CapitalX – Is this a Ponzi Scheme? The Truth Exposed (Update 2024)

Find out why CapitalX is a dangerous scam you must avoid at all costs in this following review:

CapitalX’s website lacks ownership and executive information.

On March 7th, 2023, CapitalX’s website domain (“capitalX. pro”) was privately registered. Dubbed over-stock footage appears in CapitalX marketing videos on their website.

CapitalX presents incorporation details for CapitalX Limited to appear authentic.

On March 7th, CapitalX Limited was incorporated in the United Kingdom.

The corporation states in the footer of its website:

CapitalX Limited is a UK Financial Conduct Authority-registered Registered Cryptoasset business.

CapitalX Limited is not registered with the FCA, according to a search of the FCA’s publicly accessible database. CapitalX looks to be seeking to pass off basic incorporation as FCA registration.

In any case, an MLM company based in or claiming to be based in the United Kingdom is a red sign.

In the United Kingdom, incorporation is dirt cheap and effectively unregulated. Furthermore, the FCA, the United Kingdom’s leading financial regulator, does not actively regulate MLM-related securities fraud.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

As a result, the United Kingdom is a popular destination for scammers wishing to incorporate, operate, and market bogus businesses.

Incorporation in the UK or registration with the FCA are irrelevant for MLM due diligence.

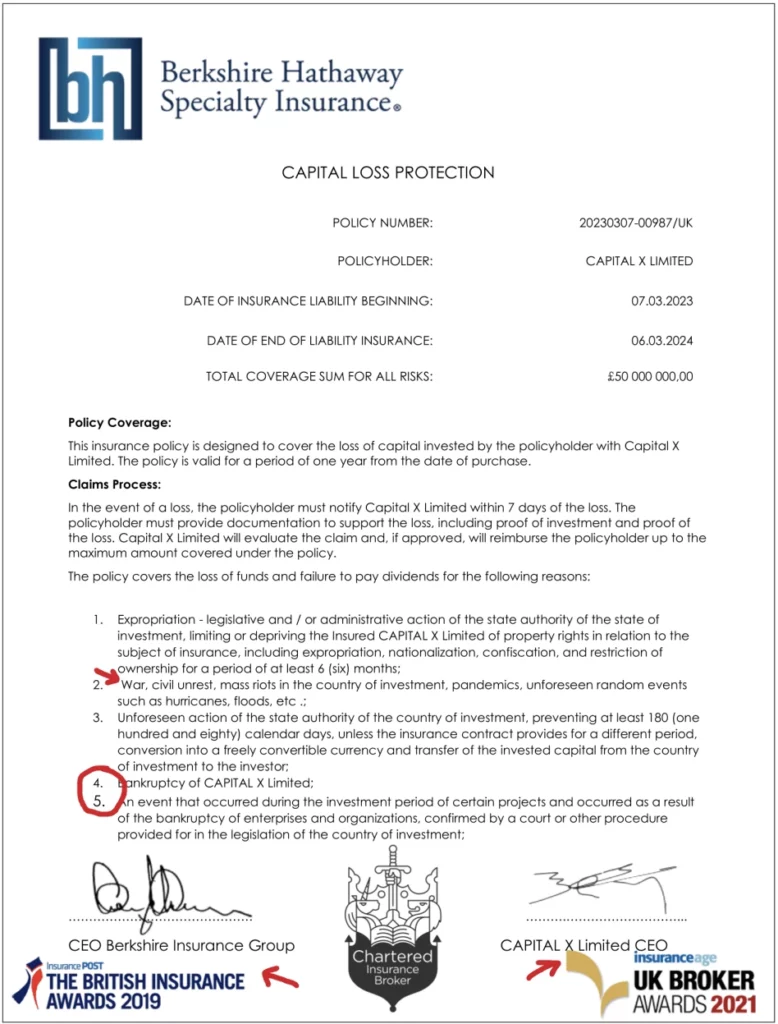

CapitalX also offers a “capital loss protection” document that it claims was obtained from Berkshire Hathaway Specialty Insurance.

This document appears to be forged, by way of

- awkwardly placed logos at the bottom

- font size disparity

- spacing inconsistencies and

- no names appear on the document

Alisher Bekmuratov is one name we may associate with CapitalX.

CapitalX’s one-page marketing presentation (right) lists Bekmuratov as the creator.

I conducted a search for Alisher Bekmuratov and found multiple results in Kyrgyzstan, Uzbekistan, and Russia. I just have a name to go on, so I can’t positively identify CapitalX’s Bekmuratov, but it’s evident he’s from Eastern Europe.

This shows that whoever is in charge of CapitalX has ties to Eastern Europe.

As always, if an MLM firm is not honest about who runs or controls it, consider twice before joining and/or turning over any money.

Their Products

This company offers no goods or services.

Affiliates can only promote their affiliate membership.

Their Compensation Plan

Affiliates of CapitalX invest funds based on the prospect of advertised returns:

- Invest $50 to $10,000 in silver and receive 3% every day for 90 days.

- Invest $1500 to $10,000 in gold and receive 5% every day for 24 days.

- Platinum – invest $2000 to $10,000 and get a 200% return in 14 days.

- Elite – invest $2500 to $50,000 and get 250% back in 7 days.

- VIP – invest $5000 to $50,000 and get a 300% return after 120 hours.

They claim to pay referral commissions on invested assets at three recruitment levels (unilevel).

- level 1 (personally recruited affiliates) – 5%

- level 2 – 3%

- level 3 – 1%

How to Join

CapitalX affiliate membership is completely free.

A $50 commitment is required to fully participate in the attached income opportunity.

Review Summary

CapitalX claims to create returns through the usage of AI trading bots.

CapitalX Limited creates trading bots using advanced AI technology that can evaluate market data and make trading decisions based on that data.

The company’s AI algorithms are meant to scan massive volumes of data and uncover patterns and trends that human traders may not see.

There is no proof that CapitalX has or is utilizing trading bots to generate external revenue.

CapitalX’s marketing claims also flunk the Ponzi logic test.

What do they need your money for if CapitalX has an AI trading bot that can generate 300% every 120 hours?

As of now, new investment is the sole provable source of revenue entering CapitalX. CapitalX is a Ponzi scheme since it uses new investments to pay ROI withdrawals.

As with other MLM Ponzi schemes, once affiliate recruiting is exhausted, new investments will dry up.

This will deprive CapitalX of ROI revenue, eventually leading to its demise.

Ponzi schemes’ math ensures that when they fail, the vast majority of participants lose money.

What is a Ponzi scheme?

A Ponzi scheme is a deceptive investment strategy that promises high rates of return with no risk to investors. A Ponzi scheme is a fraudulent investment scheme in which money is collected from later participants to produce profits for earlier investors. This is comparable to a pyramid scam in that both rely on new investors’ finances to pay off previous investors.

Both Ponzi and pyramid schemes inevitably fail when the influx of new investors stops and there isn’t enough money to go around. The plots begin to crumble at that time.

- By recruiting new investors who are promised a huge payoff with little to no risk, the Ponzi scheme produces returns for existing investors.

- The fraudulent investment strategy is based on using funds from new investors to pay off previous donors.

- Companies that run a Ponzi scheme concentrate their efforts on enticing new clients to make investments; otherwise, their system will become illiquid.

- The SEC has provided recommendations on what to look for in suspected Ponzi schemes, such as guaranteed returns or investment vehicles that are not registered with the SEC.

- Bernie Madoff perpetrated the greatest Ponzi scheme, duping thousands of investors out of billions of dollars.

A Ponzi scheme is a type of investment scam in which clients are promised a high profit with little or no risk. Companies that run a Ponzi scheme devote all of their resources to acquiring new investors.

This new revenue is utilized to pay original investors’ returns, which are labeled as a profit from a valid transaction. Ponzi schemes rely on a steady stream of new investments to keep paying out profits to older investors. When this flow runs out, the scheme crumbles.

Conclusion

Regardless of the technology utilized, the majority of Ponzi schemes have similar characteristics. The Securities and Exchange Commission (SEC) has recognized the following characteristics to be on the lookout for:

- A promise of high rewards with no risk.

- A steady stream of returns regardless of market conditions

- Unregistered investments with the Securities and Exchange Commission (SEC)

- Clients are not permitted to access official papers for their investment strategies that are kept secret or described as too hard to comprehend.

- Clients who are having difficulty withdrawing their funds