Jerry Couvaras is the CEO of Atlanta Bread Company. He has done a lot of things in his long career. From wrongful takeover of a company to freezing the income of a franchisee, a lot has happened in Jerry Couvaras’s past.

This column will cover the controversial business owner and explore the numerous actions he has taken against others.

About Jerry Couvaras, President At Atlanta Bread Company:

Jerry Couvaras is the president and CEO of Atlanta Bread Company. He became the CEO of Atlanta Bread Company in 1995 and his brother, Basil Couvaras became the COO (chief operating officer) of the company that year. Jerry had joined this company as a manager in 1994. He used to work as an investment banker before joining Atlanta Bread Company.

How Jerry Couvaras jumped from being a manager to becoming the CEO is a questionable journey. Why?

Because the founders of the company filed a lawsuit against Jerry for unfairly gaining control over the fast food chain in 1999. Robert and Richard Auffenberg had founded the Atlanta Bread Company in 1993 in Sandy Springs, Georgia.

Jerry Couveras had settled that lawsuit outside the court and had to pay millions of dollars through royalties to the Auffenbergs for the next 15 years. That’s not all.

Jerry Couvaras has seen a lot of controversy in his business career. He and his brother gained notoriety in South Africa for defrauding investors for $5.54 million. His firm has been struggling under his leadership as well. The Atlanta Bread Company used to have 170 restaurant locations in 25 states. By November 2020, they were limited to only 18 restaurant locations in six states.

What is Investment Fraud?

Investment fraud constitutes a white-collar criminal activity wherein individuals intentionally mislead or deceive investors to achieve financial gains. It is unlawful for any party to conceal essential information regarding investments, including associated risks, with the intent of persuading investors to invest their capital.

Defrauded South African Investors For $5.54 Million

Jerry Couvaras was arrested in South Africa for swindling investors out of $5.54 million. The arrest took place in Johannesburg on March 27, 2004. He faced charges of fraud and violating the Banks Act.

The authorities arrested him under the suspicion that he was a prominent figure behind two investment companies that went liquid in 1993. Jerry had to take a $145,000+ bail to release from custody. He also had to surrender his Greek passport and report twice everyday to Johannesburg police.

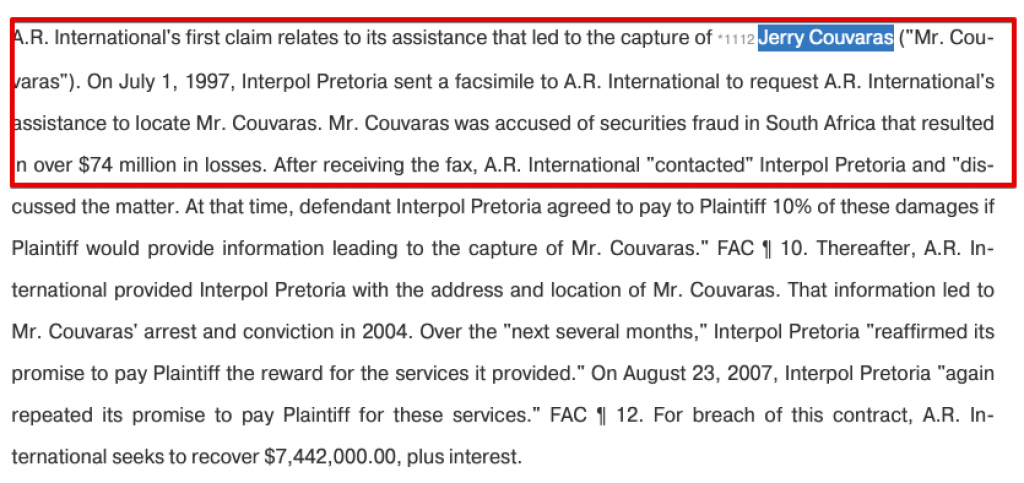

Jerry was under the radar of international agencies for committing securities fraud that caused $74 million worth of losses.

HIs arrest took place when A.R. International had made a deal with Interpol Pretoria. The deal was to assist the agency in locating Jerry Couvaras. Interpol Pretoria had to give 10% of the losses’ worth to A.R. International for helping them in finding Jerry.

A.R. International assisted them and as a result, Jerry was caught. The case was later dismissed and Jerry and his brother had to pay $190,000 and $120,000 respectively.

A.R. International had sued Interpol later for not paying them the 10% they owed.

You need to commit a lot of crimes to get on Interpol’s radar. However, Jerry and his brother constantly deny the allegation of committing securities fraud and stealing from investors. They claim that they didn’t do anything wrong. But they shouldn’t have needed to settle the case out of court if they were innocent. The fact that they pursued out of court settlement shows that they weren’t innocent.

Moreover, they pleaded guilty to the banking violation and paid the required fines. The court dismissed the rest of the charges as part of the settlement agreement.

Jerry Couvaras had faced a lawsuit for defrauding South African investors in 2004. He paid $190,000 to settle the case and pleaded guilty to the banking violations.

Harassing a Multi-Franchise Owner

Jerry and his company made the headlines in 2007 when a franchisee sued them for wrongfully terminating his ownership of five franchises.

The franchise owner had bought the Atlanta Bread Company franchises from his brother’s two-year-old daughter when his brother was run over by a car in 2002. He decided to launch another restaurant when he saw that Jerry and Basil Couvaras were facing legal trouble in 2004.

His new restaurant was quite successful and the people at Atlanta Bread Company took notice. The franchise owner was running one of the highest-earning franchises for Jerry’s company.

So he had a lot at stake. And he didn’t want to lose his business because Jerry had paid $190,000 in court.

The army of lawyers at Atlanta Bread Company went after the franchise owner and took away all the franchises he owned. They forced him to put the stores’ revenue in an escrow account until he handed over the ownership of those franchises to them. In other words, they froze his earnings so he had no choice but to hand over the ownership at a significantly lower rate.

Two of the franchises Jerry’s company took from that person were earning around $2 million in profits a year. And the guy owned five franchises.

The highest offer Atlanta Bread Co. made to him was $1.5 million for the franchise’s ownership, revenue, and other related assets. That’s it.

Jerry’s company has a history of going after franchise owners and forcing them to hand over their operations to Atlanta Bread Co.

Hiding The Multi-Million Dollar Scam News Using Illegal Methods

Jerry Couvaras has used various methods to hide any mentions of his $5.54 million lawsuit for defrauding South African investors in early 1990s.

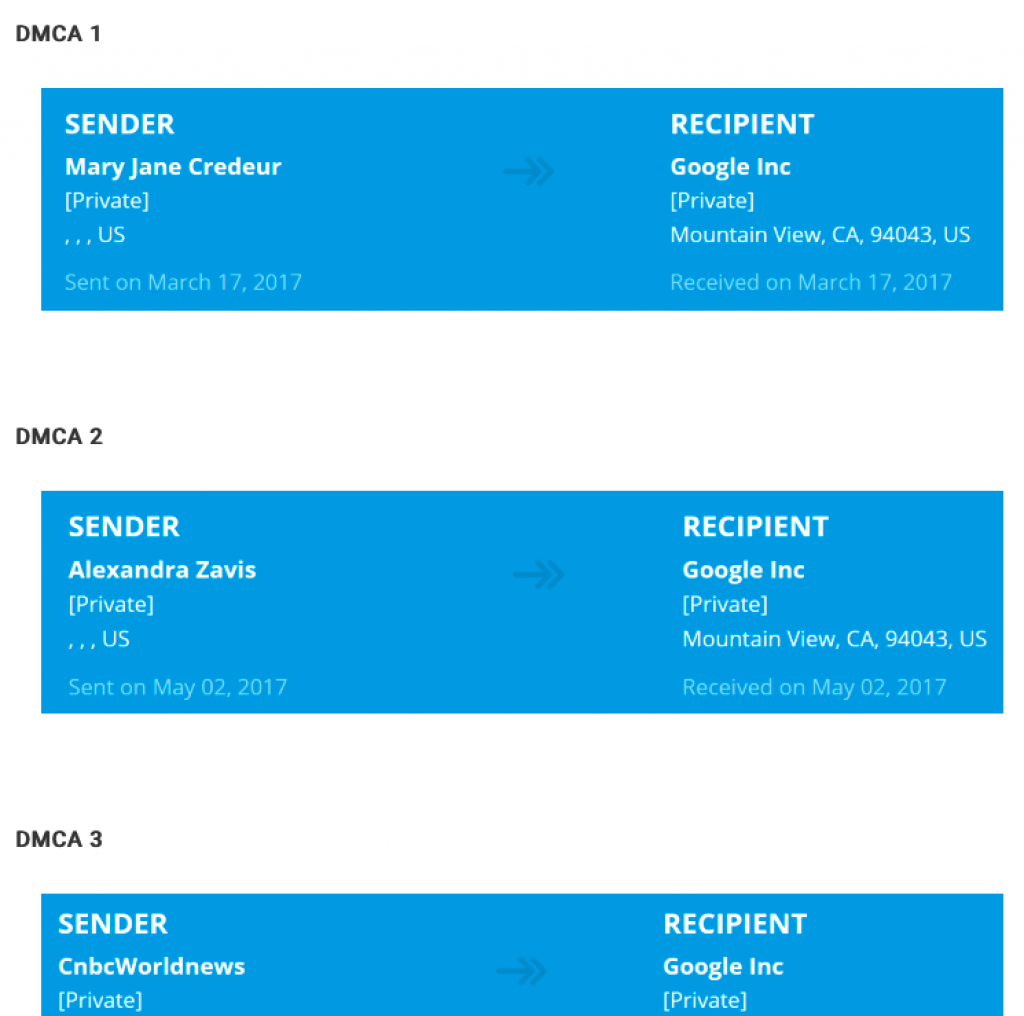

His company resorted to filing fake DMCAs to remove articles that mentioned this event. They filed these DMCAs by claiming to be the author when they weren’t.

For example, a Mary Jane Credeur had claimed that her article at Bizjournals.com was copied at Entrepreneur.com without their consent. She wanted to remove the article.

However, when I contacted Mary Jane Creduer, an airlines and freight reporter for Bloomberg News, she told me that she had no idea about any DMCA notice.

It’s a case of identity theft. Jerry’s representatives claimed to be someone they were not so they can take down an article about his past wrongful acts.

DMCA notices are very dangerous. The fake DMCA notice Jerry’s team sent worked. And Entrepreneur.com took down the article because of that notice.

Similarly, Jerry’s team created free news websites and backdated the original articles there so they can file more fake DMCAs. Their fake DMCA notices allowed them to remove articles from reputed news websites such as Wtvy.com and franchisetimes.com.

What is DMCA?

DMCA refers to the Digital Millennium Copyright Act. It criminalizes the production and dissemination of services, technology, or devices intended to circumvent measures that control access to any copyrighted work.

This law ensures that a company can’t copy and paste this article on their website. It safeguards the copyright of digital content.

Companies can file DMCAs if someone copies their copyright material and posts it without their consent. For example, if a website copies and pastes this column on Jerry Couvaras, Gripeo can file a DMCA and take the copied article down.

Some companies like Jerry Couvaras take advantage of DMCA by using various suspicious tactics. For example, they claim to be the original author of the article when they aren’t.

Fraudsters and scammers use many tactics to hide any news that highlights their previous scams. For example, MiTio resorts to paying websites and using deceptive marketing tactics to bury such news.

Similarly, Jerry’s company chose to lie and post fake articles.

Jerry Couvaras Report Summary

Jerry Couvaras has a troubled history. The current CEO and president of Atlanta Bread Co. resort to hiding the truth, harasses franchisees and settles a lawsuit for defrauding investors.

His company has shrunk significantly under his leadership. It would be interesting to see how Atlanta Bread Co. manages itself in a post-pandemic world under Jerry Couvaras.

Scammers will keep getting away with their crimes until we as people take a stance against them.

I’ve had enough of people like Jerry Couvaras & Basil Couvaras, who steal hundreds of millions of dollars, and us, the normal people, pay for them.

What is the FBI doing? Where is the FTC? Arrest him, please.

While students go into depressive financial ruts because of loans, scammers are living lavishly, this is wrong. What has happened to our society.