Notorious P2P Lender With Numerous Complaints

Peerform is a peer to peer lending platform that accepts low credit scores. It has multiple consumer complaints online and that’s why I chose to write this Peerform review. This platform’s terms and rates are quite similar to other bad credit lenders.

Did You Know?

P2P lending industry is a form of finance corporate that uses online platforms to directly connect people, who are in need of money or who want to provide money in lending. P2P lending might be beneficiary in various areas such as interest rates, loan approvals, and credits.

The customers of this platform claim it’s only a data-stealing scam and doesn’t process any loan requests whatsoever.

Here’s a quick summary of my findings:

Peerform seems like a great idea executed poorly. It has excessive fees, long waiting periods, poor customer service, and multiple user complaints. You should avoid doing business with this platform.

What is Peerform?

Peerform is a P2P (peer to peer) lending platform. It offers loans to individuals as well as small businesses. It entered the industry in 2010 and since then, has grown substantially. They claim to streamline the borrowing process by simplifying the same.

As Peerform is an online lending platform, it boasts of having low operation costs. It’s not a brick and mortar establishment, which allows it to keep its costs low and thus, keep the charges affordable.

It allows accredited investors to lend money to individuals. Peer-to-peer lending platforms have become quite popular in recent years due to their accessibility and quick loan resolution capabilities.

This platform claims to be an excellent service provider but it has many issues. Many past users of this company claim that it is a scam. And the number of such Peerform reviews is substantially high.

Here are some quick pointers about Peerform:

| Minimum Credit Score: | 600 |

| Estimated APR (Annual Percentage Rates): | 5.99 to 29.99% |

| Allowed Loan Range: | $4,000 to $25,000 |

| Origination Fee: | 1% to 5% of the loan |

Peerform Loan Requirements

In this section, I have laid out all the necessary details about getting a loan from this lender.

To qualify for a Peerform loan, you should have a minimum credit score of 600, a minimum credit history of a year, and a debt-to-income ratio less than or equal to 40% (excluding mortgage). You should also have a minimum gross yearly income of $10,000.

How to Apply for a Peerform Loan

To apply, you’d have to register on their platform by providing your name, birth date, and address. Apart from that info, you’d also have to provide information about the total amount you need to borrow and specify your income.

After you complete these steps, the platform would review your financial background and requirements then provide you with a list of loan choices.

You can choose the loan which matches your needs the most effectively after which, the platform lists your requests.

During the waiting period, you’d have to give a valid government-issued ID to the platform to verify your identity along with your recent bank statements, pay stubs or tax returns as proof for your income.

I’ll first discuss the good things about Peerform. Everything has its pros and cons, this platform is no exception:

Advantages of Peerform

Fixed Rates

They have specified their range and all the rates vary between 5.99% to 29.99%. With fixed rates, you don’t need to worry about any fluctuation in your interest and monthly payments.

Read also about: Mark Eliam

This advantage gives stability to the borrower and once you have started repaying the loan, you don’t have to worry about any changes in your rates.

No Prepayment Charges

If you prepay the loan, you wouldn’t have to pay any additional fees. This is another advantage which caught my attention. You have the option of making additional payments and paying off your loan early.

It makes the repayment flexible for the borrower. Having the option of prepaying the loan is always useful.

Available for Low Credit Scores

The biggest advantage of Peerform is that it provides loans to low credit scores as well. Even though they don’t guarantee approval, they promise that clients with less than great credit scores get consideration and acceptance for loans.

Consumers with such credit scores, who might not get loans on other establishments, would benefit from this facility the most. Peerform also claims that customers with low credit scores can repay their loans on time and improve their credit scores as a result.

You should note that there are many other bad credit lenders in the market. And even though Peerform has these advantages, its list of disadvantages is too long. That’s a big reason why I can’t recommend this P2P platform.

Disadvantages of Peerform

Slow Funding Speed

It takes 14 days (two weeks) for a loan to get funding on Peerform. This can be quite long for many users. Such a long funding period makes this platform a bad choice for emergency situations too. You can get loans quicker from multiple other providers.

Peerform Personal Loan Fees

Probably the biggest disadvantage of Peerform is the numerous fees it charges its users. Apart from the origination fee I mentioned earlier, there are many other charges you have to pay as a borrower:

| Check processing fee | $15 |

| Returned check fee | $15 |

| Late payment fee (if payment is 15 days late or more) | 5% of the unpaid amount or $15, whichever is higher |

The highest out of all these fees is the origination fee and you should be quite alert regarding its deduction. Let me explain every Peerform fees so you can understand them better:

Origination Fee

The origination fee ranges from 1% to 5% of the total loan. The lender charges it for processing the loan and you can’t avoid it. When you’ll get your loan payment from Peerform, the origination fee would already be deducted.

Peerform determines what origination fee it would charge you according to its grading system. The platform grants a grade to every borrower on the platform and charges the origination fee accordingly. Your grade depends on your credit score and history. Peerform’s grade ranges from AAA to DDD.

So if you have a bad credit score, chances are you’d get a lower grade (such as DDD) and end up paying the highest origination fee. The platform charges you this fee after the loan is issued. You should keep this fee in mind while calculating your loan.

Suppose you get a $5,000 loan with 5% origination fee. Peerform will deduct $250 from your loan beforehand and give you $4,750.

Returned Check Fee (Failed Payment Fee)

This is another fee that you should be highly alert about. When you have opted for automatic deduction but the payment fails, Peerform charges you $15. This usually happens when the account has insufficient funds or when the bank has closed that account.

You should note that Peerform would charge you $15 for every failed attempt of getting the due payment. So the fee can pile up and become too much for you to handle.

Check Processing Fee

If you choose to pay your monthly due through a check then this company charges you additional $15 as a check processing fee. It is NOT a one-time fee.

Peerform will charge you $15 whenever you pay them through check instead of the automating deduction system they have in place. So, this fee can also add up to become a big nuisance.

Late Payment Fee

If you are 15 days (or more) late on a monthly payment, then you’d have to pay a late payment fee. It could be 5% of that month’s due or $15, whichever is greater. Peerform charges this fee only once per month.

No Cosigners

Having a cosigner can make the repayment process quite easy for you. The biggest benefit of having a cosigner is that they increase your chances of getting an approval. If they have a better credit score than you, your chances will increase tremendously.

Peerform doesn’t have this facility. So you can’t cosign with another person which is another prominent disadvantage of this platform.

Impractical Minimum and Maximum Limits

The minimum amount you can borrow from Peerform is $4,000. This makes Peerform a bad choice for people who have smaller requirements. Also, many consumers with low credit scores tend to require loans smaller than $4,000, so they can’t get a loan from this platform.

The maximum limit on the lending amount here is $25,000. While that’s a generous limit, it excludes a huge segment of consumers as well.

Many people have needs that exceed the $25,000 amount. Not only that, but there can also be many lenders who offer much better limits with smaller interest rates.

Multiple User Complaints

Peerform seems like an excellent solution from afar but in reality, it has numerous customer complaints. People complain that this company makes many false claims about its funding chances.

Many users have even called this company a scam. Some have shared concerns regarding the intent of this organization’s owners. I have discussed multiple Peerform reviews in the next section of this article. You can see there how poorly this company actually treats its customers.

No Rate Discounts

Several lenders offer rate discounts to customers when they set up automatic payments for repaying the loan. Even though this platform promotes the use of automatic payments, it doesn’t offer any incentive for using them.

Once your APR is fixed, it wouldn’t change. So you can’t get any rate discounts on this platform.

No Info on Ownership

There’s no way to find out who the people behind this company are. In my opinion, that’s a bad sign.

Transparency is vital to gain trust for companies. So when a company like Peerform doesn’t provide any information about its team, it seems quite shady. All the trustworthy companies I know don’t hesitate in mentioning the people behind them.

When you’d check the ‘About Us’ page of Peerform, you’d notice that they mention how a group of Wall Street executives started this company. However, there’s no information on those people anywhere.

As you can see in the above points how this platform has too many disadvantages. At first, I thought I was exaggerating but when I read the various Peerform reviews online, I found that all of these factors have made it one of the worst P2P lenders out there.

Peerform has too many disadvantages due to which, it would be wise to avoid this P2P platform.

Customers’ Peerform Reviews:

The following are some customer reviews of Peerform. There were many more but I couldn’t share them all.

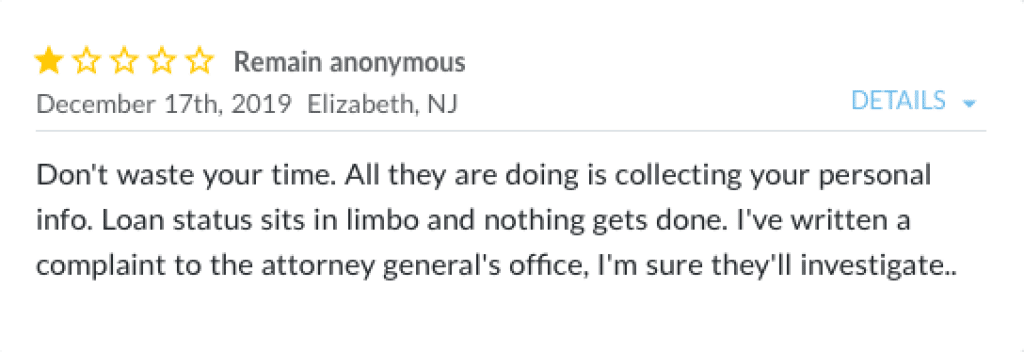

Don’t Waste Your Time

The first Peerform complaint I’d like to share is this one. It claims that the company is only stealing its users’ personal data and does nothing else. According to them, the borrower’s loan request makes no progress whatsoever.

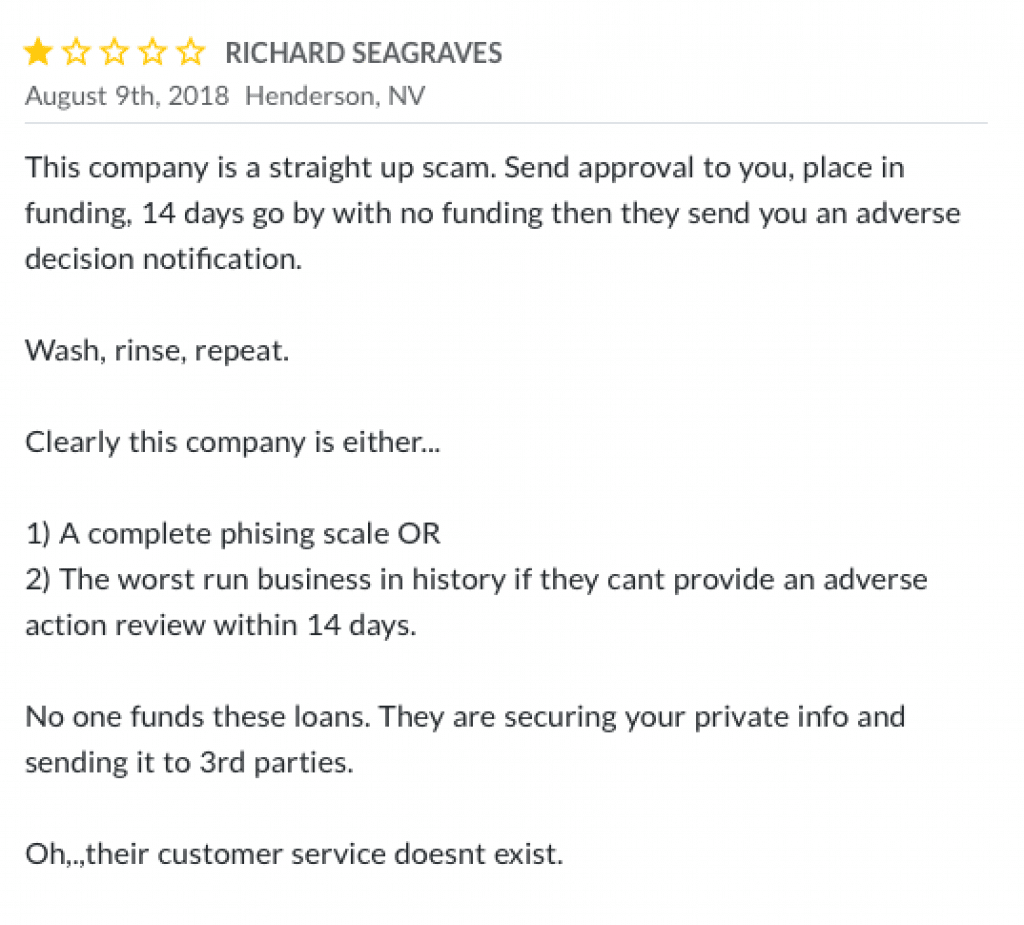

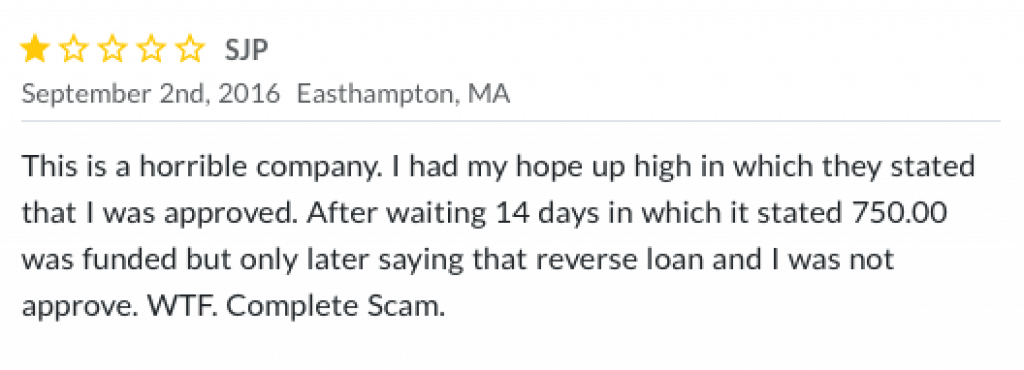

A Straight Up Scam

This person had a terrible experience with Peerform as well. According to the review, the company sends approval letters, waits for 14 days and then declines the loan request.

The reviewer suspects that this company might be selling its users’ data to 3rd parties.

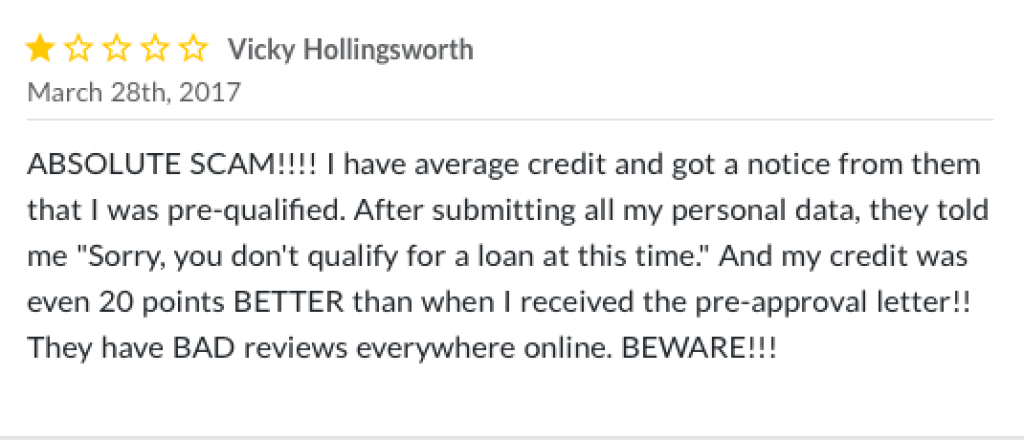

Absolute SCAM!

According to this reviewer, Peerform might be a data stealing scam. The platform had notified them that they were pre-qualified but after they submitted all of their personal data, the company claimed that they didn’t qualify.

The reviewer has mentioned that their credit was 20 points better than the pre-approved state so it was highly unlikely for their request to remain unqualified.

It wouldn’t surprise me if Peerform turns out to be a data stealing scam. They lack transparency and have tons of negative user reviews online.

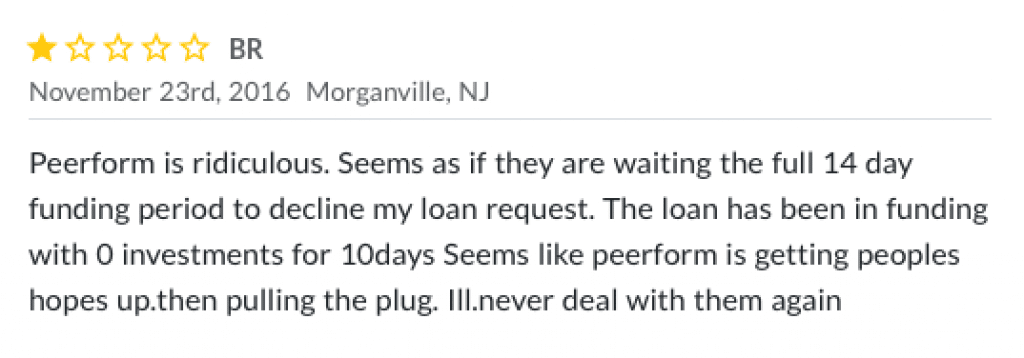

Ridiculous

This person had waited for the entire funding period (two weeks) but at the end, the platform denied their loan request. They believe that the platform only gets people’s hopes up and then pulls the plug.

A Horrible Company

This reviewer waited for 14 days but their loan didn’t get the required funding. As you can see, it’s a common occurrence on Peerform. Many borrowers don’t even get sufficient funding on their loans.

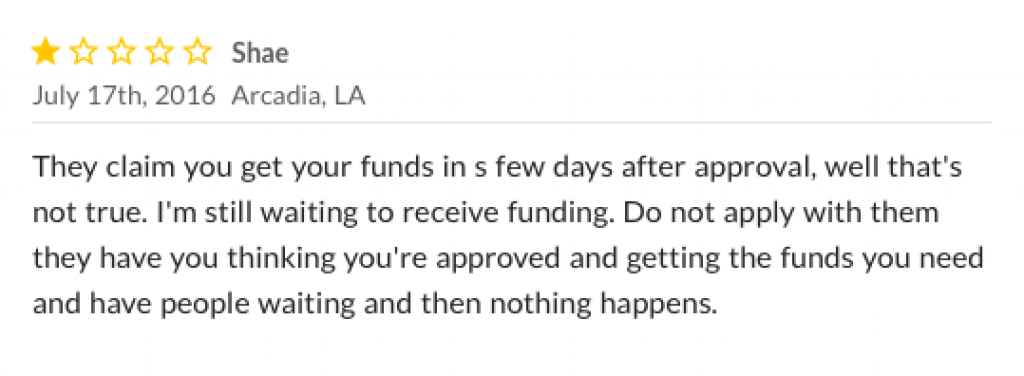

Do Not Apply With Them

This person has called out this company on its seemingly fake claims too. According to them, the company claims that a borrower can get their funds within a few days of getting an approval.

However, this person discovered that’s not the case. The reviewer has warned others about this company’s shady claims as well.

As I mentioned earlier, there were many other complaints. Peerform is terrible in providing services to its customers and these complaints reflect it.

According to customer reviews, Peerform is a data-stealing scam which provides no services and doesn’t process loan requests.

Peerform Review 2021: Conclusion

While this company seemed great on paper, in reality, it’s horrible. You can’t ignore the tons of negative reviews it has online. Apart from that, its various disadvantages including the excessive fees, lack of rate discounts, etc. have made it one of the worst P2P lenders out there.

You should avoid doing business with this company. If you had an experience with Peerform, feel free to share it below. On the other hand, if you know someone who might benefit from this review, share it with them. The more people know the better.

Don’t sign up on this platform people! Peerform is a fraud. They contact you and tell you that you have been approved for a Peerform personal loan so you would contact them and submit all of your personal and financial information. Once you submit all your data, those guys make you wait for weeks to tell you that you can’t get a loan. You’d be disappointed for a while but then you’d move on and that’s what they want you to do.

Peerform doesn’t want you to realise that you’ve been scammed. These people don’t make money from their borrowers. No, they make money by selling your personal and financial data to third-parties. Don’t sign up on Peerform, that’s all I want to say.

My experience with Peerform has been a nightmare. I signed up there to get a loan after receiving an email saying that I was approved for one. When I applied for a Peerform loan, my request got denied. It’s obvious that they are running a scam and are stealing everyone’s data. They probably sell their users data to a third-party and make money off of it. I don’t see any other point in telling people that their loan is approved then declining their request. It’s nonsense. I wouldn’t recommend anyone to sign up on Peerform.

I am 100% certain that Peerform is only a scam for stealing everyone’s personal data. They tell you that you are pre-approved so you would apply for a loan but then they would simply wait for 14 days and decline your request. If I was pre-approved, then there is no reason for them to decline my request like this. Peerform is a horrible platform. Avoid that place!!