About Keller Finance

“Almost all firms and individuals carrying out financial services activities in the UK have to be authorized or registered by us”, as per FCA.

According to FCA – “This firm is not authorized or registered by us but has been targeting people in the UK, claiming to be an authorized firm.”

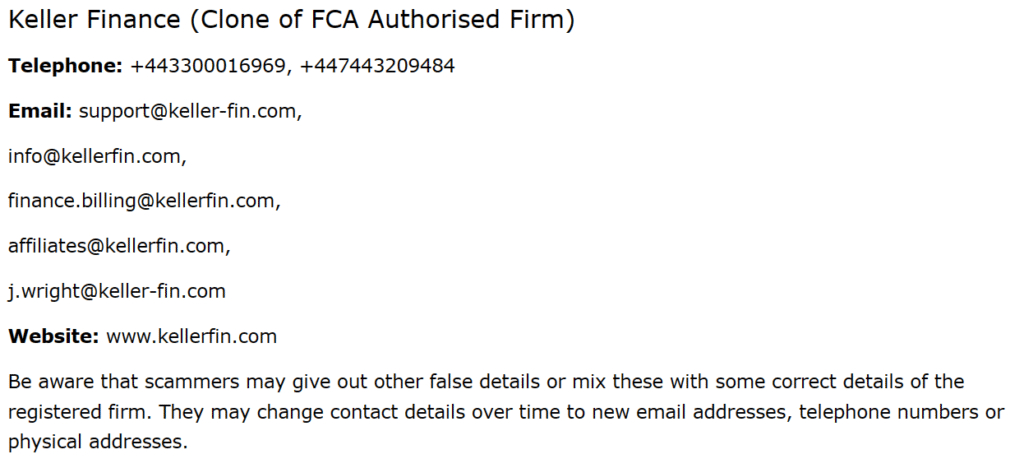

What does the FCA warning read?

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool provided by FINRA. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

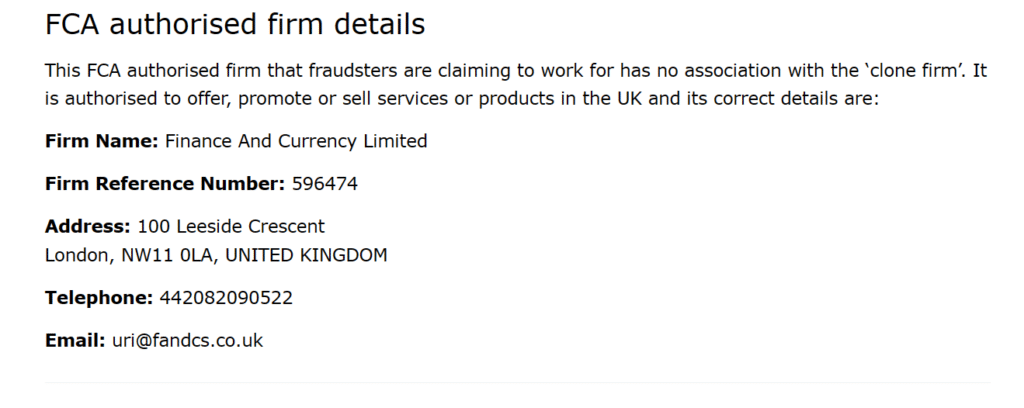

“Fraudsters are using the details of firms we authorized to try to convince people that they work for a genuine, authorized firm”. “This is what we call a ‘clone firm’; and fraudsters usually use this tactic when contacting people out of the blue, so you should be especially wary if you have been cold-called. They may use the name of the genuine firm, the ‘firm reference number’ (FRN) we have given the authorized firm, or other details.”

What are Clone Firms?

Although con artists may attempt to convince you otherwise, clone companies are not authorized. They frequently imitate a legitimate firm’s name and address or firm reference number (FRN). Also, anyone might replicate and make minor changes to an authorized company’s website (for example, to the phone number)

What is the FCA warning list?

The Warning List is a web-based service that alerts consumers to the potential hazards of investments and enables them to verify a list of companies that the FCA is aware are operating without its authorization.

What is DMCA?

The Digital Millennium Copyright Act is a 1998 United States copyright law that implements two 1996 treaties of the World Intellectual Property Organization. It criminalizes the production and dissemination of technology, devices, or services intended to circumvent measures that control access to copyrighted works.

Warning by FCA for being cautious by getting caught up with clone firms

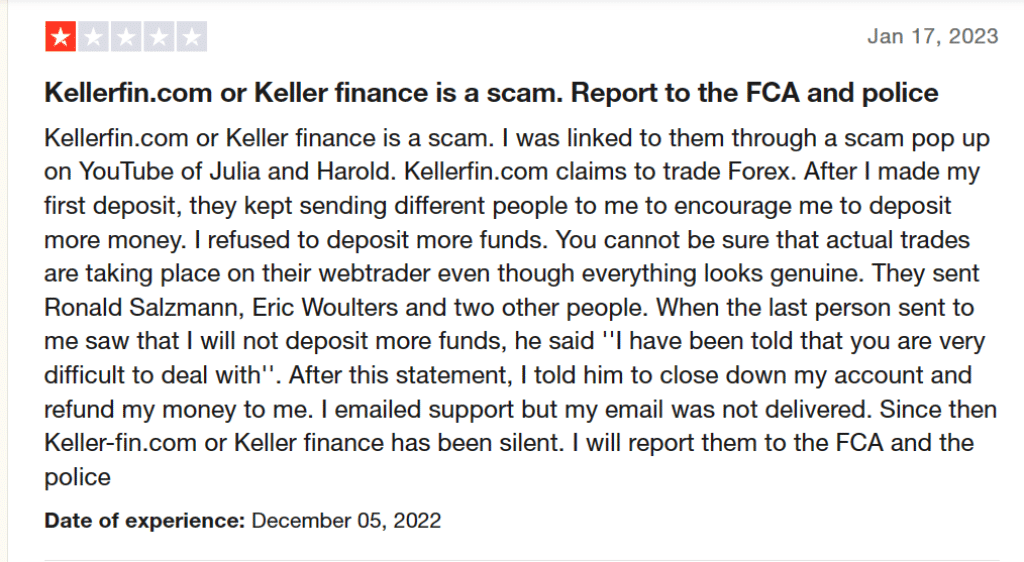

Keller Finance is posing as Finance And Currency Limited, a UK-based, FCA-regulated company that has nothing to do with the phony website in question, despite Keller Finance’s deceptive representation of it.

Our strong recommendation in these situations is to always confirm your new broker’s name and license credentials in the records of the relevant regulatory institution, in this example the FCA in the UK, and to avoid making any deposits completely if something does not match.

It goes without saying, but that also makes the Keller Finance website essentially anonymous, as you should agree, because you simply have no reason to believe anything you might be told, including whether the website’s alleged London address is real or not, if you cannot check your new broker’s identity in the registers of any official regulatory institution, such as the FCA in the UK.

Tactics Scammers Like Keller Finance Use:

Bonuses with too high withdrawal requirement

As alluring as a trading bonus may appear, as offered by shady websites like the one we are discussing here, it always has some conditions a minimum trade volume requirement, for example, that will essentially prevent you from withdrawing any money, regardless of how you trade or what you do. Our best advice in these situations is to carefully read the tiny print, especially when it comes to trading bonuses or promotions, aside from avoiding unregulated brokers entirely.

Faux gains and a 20% “fee” for withdrawal requests

You should also be aware of the absurd withdrawal handling and processing fees, as well as the so-called “profit fees,” which, in actuality, you will be obliged to pay each time you request a withdrawal, regardless of whether your request is ultimately allowed or not. The absurd thing about these fees is that they can easily approach 20%, which is hilarious.

Guaranteed Returns

Moreover, keep in mind that any broker who guarantees returns or offers risk-free transactions is undoubtedly planning to defraud you. Contrarily, legitimate and regulated brokers are even compelled to inform you of the risks associated with trading leveraged instruments and the high likelihood that you will soon lose all of your money.

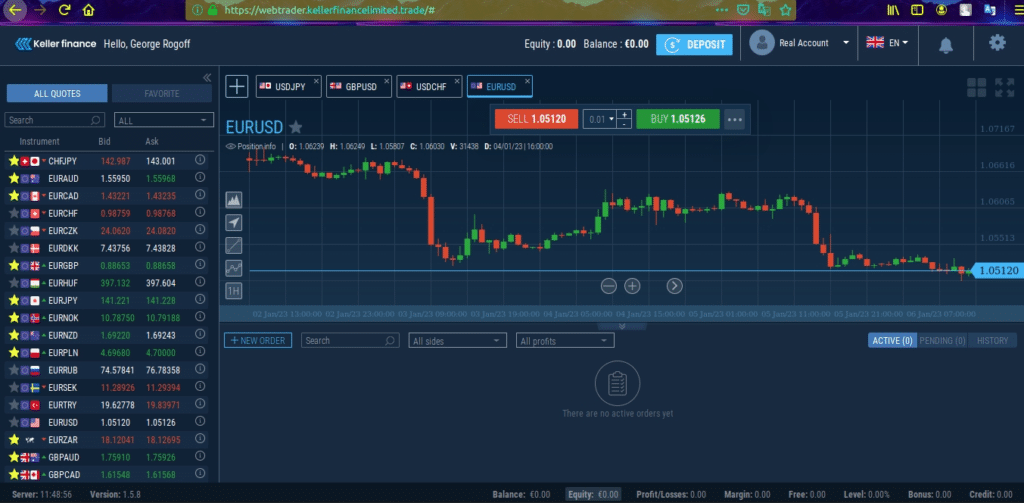

The platform offered by Keller Finance

Keller Finance offers a simple web trader, which you may check on the screenshot below.

The software lacks many common features found on professional platforms like the ones used by most traders, MetaTrader4 and MetaTrader5.

With over 10 million downloads on Google Play and a 4.5-star rating based on 403,000 reviews, MetaTrader5 is without a doubt the most well-known trading platform in the history of the FX market.

And there is a valid explanation for it. An MT5 will also allow you to run algorithmic trading sessions with the help of specially designed trading bots, called Expert Advisors, which you can also quite easily customize on a proprietary scripting language MQL5 – an object-oriented high-level programming language intended for writing automated trading strategies and custom technical indicators. An MT5 will feature real-time quotes, financial news, and various FX and stock charts.

More than 80 built-in technical indicators and analytical objects are supported by MT5, and you have the option to support up to 100 open charts at once in 21 different time frames, ranging from one minute to one month. This feature enables you to examine both short-term price fluctuations and long-term trends. Also, all MetaTrader 5 servers are housed in Equinix, one of the best worldwide providers of digital infrastructure, which has 240 data centers across 27 nations and all five continents.

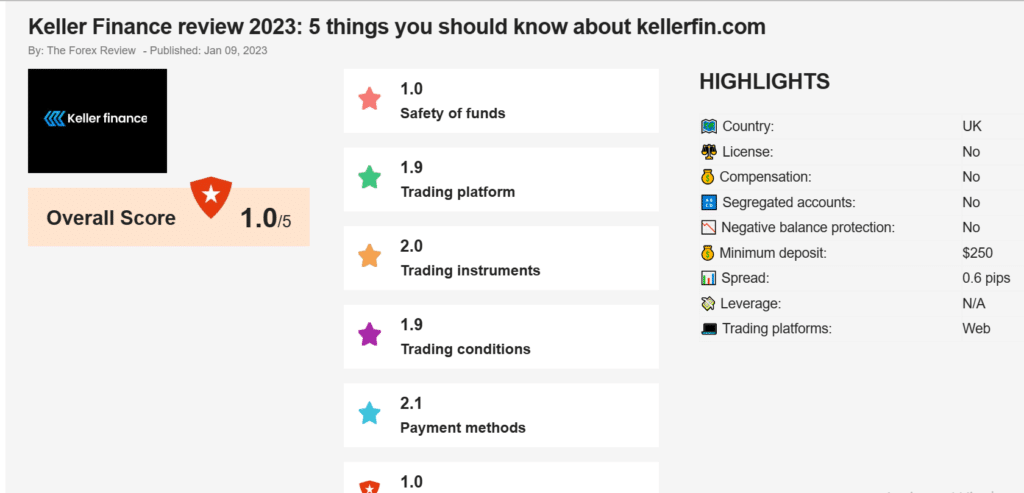

Conditions for trading with Keller Finance

Yet, the fact that we are dealing with a clone website fraud that has also already been revealed by the Financial Conduct Authority in the UK does not affect the fact that the spreads we observed on the Keller Finance platform start as low as 0,6 pips with the benchmark EUR/USD pair. As for the greatest leverage, it appears to be enticing as well 1:200 but once more, the website is not to be trusted because it has been revealed to be a clone website and all.

Procedures and Costs for Deposits and Withdrawals at Keller Finance

Although Keller Finance claims to accept payments via bank wire transfers, PayPal, Skrill, Mastercard, JCB, and other payment methods, we were unable to check this right away.

Just keep in mind that scam websites like this generally prefer to accept your payments in Bitcoins or other crypto coins like USD Tether because you won’t stand a chance to reverse the payment, not even when you realize you have been scammed. Additionally, keep in mind that the website is an outright scam in the first place.

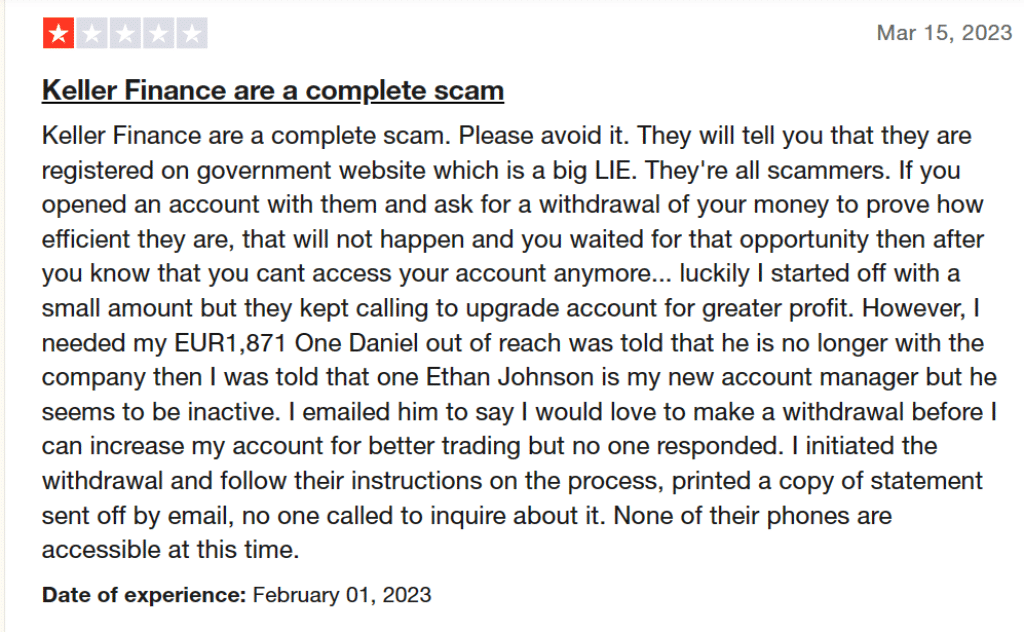

How does the scam of Keller Finance work?

Be very careful who you give your personal information, such as your phone number or email address. Scammers will call you as soon as they acquire your phone number to convince you to invest immediately.

They will claim that trading with them is risk-free, but that is exceedingly improbable, to say the least. Be prepared to hear that you can earn a quick and extraordinarily large return on investment as well. Of course, this is a flagrant lie. Scammers frequently coerce traders into depositing and disappearing out of thin air.

Nevertheless, before that, they might try to trick their trading software into making it appear as though your money is being invested. Also, they might deceive you into thinking that your outcomes are highly profitable. This is done specifically to increase your investment before you realize everything is a sham.

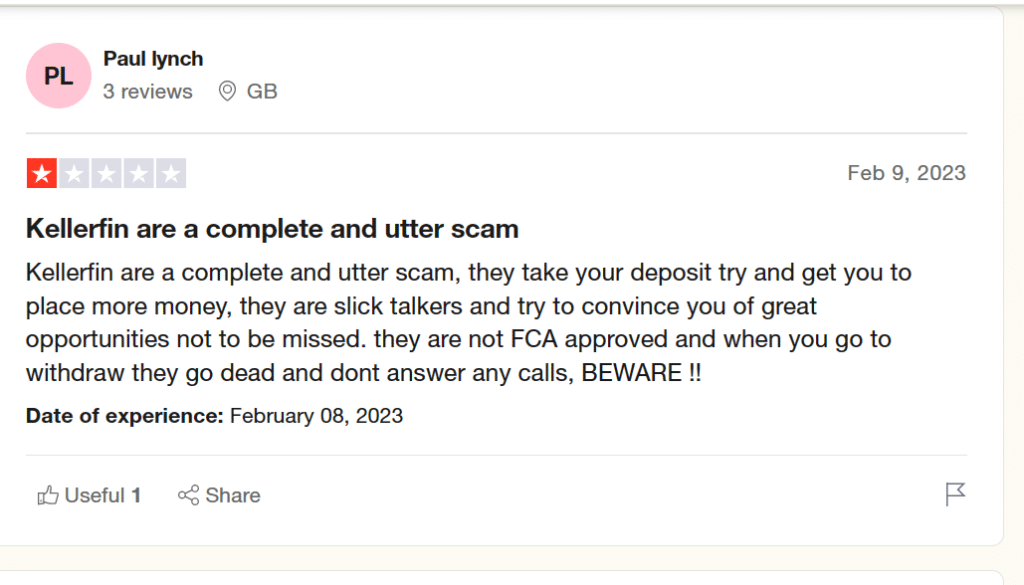

When you try to withdraw even a small amount, expect to be hit with a variety of hidden fees, and the worst-case scenario is that your withdrawal will be rejected no matter what.

Keller Finance Review: Conclusion

The first step you should take if you believe you have been scammed is to contact the bank that issued your credit or debit card and request a chargeback. If you used your Visa or Mastercard to make the purchase, you have 540 days to file a chargeback.

The finest course of action in this circumstance is to promptly replace your online banking username and password because wire transactions are more challenging to reverse.

You also have the option to file a claim if you use a payment method like Neteller, Paypal, or Skrill.

Unfortunately, crypto transactions are irreversible as we already stated and therefore your money can not be returned. All in all, we advise you not to trust brokers that use only crypto coins such as Bitcoin or Ethereum.

Last but not least, certainly don’t trust people on the internet offering to return your funds only after you pay a certain fee. They might also be scammers so don’t risk losing more money than you already have!

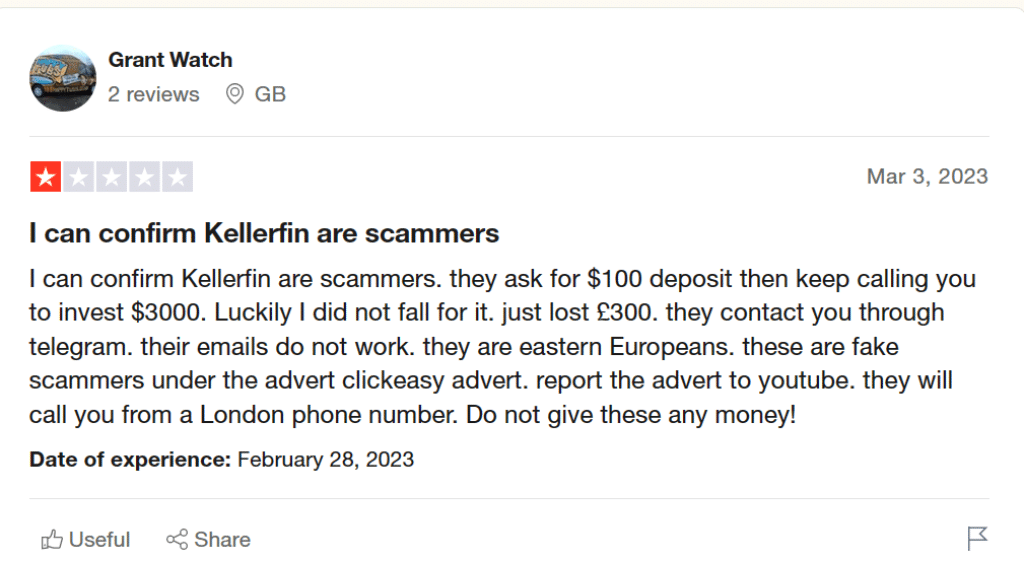

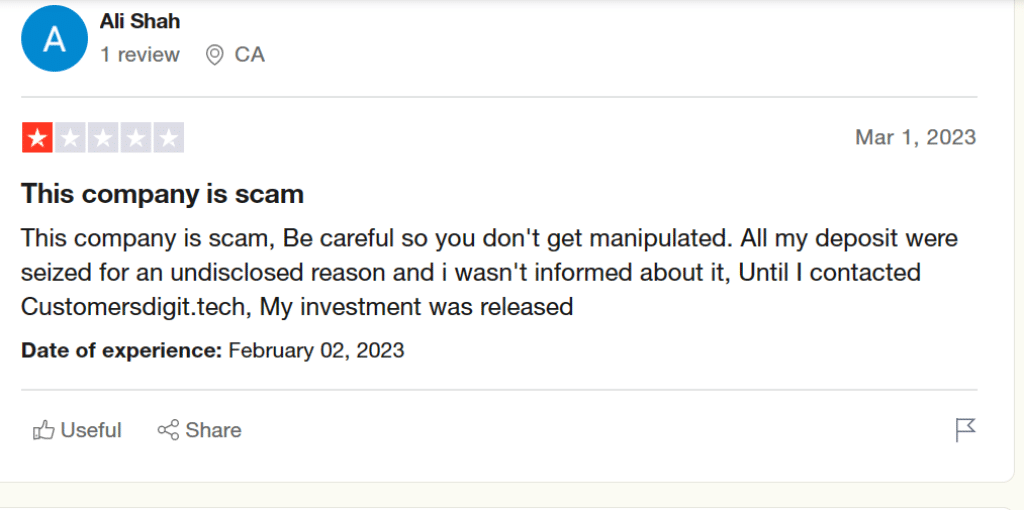

Keller Finance Reviews You Must Read:

Conclusion:

If you have been scammed, the first thing you should do is get in touch with the bank that provided your credit or debit card and ask for a chargeback, according to Keller Financial Review.

You have 540 days to submit a chargeback if you made the payment with a Visa or Mastercard. Because those wire transactions are more challenging to reverse, the best course of action in this situation is to immediately reset your online banking login and password.

If you pay with a system like Neteller, Paypal, or Skrill, you can file a claim.

Yet because cryptocurrency transactions are irreversible, as we already said, there is no way to get your money back.

Finally, we issue a warning against putting your trust in brokers who only deal in digital currencies like Bitcoin or Ethereum.

Because of this, you ought to never believe anyone online who offers to give you a refund if you make a purchase. They might also be con artists, so don’t risk losing more money than you already have by ignoring them.