You can help us put a stop to online scams before they grow too big and end up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

WTC Cloud Mining- On its website, WTC Cloud Mining doesn’t list ownership or leadership information. The domain name “wtccm.com” for WTC Cloud Mining’s website was privately registered on April 23, 2023.

WTC Cloud Mining inaccurately asserts that it has been around since 2018, even though it has only been around for a few months.

According to WTC Cloud Mining, it is being operated from offices in Singapore and Geneva, Switzerland, and a main office in Texas, USA.

If we examine the website code for WTC Cloud Mining, we discover Chinese:

As a result, we can rule out any connections between WTC Cloud Mining and the US or Switzerland. Those in charge most certainly have connections to China. Typically, this refers to Hong Kong, Singapore, or the mainland of China.

Always consider joining and/or giving any money to an MLM firm very carefully if it is not transparent about who owns or runs it.

We look at 34 different data points when analyzing and rating online money-earning opportunities. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

WTC Cloud Mining’s Products- What they have to Offer

WTC Cloud Mining doesn’t offer any retail-ready goods or services. Only the WTC Cloud Mining affiliate membership itself may be promoted by affiliates.

WTC Cloud Mining’s Compensation Plan

Affiliates of WTC Cloud Mining contribute 20 Tron (TRX) or more. This is done in exchange for a daily ROI of 5%, with a cap of 200% to

- Invest 20 to 50,000 TRX and get a 200% return.

- Invest 50,000 to 99,999 TRX and get a 230% return.

- Invest 100,000 to 199,999 TRX and get a 250% return.

- Invest 500,000 to 999,999 TRX and get a 400% return.

- Invest 1,000,000 TRX or more and get a 500% return.

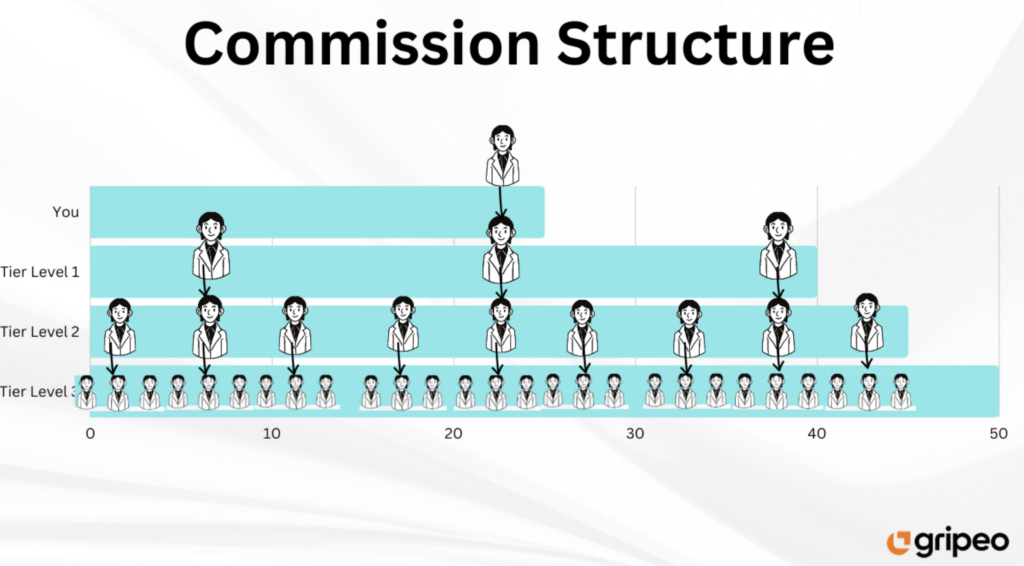

With three tiers of recruitment, WTC Cloud Mining offers referral commissions on TRX invested (unilevel):

- level 1 (personally recruited affiliates) – 13%

- level 2 – 5%

- level 3 – 3%

WTC Cloud Mining states affiliates who recruit over 100 investors will “receive rich extra cash rewards”. No specific details are provided.

WTC Cloud Mining- What It Takes to Join

The WTC Cloud Mining affiliate program is free to join. The connected income potential requires a minimum investment of 20 TRX to be fully engaged.

WTC Cloud Mining Conclusion

WTC Cloud Mining fails the Ponzi logic test for apparent reasons. We have generated more than $190 billion in value over the past several years for the 3,789 fund companies we service thanks to the strong growth of the bitcoin sector. If WTC Cloud Mining has made $190 billion in payouts, they have made $3.8 trillion in total revenue. All of that cash came from a random Chinese software that just recently went live. Riiiiiiiiiiiiiiigh…….t.

Another “click a button” app Ponzi scheme is WTC Cloud Mining. The “click a button” Ponzi scheme of WTC Cloud Mining involves signing in every day and pressing a button to get a 5% return on investment.

It is stated that TRX cloud mining is taking place in the background, which is absurd of course. Why would WTC Cloud Mining make its multi-billion dollar mining operations accessible for free? In reality, moving numbers on a screen by pressing a button inside the WTC Cloud Mining program. To pay for actual withdrawals, newly invested funds are recycled to pay off older investors. The “click a button” app Ponzis that has surfaced since late 2021 includes WTC Cloud Mining. With WTC Cloud Mining included, BehindMLM has so far identified 56 “click a button” app Ponzi schemes. Before crumbling, the majority of them last a few weeks to a few months.

The “Click a button” app Ponzi schemes vanish by blocking their websites and mobile applications. The bulk of investors lose money as a result of this happening suddenly (inevitable Ponzi math). The “click a button” app Ponzi scourge is thought to be the work of the same set of Chinese con artists.

Reference- WTC Cloud Mining Review: Tron mining “click a button” Ponzi (behindmlm.com)

What is a Ponzi Scheme? (The crime committed by WTC Cloud Mining)

A Ponzi scheme is a type of scam in which investors are attracted and earnings are distributed among earlier investors using money from more current investors. The Ponzi scam, so named after the Italian businessman Charles Ponzi, deceives its victims into thinking that gains are the result of successful business operations (such as sales of goods or profitable investments), while the true source of the money is other investors.

As long as new investors continue to invest money, as long as the majority of investors continue to believe in the fictitious assets they are said to possess, and as long as new investors continue to put money into the Ponzi scheme, the illusion of a sustainable business may be maintained.

The “Ladies’ Deposit,” run by Sarah Howe in the 1880s in the United States and Adele Spitzeder in Germany from 1869 to 1872, was used in some of the earliest documented instances that fit the contemporary description of the Ponzi scam. Howe gave his only female clientele an 8% monthly interest rate before robbing them of their invested funds.

After being found, she was sentenced to three years in prison. There have also been literary descriptions of the Ponzi scam; Little Dorrit, published in 1857, and Martin Chuzzlewit, published in 1844, both contain descriptions of the Ponzi scheme. Ponzi schemes are named after Charles Ponzi, a 1920s businessman who successfully persuaded tens of thousands of clients to invest their funds with him. The Ponzi scheme promised a specific amount of profit after a specific amount of time through the purchase and sale of discounted postal reply coupons. Instead, he was using new money invested to pay off old obligations.

- The Ponzi scam brings in new investors by promising them a substantial payoff with little to no risk, which creates returns for previous investors.

- The fraudulent investment scheme’s basic idea is to reimburse the initial backers with money from future investors.

- Companies that run Ponzi schemes concentrate all of their efforts on finding new investors because, without them, the scheme will run out of money.

- The SEC has provided advice on potential Ponzi scheme red flags, such as guarantees of returns or unregistered investment vehicles with the SEC.

Ponzi Scheme Red Flags (The red flags discovered with the Ponzi scheme of WTC Cloud Mining)

No matter the technology employed in the Ponzi scheme, the majority have similar features. The following characteristics to look out for have been recognized by the Securities and Exchange Commission (SEC):

- a promise of large returns with little risk that is guaranteed.

- a steady stream of returns irrespective of market conditions.

- Unregistered investments with the Securities and Exchange Commission (SEC).

- Clients are not permitted to read the formal paperwork for their investment because it is hidden or too hard to explain

- Customers had trouble withdrawing their money

How The WTC Cloud Mining Ponzi Scheme was discovered

The SEC has identified a few traits that often signify a fraudulent financial scheme. It is important to understand that almost all types of investing incur some level of risk, and many forms do not carry with them guaranteed profits. If an investment opportunity (1) guarantees a specific return, (2) guarantees that return by a certain time, and (3) is not registered with the SEC, the SEC advises to invest with caution as these as identifiers of fraud.

Bottom Line

Customers anticipate some sort of fiduciary duty when they give money to their financial advisors or investing companies. Unfortunately, Ponzi schemes can be used to fraudulently mismanage those funds. Ponzi schemes aren’t real investment plans because they use the money from one investor to pay another. They are dishonest investment schemes that cost billions of dollars in losses.