Jeffrey A. Broten

Background Of Jeffrey A. Broten (CRD No. 1006678)

Broten first became registered with FINRA in 1981. Broten was registered as a General

Securities Representative through an association with First Standard Financial Company

LLC (CRD No. 168340) from February 2018 to August 2019.

On August 28, 2019, First Standard filed a Uniform Termination Notice for Securities Industry Registration (Form U5) stating that Broten had voluntarily terminated his registration with the firm.

From August 2019 to December 2019, Broten was registered as a General Securities

Representative through an association with another FINRA member firm.

Broten is not currently registered or associated with a FINRA member firm. However, he

remains subject to FINRA’s jurisdiction pursuant to Article V, Section 4 of FINRA’s ByLaws.

Did You Know?

The American corporation, FINRA (Financial Industry Regulatory Authority) with private ownership is a tool for checking the authenticity of brokers. The firm is a self-regulatory organization that affects the member brokerage firms and exchange markets.

On February 6, 2020, the New Jersey Bureau of Securities issued a Summary Denial,

Revocation and Penalty Order that revoked Broten’s agent registration in the State of

New Jersey and imposed a $100,000 civil penalty against Broten for engaging in “a

pattern of … excessive, unsuitable and unauthorized trading activity in customer

accounts” while registered through First Standard.

Activity(s) Reported – Jeffrey A. Broten

This matter originated from a customer complaint made to FINRA.

FINRA Rule 8210(a)(1) states, in relevant part, that FINRA may require a person subject

to its jurisdiction “to provide information orally, in writing, or electronically . . . and to

testify at a location specified by FINRA staff . . . with respect to any matter involved in [a

FINRA] investigation [or] examination.” FINRA Rule 8210(c) further states that “[n]o . .

. person shall fail to provide information or testimony . .. pursuant to this Rule.” A

violation of FINRA Rule 8210 is also a violation of FINRA Rule 2010.

On September 24, 2020, in connection with an investigation into Respondent’s

potentially unsuitable and unauthorized trading while associated with First

Standard, FINRA sent a request to Respondent for on-the-record testimony

pursuant to FINRA Rule 8210. As stated in his email to FINRA on September 25,

2020, and by this agreement, Respondent acknowledges that he received FINRA’s

request and will not appear for on-the-record testimony at any time. By refusing

to appear for on-the-record testimony as requested pursuant to FINRA Rule 8210,

Respondent violated FINRA Rules 8210 and 2010.

Penalty(s)

a bar from associating with any FINRA member in any capacity.

Respondent understands that if he is barred or suspended from associating with any

FINRA member, he becomes subject to a statutory disqualification as that term is defined

in Article III, Section 4 of FINRA’s By-Laws, incorporating Section 3(a)(39) of the

Securities Exchange Act of 1934. Accordingly, he may not be associated with any

FINRA member in any capacity, including clerical or ministerial functions, during the

period of the bar or suspension. See FINRA Rules 8310 and 8311.

Recent Activity(s)Of The Individual/Firm

Broten refused to provide on-the-record testimony requested pursuant to FINRA Rule

8210, in violation of FINRA Rules 8210 and 2010.

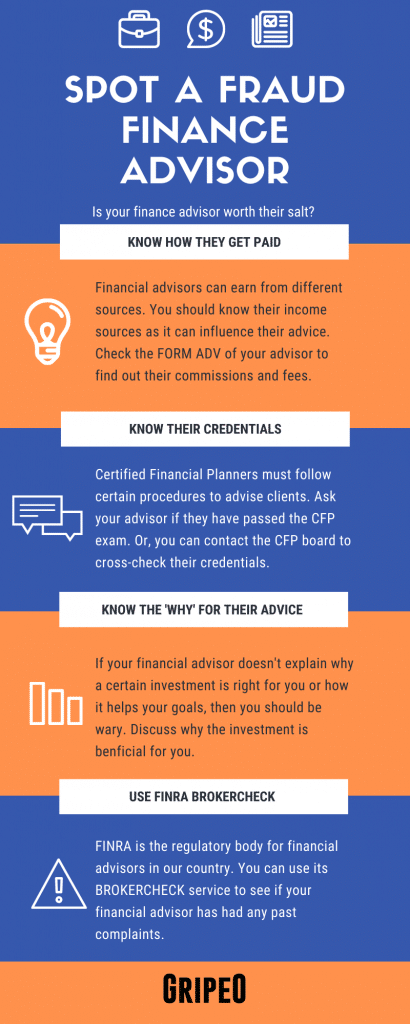

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Jeffrey A. Broten

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Jeffrey A. Broten. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.