Richard Michael Wesselt

Background Of Richard Michael Wesselt (CRD No. 2195569)

In 1992, Wesselt first became registered through a FINRA member firm as an Investment

Company and Variable Contracts Products Representative. In March 1997, a FINRA

member firm discharged Wesselt for “placing a customer’s signature on a document.”

Another FINRA member firm discharged Wesselt in February 2014 for a “[s]uspected

breach of firm policy regarding signatures on blank documents.”

From March 2014 through September 2017, Wesselt was registered as an Investment

Company and Variable Contracts Products Representative through O.N. Equity Sales

Company, Inc. (CRD No. 2936). On September 6, 2017, O.N. Equity filed a Form U5,

terminating Wesselt’s registration. Wesselt is currently associated with another FINRA

member firm.

Activity(s) Reported – Richard Michael Wesselt

A. Unsuitable Recommendations

FINRA’s Suitability Rules

FINRA Rule 2111(a) provides in pertinent part that “[a] member or an associated person

must have a reasonable basis to believe that a recommended transaction or investment

strategy involving a security or securities is suitable for the customer based on the

information obtained through the reasonable diligence of the member or associated

person to ascertain the customer’s investment profile.” A customer’s investment profile

includes, among other things, the customer’s age, other investments, financial situation

and needs, tax status, investment objectives, investment experience, investment time

horizon, liquidity needs, and risk tolerance. FINRA’s Regulatory Notice 12-55 confirmed

that suitability obligations apply to “a registered representative’s recommendation of an

`investment strategy’ involving both a security and non-security investment.”

variable annuity is a complex, long-term investment vehicle that offers tax-deferred

treatment of earnings, annuity payout options that can include guaranteed income

payments, and a death benefit. Because of their cost and complexity, registered

representatives must exercise particular care to ensure that a variable annuity is suitable

for a customer before recommending it. Thus, in addition to the general suitability

requirements imposed under Rule 2111, FINRA Rule 2330(b) specifically requires that,

when recommending variable annuities, representatives have a reasonable basis to

believe that “the particular deferred variable annuity as a whole … and riders and similar

product enhancements, if any, are suitable … for the particular customer ….”

In general, variable annuities have two phases: (1) an accumulation phase, during which

the investor’s premiums are allocated to investment portfolios; and (2) a distribution

phase, during which the insurance company guarantees a minimum payment to the

investor based on the principle and investment returns. A recommendation that a

customer with short-term liquidity needs purchase a variable annuity may be unsuitable

because withdrawals during the accumulation phase can be costly, often resulting in the

imposition of surrender charges, income tax liability, and tax penalties.

Wesselt’s “Infinite Banking” Investment Strategy

From March 2014 through September 2017, Wesselt made unsuitable recommendations

to 78 customers to purchase a variable annuity. These recommendations were

inconsistent with the customers’ investment profiles, including their time horizon,

liquidity needs, and risk tolerance. Despite that variable annuities are intended to be longterm investments, Wesselt knew when he made the recommendations that his customers

would be making short-term withdrawals from their variable annuities. Specifically,

Wesselt recommended that his customers follow an investment strategy that he termed

“building your own bank” or “infinite banking.” Wesselt’s strategy was predicated on

persuading customers to liquidate their retirement accounts, which typically held a

portfolio of mutual funds, to use the proceeds of that liquidation to purchase variable

annuities, and then to liquidate the variable annuities in order to build cash value in whole

life insurance policies.

During the relevant period, Wesselt was one of the top producers for variable annuity

sales at O.N. Equity; in 2016 he was the firm’s highest producer. For the 78 customers

who were harmed by his variable annuity recommendations, and recommendations to

take early withdrawals, Wesselt earned $686,025 in commissions on the sale of the

variable annuities.

Wesselt’s recommended investment strategy generally involved three steps.

First, Wesselt recommended that his customers liquidate their retirement savings, which

they often held in qualified, tax-deferred accounts such as 401(k)s or IRAs. As a result,

these customers lost benefits associated with their 401(k)s, including services such as

access to investment advice, telephone help lines, educational materials and workshops.

Also, assets held in 401(k) plans are typically protected from creditors and legal

judgments, and certain 401(k) plans may allow for penalty free withdrawals.

Next, Wesselt recommended that customers purchase a variable annuity with funds

liquidated from their retirement plans. Wesselt generally recommended that his

customers purchase an X, or bonus, share class variable annuity. These products, which

add a cash bonus to the contract, typically have the longest surrender periods of any

variable annuities offered in the marketplace and charge higher mortality and expense

fees than other share classes. Early withdrawals decrease the amount of the bonus

awarded under the contract. Wesselt also recommended customers invest in a guaranteed

minimum withdrawal benefit rider, which allows lifetime withdrawals of a specified

percentage once the customer reaches a specified age. Both the X-share and the

withdrawal rider increased the customers’ fees for purchasing the variable annuity, and

thus were uniquely unsuited for customers who intended to make short-term withdrawals

from the variable annuity. Wesselt typically had his customers sign blank or incomplete

disclosure documents or had them sign those documents quickly in his presence. As a

result, his customers frequently did not understand the unique features and risks

associated with these variable annuities and riders.

Finally, after the variable annuity was issued, Wesselt recommended customers take early

withdrawals, causing customers to lose benefits associated with the variable annuity and

incur surrender charges. Wesselt’s recommendations that customers make withdrawals

from their variable annuities generally fell into two categories: (1) large one-time

withdrawals to pay life insurance premiums; and (2) large one-time withdrawals to pay

significant expenses, such as the purchase of a home or the settlement of a divorce.

Wesselt’s Recommended Investment Strategy was Unsuitable for 78 Customers

Wesselt’s recommendations to 78 customers that they purchase and then take early

withdrawals from their variable annuities in order to pursue his “infinite banking”

investment strategy, were unsuitable in light of those customers’ investment profiles—

including their investment time horizons, liquidity needs, and risk tolerances—and those

recommendations resulted in substantial customer harm.

For example,

• In September 2014, Customer 1, 43 years old, met with Wesselt to discuss her

financial needs, which included substantial daycare expenses. Wesselt

recommended that she liquidate her 401(k) account, which was worth

approximately $220,000, and use the proceeds to purchase an X-share variable

annuity with a lifetime withdrawal rider. At the same time, Wesselt recommended

that Customer 1 purchase whole life insurance policies for herself and her family,

and pay for the premiums on these policies by making withdrawals from the

variable annuity. Finally, Wesselt recommended that Customer 1 take loans from

her life insurance policies to pay for her family’s daycare expenses. In four years,

Customer 1 withdrew $225,662 from her variable annuity to pay life insurance

premiums and other expenses, which included surrender fees of $11,998 and tax

withholding of $71,564. The early withdrawals also caused Customer 1 to incur a

tax penalty. She is no longer able to afford her life insurance premiums, and her

variable annuity, which held most of her retirement savings, is now worth less

than $10,000.

• Customer 2, who was 33 years old at the time, met with Wesselt in December

2014 to discuss financial planning after taking a new job. Wesselt recommended

that he purchase a whole life insurance policy and use his 401(k), which was

worth approximately $40,000, to purchase an X-share variable annuity with a

lifetime withdrawal rider. Tlu•ee days after the variable annuity was issued,

Wesselt recommended that this customer take a withdrawal from this variable

annuity to pay life insurance premiums. Wesselt later recommended that he

withdraw funds from his variable annuity to pay for repairs on his home. In

November 2015, Wesselt recommended another withdrawal to pay for the next

year’s life insurance premiums. In less than a year, Customer 2’s variable annuity

declined from $39,693 to $13,601, he incurred $1,814 in surrender charges, he

paid $7,286 in tax withholding, and was assessed a tax penalty for early

withdrawal of retirement funds.

• Customer 3 met with Wesselt in October 2014, when she was 59 years old and

nearing retirement, and sought Wesselt’s advice regarding the purchase of an

apartment and assisting a child with student loan repayment. Wesselt

recommended that she purchase a variable annuity, using approximately $58,000

that she held in a 401(k). In June 2015, Wesselt recommended Customer 3

purchase a whole life insurance policy and make annual withdrawals from her

variable annuity to make premium payments on that policy. Each annual

withdrawal from her variable annuity was $16,840, which included $12,000 for

premiums, $840 in surrender charges, and tax withholding of $4,000. The

withdrawals could only be sustained for three years, as each withdrawal depleted

the contract value of Customer 3’s variable annuity. By June 2017, the variable

annuity had declined from its original value of $57,955 to $8,489.

• Customer 4, who was 52 years old, met with Wesselt in the spring of 2016 to

discuss finances and an impending divorce. She needed to pay $40,000 as part of

a divorce settlement, and the only available funds to do so were in the customer’s

401(k). Customer 4 also wanted to help her child pay off student loans. Though

Wesselt was aware of Customer 4’s immediate need for these funds, he

nonetheless recommended that she roll her 401(k) into an X-share VA with a

lifetime withdrawal rider. The initial contract value was $133,144. Within three

days of its issuance, Wesselt recommended that she withdraw $63,697, which

included $40,000 for the divorce settlement. A week later, Wesselt recommended

that she withdraw $55,323 from the variable annuity in order to pay $33,000 in

premiums for a new whole life policy that Wesselt sold her. In just one week,

Customer 4’s variable annuity declined by 85% to $19,764, and she paid $8,180

in surrender charges. In addition to funds withheld for taxes, Customer 4 was also

assessed a tax penalty for taking the early withdrawals.

• Customer 5, a 49-year-old single parent of a child with special needs, met Wesselt

in December 2014. Wesselt knew that Customer 5 had limited means, did not

have a steady income, and needed liquidity because of her significant, recurring

living expenses. Wesselt recommended that Customer 5 roll her 401(k) into an Xshare variable annuity with a lifetime withdrawal rider. This policy was issued on

January 20, 2015 with a value of $196,827. At the same time, Wesselt also

recommended that Customer 5 make withdrawals from the variable annuity in

order to pay premiums on whole life insurance policies that he sold to her. Two

months later, Customer 5 began making withdrawals from her variable annuity to

pay for her living expenses. Over the next two years, Customer 5 made a series of

withdrawals that ultimately resulted in the complete liquidation of her variable

annuity. She paid $16,044 in surrender charges and $37,426 in tax withholding.

Customer 5 also was subject to a tax penalty for taking early withdrawals from

her retirement account.

In total, Wesselt made unsuitable recommendations that 78 customers purchase and then

liquidate variable annuities. These unsuitable recommendations caused the customers to

incur surrender charges of $378,452. These 78 customers were subjected to costly fees

and penalties, forfeiture of expected benefits, lapsed or cancelled policies, and the

depletion or complete loss of their retirement savings. Wesselt, by contrast, earned

commissions of $686,025 from the sale of these variable annuities.

Wesselt’s unsuitable recommendations to 78 customers violated FINRA Rules 2111,

2330(b) and 2010.

B. Wesselt’s Improper Signature Practices

FINRA Rule 2010 provides that a “member, in the conduct of its business, shall observe high

standards of commercial honor and just and equitable principles of trade.” Causing customers

to sign incomplete or blank forms or using photocopied or recycled customer signatures

violates FINRA Rule 2010.

FINRA Rule 4511 requires each member firm to make and preserve books and records in

conformity with applicable FINRA rules and Exchange Act Rules 17a-3 and 17a-4.

Exchange Act Rule 17a-4(b)(4) requires firms to preserve records relating to

communications concerning the firm’s business. A registered representative who enters

inaccurate information into a firm’s books and records violates FINRA Rules 4511 and

2010.

O.N. Equity’s written supervisory procedures expressly prohibited its registered

representatives from having customers sign blank or partially completed documents.

Wesselt was aware of these procedures and he signed annual compliance certifications on

three occasions, attesting that he understood the firm’s procedures. Wesselt had also

previously been terminated from his prior employer for allowing a customer to sign a

blank form.

Nonetheless, during his tenure at O.N. Equity, employees in Wesselt’s office engaged in

a practice of obtaining customer signatures on blank or incomplete forms at Wesselt’s

direction. The forms included, among others, new account agreements and variable

annuity withdrawal request forms. Wesselt directed his staff to send or provide partial documents or forms, or signature pages, to customers with instructions to sign and return

the document. The forms were then completed by Wesselt or his staff and submitted to

O.N. Equity or the variable annuity company for processing. As a result of this practice,

many of Wesselt’s customers did not have the opportunity to read important disclosures

regarding their variable annuities, and thus were unaware of the features, costs, and risks

associated with these products. Similarly, blank variable annuity withdrawal forms

provided no information about the amount of the withdrawal, the withholding of taxes, or

surrender fees.

By directing his employees to have customers sign blank or incomplete forms, Wesselt

caused O.N. Equity to create and maintain inaccurate books and records in violation of

Rules 17a-3 and 17a-4 of the Exchange Act.

By virtue of the foregoing, Wesselt violated FINRA Rules 2010 and 4511.

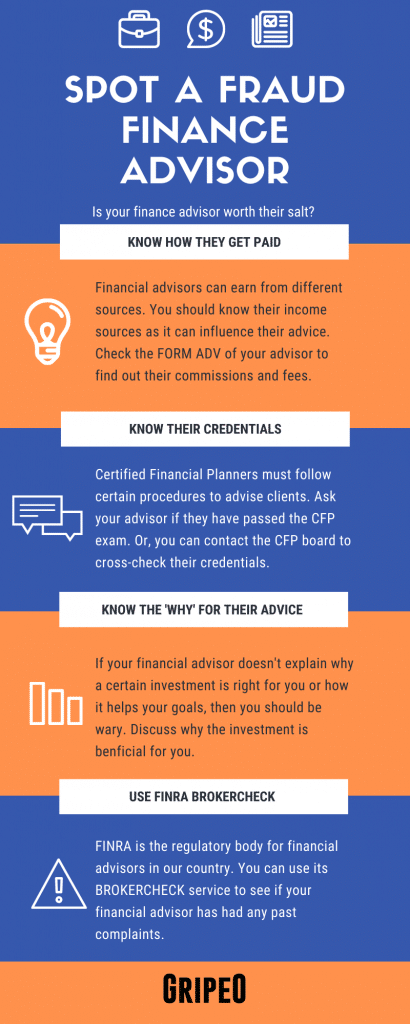

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Penalties And Sanctions

A bar from association with any FINRA member in all capacities.

Respondent understands that if he is barred or suspended from associating with any

FINRA member, he becomes subject to a statutory disqualification as that term is defined

in Article III, Section 4 of FINRA’s By-Laws, incorporating Section 3(a)(39) of the

Securities Exchange Act of 1934. Accordingly, he may not be associated with any

FINRA member in any capacity, including clerical or ministerial functions, during the

period of the bar or suspension. See FINRA Rules 8310 and 8311.

Similar post: JP Markets

The sanctions imposed herein shall be effective on a date set by FINRA staff. A bar or

expulsion shall become effective upon approval or acceptance of this AWC.

Recent Activity(s)Of The Individual/Firm

From March 2014 through September 2017, Wesselt promoted investment strategies

involving the purchase of variable annuities and whole life insurance policies. An integral

component of Wesselt’s strategies was his recommendation that customers first liquidate

their retirement savings in order to purchase variable annuities. Then, almost immediately

after purchasing these annuities, Wesselt often recommended that customers make

substantial and costly withdrawals from the annuities in order to purchase from Wesselt

whole life insurance policies. Wesselt told these customers, many of whom were

incurring large or unexpected expenses, that they could use the cash value in their whole

life insurance policies to make loans to themselves. Wesselt’s recommendations to 78

customers that they purchase variable annuities as part of this investment strategy were

unsuitable, and resulted in significant harm to these customers, including unnecessary

surrender charges, costly fees and penalties, forfeiture of expected benefits, and the

depletion or complete loss of their retirement savings.

Wesselt’s recommendation of this unsuitable investment strategy to 78 customers

violated FINRA Rules 2111, 2330(b) and 2010.

In connection with his unsuitable recommendations, Wesselt had customers sign

incomplete or blank pages of various documents, including new account documents,

variable annuity disclosure forms, and documents authorizing the withdrawal of funds

from variable annuities, in violation of FINRA Rule 2010; this conduct also caused his

firm to have inaccurate books and records in violation of FINRA Rules 4511 and 2010.

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Richard Michael Wesselt

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Richard Michael Wesselt. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.

–