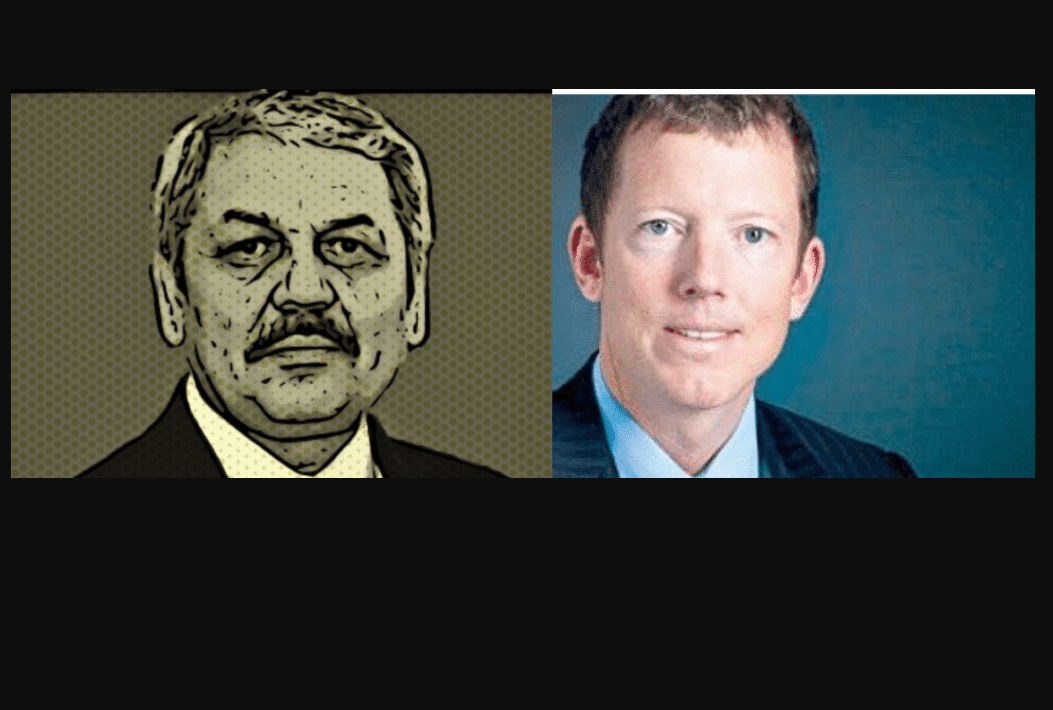

Nath Rothschild & Rajat Khare Connection: Exclusive Report

Nath Rothschild, a corporate raider, reveals his relationship with Indian ex-hacker Rajat Khare.

Financier Nath Rothschild, a member of the Rothschild family‘s British branch, has acquired an Indian IT firm in collaboration with Rajat Khare, well-known to Intelligence Online readers as an Indian “hack for hire” pioneer. They’ve known one another for a long time due to their positions in the same corporate battles.

The Link Between Nath Rothschild & Khare

Nathaniel Rothschild, the Swiss-based banker from the European banking family’s British branch who enjoys large-scale corporate raids, stated on March 7 that he had acquired inYantra Technologies through his investment firm, Volex. In collaboration with the Luxembourg-based investment firm Boundary Holding, created by Rajat Khare, he acquired 51% of the Indian company’s capital.

History of Cyber Crime

Rajat Khare spent a more cyber-active existence in New Delhi before beginning his peaceful life as an investor in Luxembourg, particularly investing in drone and anti-drone technology (IO, 13/12/21 and 26/02/20).

Rajat Khare pioneered the “hack for hire” market with his first company, Appin Security. He became the first port of call for investigative firms, lobbyists, and lawyers looking for someone to hack email accounts for them after opening an office in Switzerland.

In the early 2010s, he was involved in most of the major corporate conflicts, including Porsche vs. Volkswagen and Telenor vs. Alfa Group. Appin Security was also working for the Indian intelligence services at the time. They permitted the corporation to continue its profitable economic activities in exchange for assaulting targets specified by the Indian government as necessary. Appin’s fingerprints were discovered in spear phishing attacks on government targets in Pakistan and China that were clearly of political rather than commercial interest. Appin was shut down after being disclosed in a report by cyber security firm Norman Shark in 2013, its personnel has since congregated at firms aiming to keep Appin’s know-how alive, including Belltrox, CyberRoot, and Phronesis (IO, 04/11/21).

Battle for Control of Bumi

Nath Rothschild and Rajat Khare have crossed paths in a number of situations but were particularly active in the 2013 battle for control of Bumi, now known as Asia Resources Minerals. Rothschild, who owned 29% of the company, fought a protracted battle with Indonesia’s Bakrie oligarch family, which owned 30% of the company. Various investigation firms were involved, with Diligence representing Rothschild and Good Governance Group (G3) representing the Bakries.

What is a Red Flag?

A red flag serves as a signal or sign that there may be an underlying issue or danger associated with a company’s stock, financial statements, or news reports. These indicators can come in many forms and are often identified by analysts or investors as any notable undesirable trait.

Bumi and Bakries: Cutting ties

In order to persuade Bumi to cut ties with its key partners, the Bakries, Rothschild got internal information from the Indonesian family through an unnamed whistleblower. They revealed that the family’s financial practices were mainly unconventional (IO, 13/02/13).

These were turned over to the Bumi board in September, prompting the organization to launch an investigation. According to the investigative book Armes de Déstabilisation Massive (co-written by Pierre Gastineau and Philippe Vasset), Khare’s company, Appin, conducted a spear-phishing attack on the mailboxes of both Bumi and the Bakries and looted their contents.

The materials seized were identical to those used by Nath Rothschild’s attorneys.