Peter Eckerline: Disclosures Expose Fraudster (Update 2024)

Merrill Lynch Wealth Management Advisor Peter E Eckerline represents a few of the businesses that claim to help you with business and financial problems. Financial advice is provided based on the client’s individual needs and goals. They can hardly provide economic planning and market data, find suitable investments, and assist individuals and institutions with insurance decisions. Let’s check it out with further discussion.

Charges against Peter Eckerline

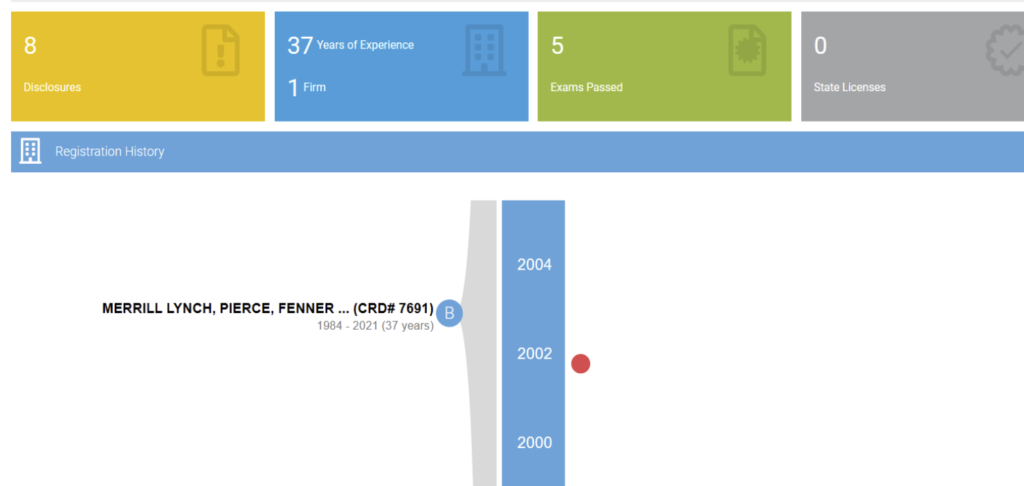

According to all reports, Peter Eckerline, a lifetime Merrill Lynch broker headquartered in Wayzata, Minnesota, spent the entirety of his 37 years in the field with the company, which lasted until August 2021. Currently, he is neither a financial advisor nor an authorized broker. His BrokerCheck record shows 9 customer disputes submitted by litigants over the last 20 years, including the first dating from October 2001. Several of them seem to accuse him of inappropriate recommendations and wrongdoing. They are outlined below in order of appearance:

| Date of case filing | Allegations |

| October 2001 | Merrill Lynch agreed to pay a $10,000 claim for unsuitability. |

| December 2009 | In a case alleging unsuitability, $180,000 was sought in December 2009. Because there was no action, the matter was closed. |

| December 2010 | Another action involving unsuitability and deception was settled for $87,500. |

| December 2011 | The customer claims unsuitability, omissions, and misrepresentation. The matter was resolved for $295,000. |

| June 2012 | The consumer charged errors and misunderstandings concerning improper investments. Merrill Lynch resolved the case for $64,500. |

| June 2012 | This disagreement accused Peter Eckerline of failing to follow directions, although this was later rejected. |

| March 2016 | The $275K settlement negotiated with the customer underscored the significance of making recommendations based on the customer’s description, tolerance for risk, and investment objectives. |

| June 2021 | A customer dispute alleging Eckerline of not working in the best interests of the consumer was dismissed. |

| June 2021 | In this ongoing disagreement, the customer claims that Eckerline breached his fiduciary duties by failing to act in their best interests, notably with regard to the fee structure and allocation of assets, and that such behavior can have an impact on earnings. |

What are the functions of Brokers & dealers?

Broker-dealers should regulate the representatives they authorize because they act in the firm’s name. They must ensure that representatives work in the best interests of the client and follow the legal criteria and rules that have been established.

This includes noting the broker’s track record as well as consumer complaints. Refusal to do so renders the firm accountable for the broker’s activities.

Disclosures against Peter Eckerline

There are a total of 8 disclosures against Peter Eckerline. Let’s go through it.

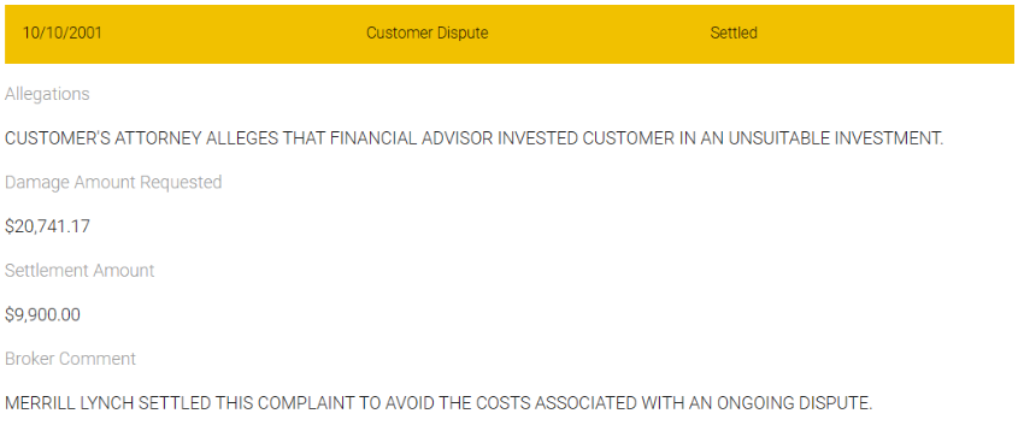

#1. First dispute of Peter Eckerline

Peter Eckerline has had eight customer disputes in his tenure as a financial counselor. The first disagreement arose in 2001 when the customer’s attorney claimed that the financial advisor had placed the client in an unsustainable position.

In the above allegation report the damaged amount which was requested is $20,741.17 and the settlement amount was $9,900 paid by Merrill Lynch of Peter Eckerline.

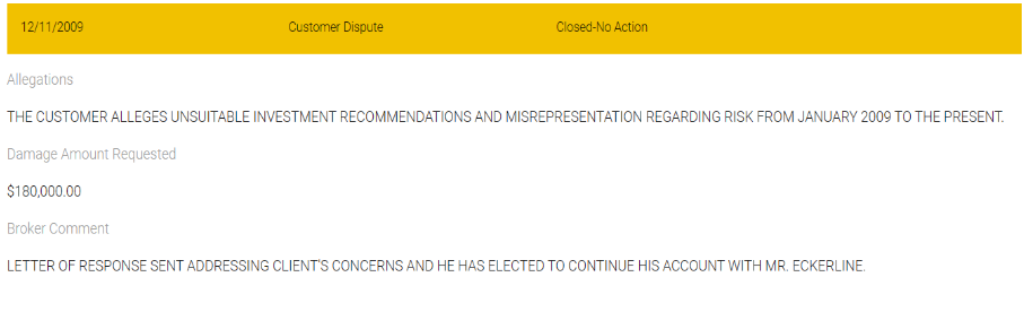

#2. Second allegation on Peter Eckerline

According to this accusation, it was improper investment suggestions and risk misrepresentation from January 2009 until the present.

In the allegation, the damaged amount requested was $180’000.

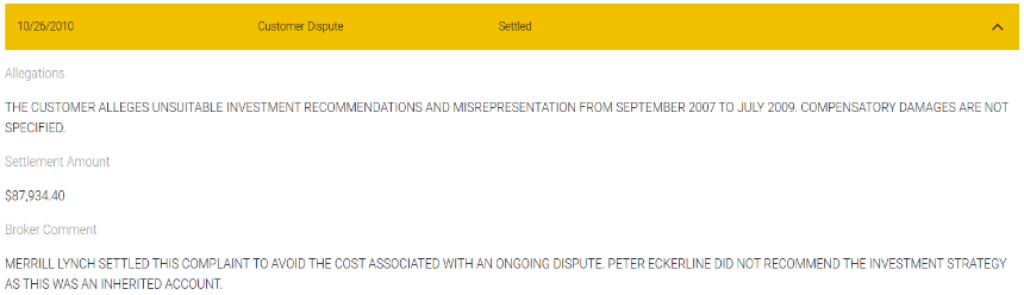

#3. Third allegation on Peter Eckerline

From September 2007 TO July 2009, the Customer alleged Inappropriate Investment recommendations & misrepresentation. Damage for compensation is not specified.

Merrill Lynch of Peter Eckerline paid the settled amount of $87,934.40 to settle this complaint in order to avoid the costs associated with a continuing dispute. Because this was an acquired account, Peter Eckerline rejected the investment approach.

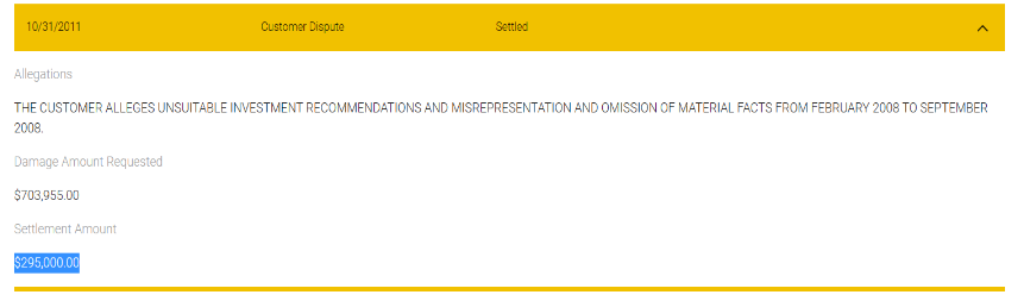

#4. Fourth Allegation on Peter Eckerline

The conflict occurred on October 31, 2011. From February through September 2008, the customer claimed improper investment recommendations as well as misrepresentation and withholding of crucial facts. They asked for $295,000.00 in damages.

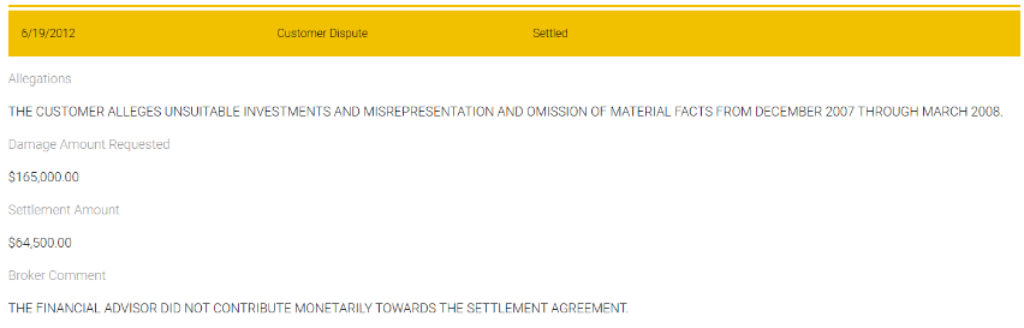

#5. Fifth Allegation on Peter Eckerline

The conflict occurred on June 19, 2012. From December 2007 through March 2008, the customer claimed improper investment recommendations as well as misrepresentation and withholding of crucial facts. They asked for $165,000.00 in damages. Whereas, the settled amount paid was $64,500.

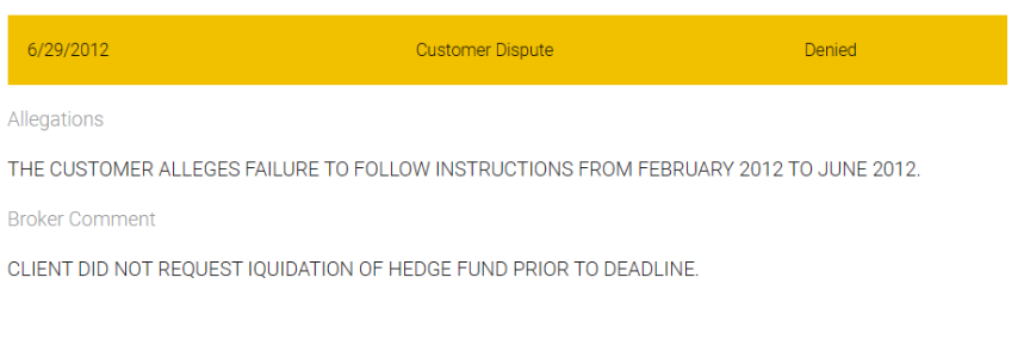

#6. Sixth Allegation on Peter Eckerline

It was the disagreement filed on June 29th, 2012, in which the client accuses of failure to follow directions from February 2012 to June 2012. In this example, the broker noted that the customer failed to ask for the bankruptcy of the hedge fund’s assets before the deadline.

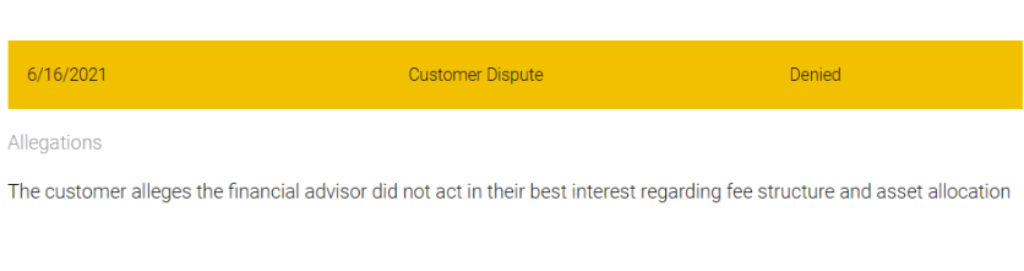

#7. Seventh Allegation on Peter Eckerline

This claim was made on June 16, 2021, and the client claims that the financial advisor, Peter Eckerline did not operate in their best interests when it came to charges and allocation of assets.

#8. Eighth Allegation on Peter Eckerline

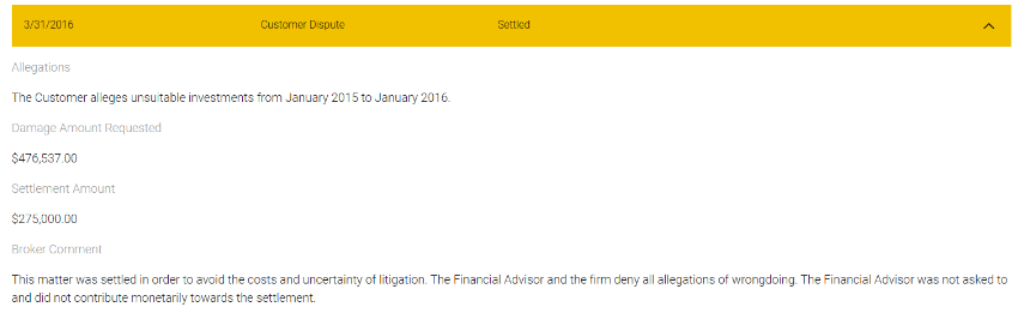

It was the dispute filed on March 31, 2016, in which the customer alleges unsuitable investments from January 2015 to 2016. The damaged amount which was demanded is $476,537.00, whereas the settlement amount paid by the broker was $275,000.00.

This case was resolved in order to prevent the costs and uncertainties of litigation. All claims of impropriety are denied by the Financial Advisor, Peter Eckerline, and the business in question. The Financial Advisor was not requested to contribute financially to the settlement and did not do so.

Do you know about Peter Eckerline?

Peter Eckerline is a man who claims for making a good difference in the lives of those around him. After 38 years at Merrill Lynch, Peter Eckerline retired as a senior adviser and chief executive of the Peter Eckerline Wealth Management Group.

Conclusion

As a result of reading all of the aforementioned charges, we conclude that Peter Eckerline, a Merrill Lynch financial advisor, is unsuitable for his job of satisfying his clients. As we can determine the rough marks of the damages demanded by his clients.

I can bet on this, no broker is at all trusted. And in case you trust a broker, be prepared to be bluffed.

One of the nightmares of all the investors, getting ditched by the financial advisor.????

Look at the list of allegations!!! Each year, since 2 decades, the man has been deceiving the clients. Meanwhile, what were the authorities doing?

So, many allegations..and the man behind the firm is still roaming free.

Merrill Lynch is dubious, I have read several reviews about the firm and its executives. So, the problem does not merely lies in the mentioned scammer.

Peter, brother, get a break from scamming. You must be tired till now. You need rest. ????????

I wonder if this man works for 10 more years, he would scam people exponentially. It’s frustrating to see people getting looted, if someone is listening, end this.