Who is Kimberlee Orth (CRD#: 1743707)

Kimberlee Orth, CFP is a private financial advisor at Orth Financial Group, an Ameriprise Financial Services, Inc. private wealth advisory business. Kimberlee Orth supervises a team of 22 individuals that service over 1,200 client groups from her Wilmington, DE headquarters. Through personal, long-term financial planning partnerships, her expanding practice focuses on assisting clients in achieving their financial goals for a lifetime. The educational qualification of Kimberlee Orth includes the

- The University of Delaware, BS Business Administration, 1985

- College for Financial Planning, Certified Financial Planner, 1990

Kimberlee Orth has qualified for the coveted Ameriprise Chairman’s Advisory Council every year since 2004, based on exceptional performance and client service. She will meet with Ameriprise Financial Chairman, CEO, and senior Ameriprise Financial management to address current concerns and business possibilities. These advisers are among Ameriprise’s top 1%.

Kimberlee Orth received the distinction of being selected No. 1 on Barron’s “Top 100 Women Financial Advisors” list in both 2020 and 2016. Kimberlee Orth was awarded #1 in Delaware on the Barron’s State-by-State Ranking of the Top 1,200 Financial Advisors in the US in March of this year. Kimberlee Orth was selected to Barron’s “Top 100 Independent Advisors” list for 2020 as recently as September. Kimberlee Orth has appeared on CNBC, Fox Business Network, and Yahoo Finance, and has been quoted widely in publications such as The Wall Street Journal, Barron’s, and Delaware Today.

When you work with Kimberlee Orth, you will receive:

1:1 financial counseling tailored to your specific goals and needs.

Personalized portfolio recommendations and strategies to help protect you against uncertainty.

Meetings should be held regularly to discuss your goals, accomplishments, and investments.

You can access your investments and digital tools at any time to help you stay on track.

The area of focus in the case of Kimberlee Orth is as follows:

Retirement Planning Strategies

Retirement Income Strategies

Wealth Preservation Strategies

Estate Planning Strategies

Investments

Tax Planning Strategies

Executive Compensation and Benefit Strategies

Insurance

Financial Strategies for LGBTQ Couples and Families

About FIRM: Ameriprise Financial Services, LLC

Ameriprise Financial Services, LLC was founded in 1894 as Investors Syndicate by John Tappan in Minneapolis, Minnesota. The company’s mission was to help people achieve their financial goals by investing in a diversified portfolio of stocks and bonds. Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services.

Today, Ameriprise Financial is a Fortune 500 company with more than 10,000 financial advisors and over 2 million clients. The company has offices in the United States, Canada, and the United Kingdom and is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning.

The History of Ameriprise Financial Services, LLC

As mentioned earlier, Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan. Tappan believed that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. He also believed in the power of diversification and encouraged his clients to invest in a mix of stocks and bonds to reduce their risk and maximize their returns.

Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States. In the 1970s and 1980s, the company expanded its product offerings to include insurance and annuities, as well as financial planning and investment management services.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. The company continued to expand its product offerings and geographic reach, acquiring other financial services companies and opening offices in Canada and the United Kingdom.

In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services. Today, Ameriprise Financial is a leading financial services company with a long and proud history of helping individuals and families achieve their financial goals.

Ameriprise Financial’s mission and values

Ameriprise Financial’s mission is to help people feel confident about their financial future. The company believes that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. Ameriprise Financial is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning that takes into account their unique circumstances and objectives.

Ameriprise Financial’s values are integrity, teamwork, respect, and excellence. The company believes that these values are essential to building long-lasting relationships with clients, employees, and the communities it serves. Ameriprise Financial’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s services and products

Ameriprise Financial offers a wide range of financial planning and investment management services designed to help individuals and families achieve their financial goals. These services include:

Financial planning: Ameriprise Financial’s financial advisors work with clients to develop a comprehensive financial plan that takes into account their unique circumstances and objectives. The plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management.

Investment management: Ameriprise Financial’s investment management services include access to a wide range of investment products, including mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, and alternative investments. Ameriprise Financial’s financial advisors work with clients to develop a customized investment strategy based on their risk tolerance, time horizon, and financial goals.

Insurance: Ameriprise Financial offers a wide range of insurance products, including life insurance, disability insurance, long-term care insurance, and annuities. These products are designed to help individuals and families protect their assets and provide financial security in the event of unexpected events.

Ameriprise Financial’s approach to financial planning

Ameriprise Financial’s approach to financial planning is based on a personalized, comprehensive, and holistic approach to financial planning. The company’s financial advisors work with clients to develop a customized financial plan that takes into account their unique circumstances and objectives.

The financial plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management. Ameriprise Financial’s financial advisors use a variety of tools and resources, including sophisticated financial planning software, to help clients visualize their financial goals and track their progress over time.

Ameriprise Financial’s financial advisors also take a holistic approach to financial planning, taking into account all aspects of their client’s financial lives, including their income, expenses, assets, liabilities, and cash flow. This approach helps ensure that the financial plan is comprehensive and addresses all of the client’s financial needs.

Ameriprise Financial’s community involvement and corporate social responsibility

Ameriprise Financial is committed to being a responsible corporate citizen and giving back to the communities it serves. The company’s community involvement and corporate social responsibility efforts include:

Volunteerism: Ameriprise Financial encourages its employees to volunteer in the communities where they live and work. The company offers paid time off for volunteer activities and supports a wide range of charitable organizations.

Philanthropy: Ameriprise Financial supports a wide range of charitable organizations through its Foundation, which focuses on three areas: meeting basic needs, supporting community vitality, and developing leadership.

Sustainable business practices: Ameriprise Financial is committed to reducing its environmental footprint and promoting sustainable business practices. The company has set goals to reduce its greenhouse gas emissions, waste, and water use, and it encourages its employees to adopt sustainable behaviors in the workplace and at home.

Ameriprise Financial’s awards and accolades

Ameriprise Financial has received numerous awards and accolades for its financial planning and investment management services, as well as its corporate social responsibility efforts. Some of the company’s recent awards and accolades include:

Forbes Best-In-State Wealth Advisors: Ameriprise Financial had more advisors on Forbes’ list of Best-In-State Wealth Advisors than any other firm.

Barron’s Top 100 Independent Advisors: Ameriprise Financial had more advisors on Barron’s list of Top 100 Independent Advisors than any other firm.

Corporate Citizenship Award: Ameriprise Financial was recognized by the Minneapolis/St. Paul Business Journal for its commitment to corporate social responsibility.

Ameriprise Financial’s financial strength and stability

Ameriprise Financial is a financially strong and stable company with a long-term track record of success. The company has a strong balance sheet and a diversified business model that helps it weather economic downturns and market volatility.

Ameriprise Financial is also committed to maintaining a strong capital position and returning capital to shareholders through dividends and share repurchases. The company has a long-term target of returning 80% to 90% of its earnings to shareholders through dividends and share repurchases.

Ameriprise Financial reviews and customer satisfaction

Ameriprise Financial has a strong reputation for customer satisfaction and has received numerous awards and accolades for its customer service. The company’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s customers have also given the company high marks for its financial planning and investment management services. The company has a 4.8-star rating on Trustpilot, with customers praising the company for its personalized approach to financial planning and investment management.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

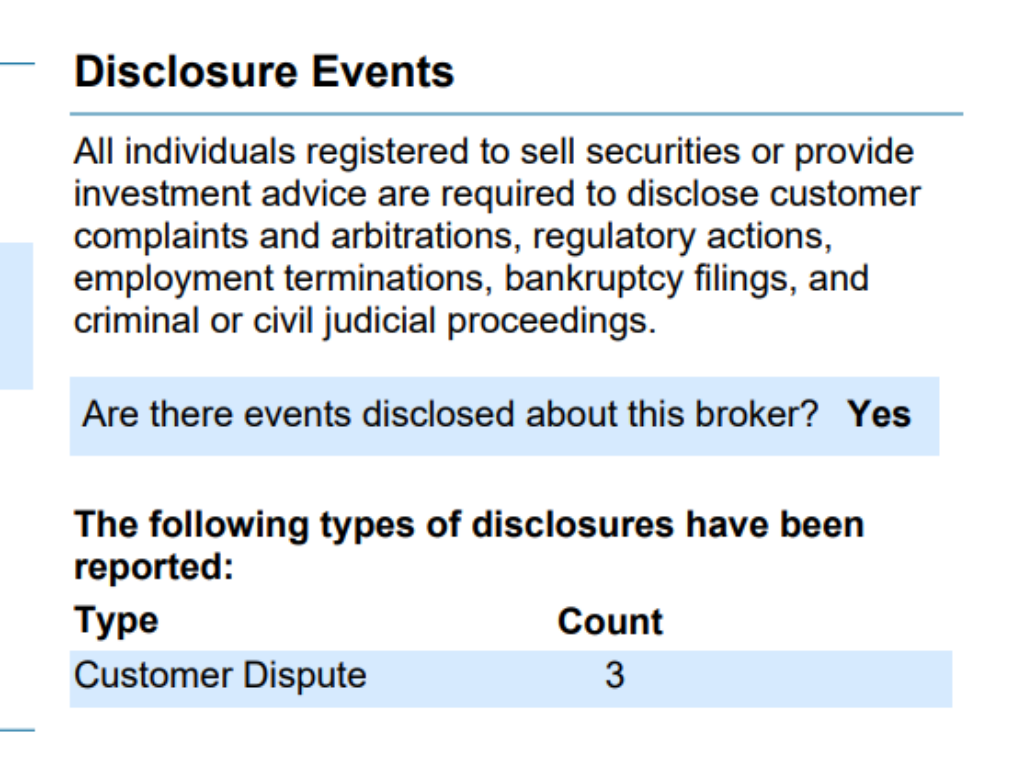

Kimberlee Orth Disclosures: BrokerCheck, FINRA, And SEC Reports

There are three disclosures named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

Disclosure could jeopardize an investigation or prosecution, or it could endanger or hurt the complainant.

FINRA’s BrokerCheck

individual_1743707.pdf (finra.org)

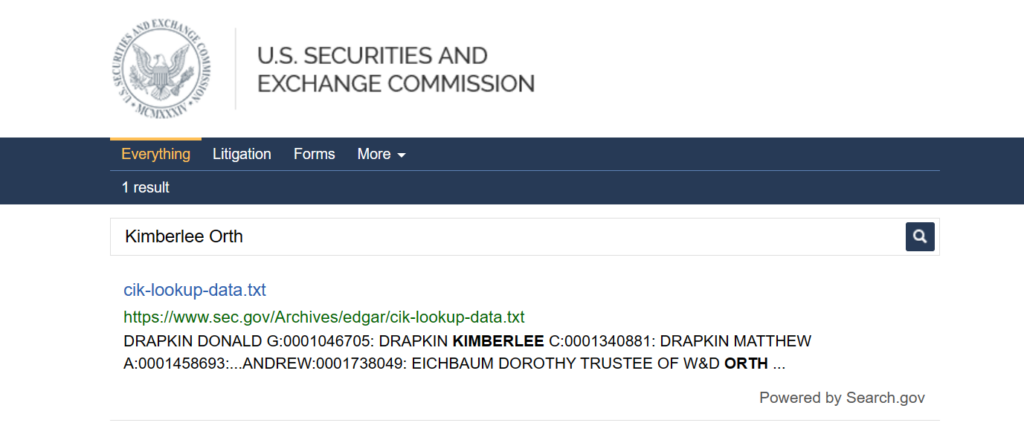

SEC Litigations & Forms

Source: Kimberlee Orth – SEC Site Search Search Results

Kimberlee Orth Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Kimberlee Orth that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Kimberlee Orth on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Kimberlee Orth Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Kimberlee Orth using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Kimberlee Orth or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Kimberlee Orth (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management