Kevin Barletta

Background Of Kevin Barletta (CRD No. 4691033)

Kevin Barletta first registered with FINRA as a general securities representative (GSR) in

December 2003. In October 2015, he registered with FINRA as a GSR through an

association with LPL Financial LLC. On December 22, 2016, LPL terminated Barletta,

stating on the Uniform Termination Notice for Securities Industry Registration (Form

U5) that the firm “reasonably concluded that advisor failed to adhere to policy regarding

cross-trades.” Since January 2017, Barletta has been registered with FINRA as a GSR

through another member firm.

Respondent does not have any disciplinary history with the Securities and Exchange

Commission, any state securities regulators, FINRA, or any other self-regulatory

organization.

Activity(s) Reported – Kevin Barletta

FINRA Rule 2010 requires associated persons in the conduct of their business to

“observe high standards of commercial honor and just and equitable principles of trade.”

An associated person violates Rule 2010 when he engages in unethical conduct, which

includes falsifying documents to circumvent firm policies that are intended to protect

customers. In addition, FINRA Rule 4511 requires members to “make and preserve

books and records” as required by FINRA rules, the Securities Exchange Act of 1934,

and rules thereunder.

An unlisted REIT is a REIT where the trust’s shares do not trade on a national securities

exchange. For that reason, investments in unlisted REITs generally are illiquid and bear

increased risk. During the relevant period, LPL’s written supervisory procedures

prohibited cross trades in alternative products, such as unlisted REITs. The firm’s

procedures also prohibited its registered representatives from assisting with the sale of

alternative products. In addition, LPL’s written supervisory procedures required

purchases of alternative products to undergo a preapproval process, which allowed LPL’s

complex products supervision group to evaluate suitability. The suitability review

considered, among other things, compliance with LPL’s alternative investment

concentration guidelines set forth in the firm’s written supervisory procedures.

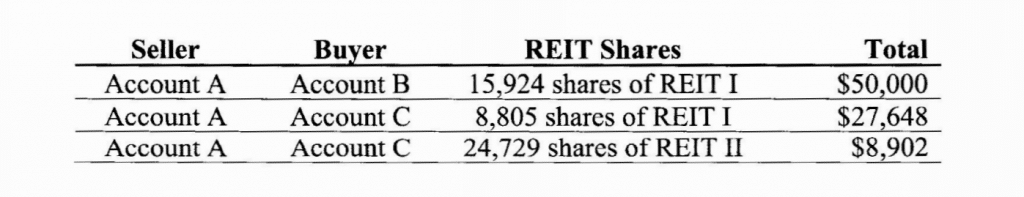

In September and October 2016, Barletta arranged three cross trades involving shares of

unlisted REITs as follows:

The purchase by Account B exceeded LPL’s concentration guidelines applicable to

customers of her age, based on her investment objective and liquid net worth.

Barletta effected the transactions with inaccurate journal entries. Specifically, Barletta

instructed the sellers to sign one set of journal entry forms to transfer the shares, and the

buyers to sign another set of forms to transfer cash payment for the shares. After the

customers signed the forms, Barletta altered them to describe the parties to the

transactions as “friends” and the transfer of shares as “gifts.” Those descriptions were

inaccurate. The transactions were not gifts and the customers did not know each other.

Barletta then submitted the inaccurate journal entry forms to LPL. All customers

consented to the transactions and Barletta received no commissions on them. Barletta’s

conduct prevented the firm from detecting the prohibited transactions and performing the firm’s suitability review. By virtue of the foregoing, Barletta violated FINRA Rule 2010.

Further, Barletta’s conduct caused LPL to create and maintain inaccurate books and

records. In addition to the inaccurate journal entry forms described above, Barletta’s

conduct caused LPL to fail to create trade tickets identifying the terms and conditions of

the customers’ orders, include the transactions in the firm’s blotter, send customer

confirmations, or properly identify the transactions on account statements as purchases

and sales of securities. By virtue of the foregoing, Barletta violated FINRA Rule 4511,

which also is a violation of FINRA Rule 2010.

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Penalties And Sanctions

• a suspension from association with any FINRA member firm in any capacity for

2 months;

• a $5,000 fine; and

• a requirement that within 90 days of notice that this AWC has been accepted, Barletta

will attend and satisfactorily complete 20 hours of continuing education, through a

provider not unacceptable to FINRA concerning the following topics: unlisted REITs,

suitability, recordkeeping requirements, and ethical considerations. At least 10 days

prior to commencing such continuing education, Respondent will notify Jonathan E.

Pahl, Principal Counsel, in FINRA’ s Department of Enforcement regarding the

continuing education provider(s). Within 30 days of Respondent’s satisfactory

completion of the continuing education, he will submit written proof thereof and a

letter to Jonathan E. Pahl, FINRA Department of Enforcement, 15200 Omega Drive,

Suite 300, Rockville, MD 20850-3241, and by email to jo***********@fi***.organd

En***************@F1***.org. All correspondence must identify the Respondent

and Matter No. 20170528283. Upon written request showing good cause, FINRA

staff may extend any of the deadlines related to the continuing education component

of the sanction.

The sanctions imposed in this AWC shall be effective on a date set by FINRA staff

Respondent agrees to pay the monetary sanction upon notice that this AWC has been

accepted and that such payment is due and payable. Respondent has submitted an

Election of Payment form showing the method by which he proposes to pay the fine

imposed.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time hereafter, the monetary sanction imposed in this matter.

Respondent understands that if he is barred or suspended from associating with any

FINRA member, he becomes subject to a statutory disqualification as that term is defined

in Article III, Section 4 of FINRA’s By-Laws, incorporating Section 3(a)(39) of the

Securities Exchange Act of 1934. Accordingly, he may not be associated with any FINRA member in any capacity, including clerical or ministerial functions, during the

period of the bar or suspension. See FINRA Rules 8310 and 8311.

Recent Activity(s)Of The Individual/Firm

In September and October of 2016, Barletta circumvented LPL’s written supervisory

procedures in connection with prohibited cross trades of alternative investment products.

He did so by falsifying journal entry forms to effect three unlisted REIT sales from one

customer account to two other customer accounts. In doing so, Barletta violated FINRA

Rule 2010. He also caused his firm to create and maintain inaccurate books and records

in violation of FINRA Rules 4511 and 2010.

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Kevin Barletta

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Kevin Barletta. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.

All of my dealings with Kevin have been positive.