, which turned out to be unsuitable for them and caused investment losses. Arbitration under FINRA No. 19-01140.

Roop’s Kalos Capital registration has been canceled as of July 22, 2019. He has been related to Dempsey Lord Smith from that time.

Conclusion

As a result, I have disclosed all of the accusations leveled against Joseph Patrick Roop regarding how he disclosed information about customer disputes. What do you believe he ought to do with his brokering?

The customer had a negative petition regarding the financial advisors and the broker due to this man. Various professional advisors have excellent and deep knowledge of investment. But this man completely degraded the industry.

The people need to check the brokers and the schemes that were offered by them, before going to any type of financial plan. There are various bogus plans and unwanted securities were there in the market. These brokers are the medium to sell unreliable securities and the source to the customers. It is best to keep a distance from these brokers.

These financial brokers are a nightmare for most people were suffer heavy financial losses while dealing with these brokers. They were giving fake and misleading advice to the customers. It would be better to stay away from these financial advisors.

Why do Brokers like Joseph Patrick not understand that it is traumatic for people to put their hard-earned money into inappropriate investments? The government needs to do anything to solve these disputes. By doing this there would be chances that the customers would be able to get relief from these bogus plans.

The regulatory authority had to take strict action on them. Many customers had numerous disputes about these incompetent brokers, who were there to mislead the people. And Also for suggesting the unsuitable investment to the customers.

There are numerous complaints on these brokers and some of the cases are still pending. Why the regulatory authority is not taking any strict action regarding this issue? Now these kinds of disputes need to be fixed and also cancelled the license of these brokers who were involved in such lawsuits.

The firm indulged in the misrepresentation of the securities. This firm is not liable for investing the retirement funds. It seems to be risky to deal with. There was a lack of transparency and the brokers were never accountable to their clients.

These brokers were only there to Conn the people and earn the money. I agree with the author’s point. This financial advisory firm has no better track. They were involved in the various shady practices.