CED Capital Limited – Is this Platform Safe for Trading? The Truth Exposed (Updated)

It turns out that starting to trade on the financial markets is now the easiest thing to do. Obviously, with the most effective platform and the best crew in the trading industry. Do you believe that this requires you to open an account with a well-known broker? No, CED Capital Ltd provides you with access to limitless assets and secure markets. Don’t you recognize this scammer?

While familiarizing ourselves with the company’s offers, details, and testimonials for this reason. This project makes one think of a con.

About CED Capital Limited

The Reality of CED Capital Limited

CED Capital Limited Registration

On the first visit, the CED Capital Ltd main website leaves something to be desired. The project’s developers have merely applied their mark to an already established template. They are merely changing the companies’ names, colors, and designs. Moreover, there is a lot of self-promotion here. The website has also been translated into several other languages. And they are likely the only benefits it has.

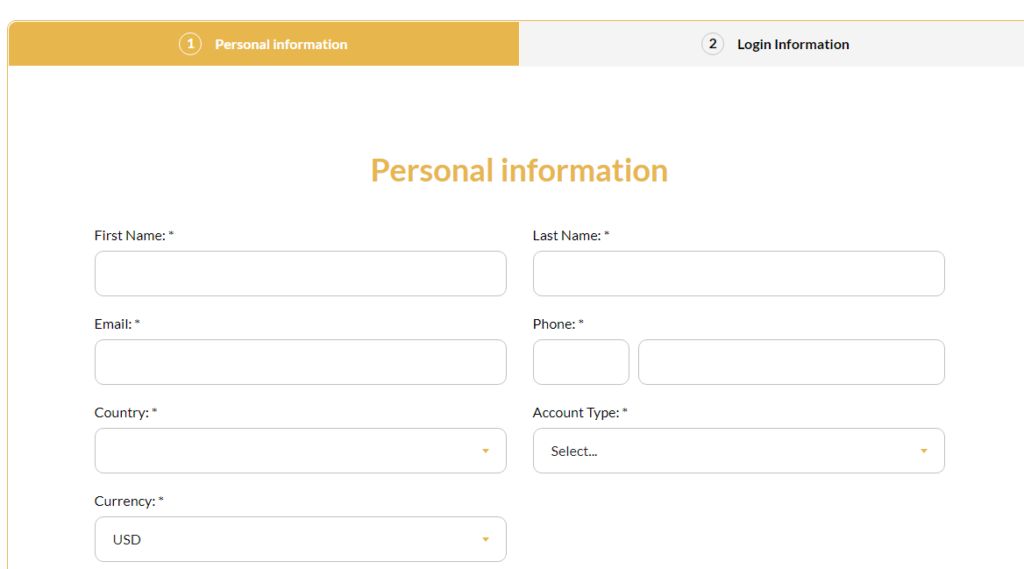

Registration on this site is simple. You will need to fill in the following fields:

- First and last name

- Email address and phone number

- Country of residence

- Password and password confirmation.

Another drawback of CED Capital Limited is that the broker does not even verify the client’s information when you register. There is no need to confirm by phone or email. One may open an account with any false information.

There are almost no surprises in the client portal. Functions are available:

Profile editing and verification

Viewing the list of accounts and transaction history

Non-trading operations and their history.

One can also access the renowned CED Capital Ltd terminal from here. It most definitely merits a few special remarks.

There is virtually no better way to lose money than to start trading with CED Capital Ltd, which has been proven to be a scam. If you want to trade safely and profitably, stay away from this broker at all costs and seek reputable, regulated brokers instead.

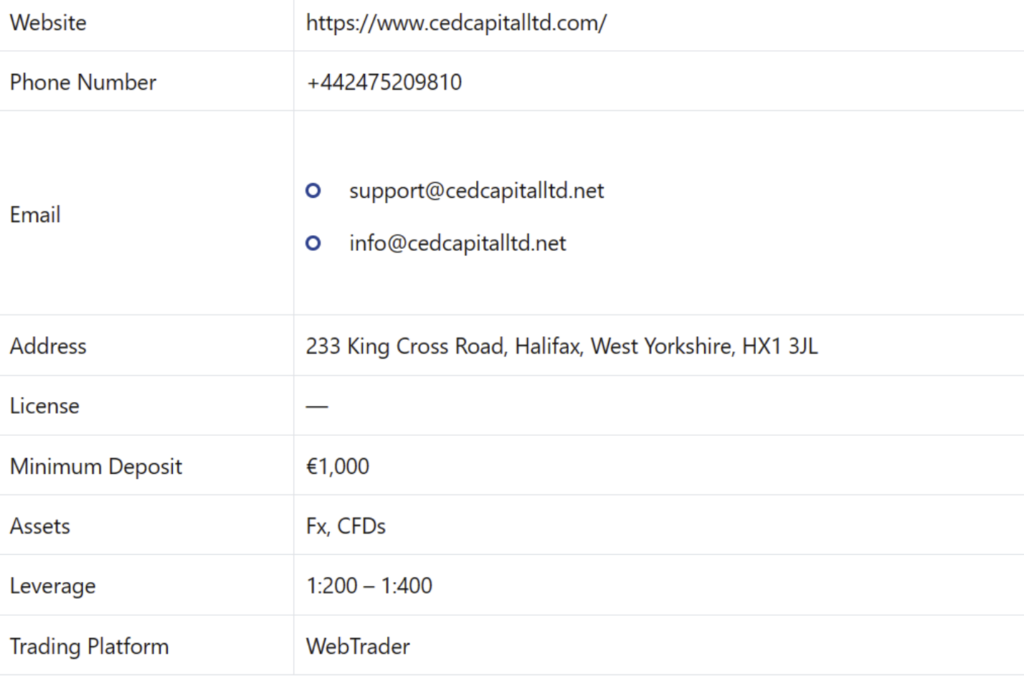

CED Capital Limited Regulation

Account Types

Three full-fledged accounts are held by the broker. There are four of them. The final person is a VIP, though. Furthermore, little is said about it. Only letting you know that you can get all individual bids for it from the manager, CED Capital Ltd. These are the other accounts:

- Starter– The down payment is just €1,000. Leverage can reach 1:200. Services for a personal manager are offered. Moreover, the broker guarantees a minimal commission charge. There are just currency pairs offered.

- Limited Account– The required down payment is €5,000. Indexes are additionally offered in addition to currencies. A little bit lower spread is also promised by CED Capital Ltd.

- Medium– The required down payment is 10,000 euros. The services of the personal manager now include an analyst. Moreover, indices are becoming one of the trading products offered.

We think the 1,000 euro minimum deposit is a tad excessive. The only differences between accounts are the magnitude of the spreads, the leverage, and the deposit. The business just employs fraud tactics. You will receive better terms the more money you deposit.

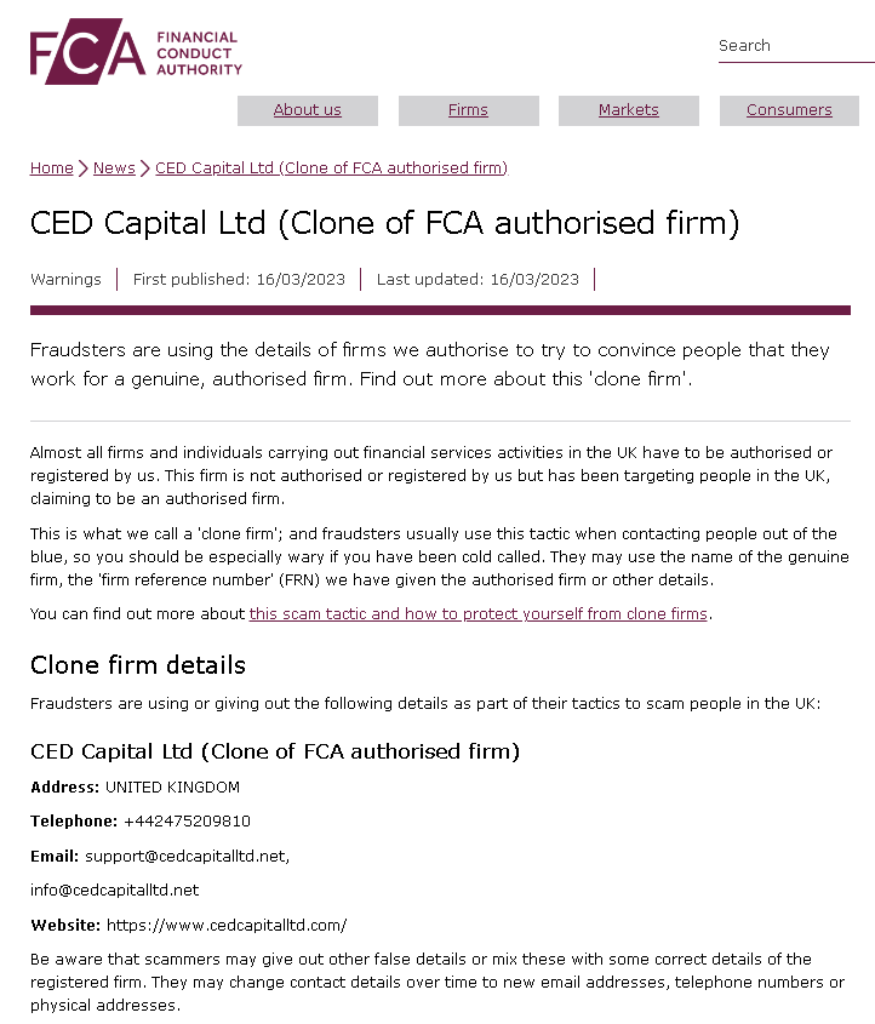

According to CED Capital Limited, it is safe to trust your money with this reputable UK broker. Unfortunately, we were unable to locate any license information when we searched the FCA’s register, a reputable UK financial authority. In reality, the authority recently warned against this broker, claiming that they are nothing more than a copy of a broker who is legitimately regulated:

This demonstrates unequivocally that CED Capital Ltd is nothing more than a risky con. Going to a broker who is genuinely regulated in the UK would be much better for you.

UK brokers must fulfill several conditions before they can begin providing services and establishing their credibility and dependability. To:

- To guarantee transparency, submit frequent reports to the authorities.

- Maintain a minimum capital of at least EUR 730 000 to demonstrate their ability to manage their finances and think long-term.

- Protection from negative balance (you can never lose more money than you have in your account).

- Maintain customer funds in separate bank accounts to which they have limited access.

- Take part in compensation programs that protect your capital up to GBP 80,000 if the broker goes out of business.

- Take part in compensation programs that protect your capital up to GBP 80,000 if the broker goes out of business.

This helps to ensure that trading with a legitimate, licensed broker would be a much better, safer approach.

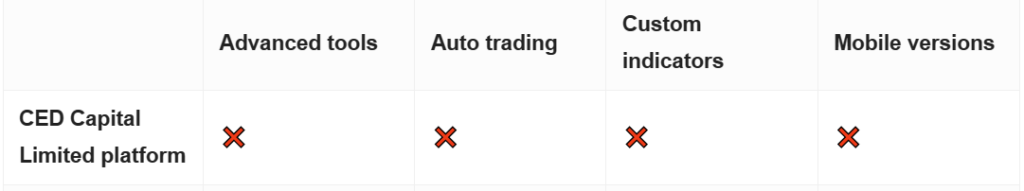

Trading Platform

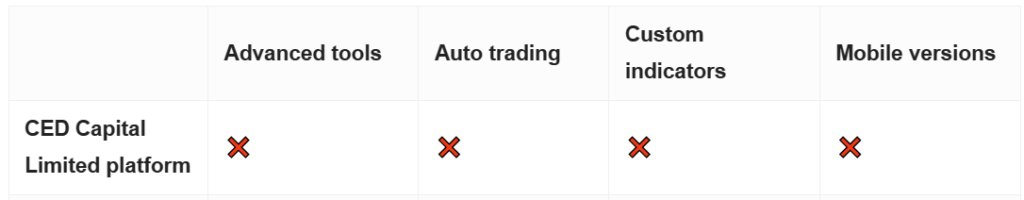

The CED Capital Limited trading platform is truly subpar. It is only employed by con artists. We are unaware of any trustworthy broker who would provide customers with this specific WebTrader. It’s only partially functional. And the price is reasonable. The business does not wish to invest further funds in trading.

CED Capital Limited offered a decent enough if unimpressive web-based trading platform:

These platforms do provide some fundamental capabilities, but in general, they fall far short of the potential that well-known platforms like MetaTrader 4, MetaTrader 5, and cTrader can provide.

All of these platforms provide capabilities for algorithmic trading, as well as extensive charting and analysis packages with a wide range of indicators, graphical objects, timeframes, and chart kinds.

CED Capital — Deposit and Withdrawal of Funds

Deposit

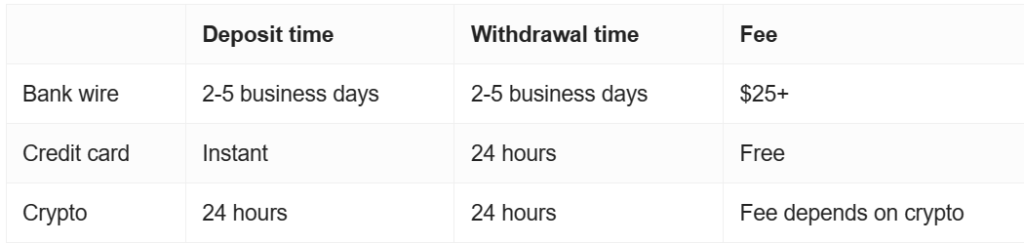

The broker offers a variety of funding and withdrawal options. Via bank transfer, credit card, or cryptocurrency, you can top off your account. Naturally, you can withdraw cash using the same procedures. The processing time for your application or the speed at which the funds will be deposited into your account is not specified by CED Capital Limited.

The minimum deposit required by CED Capital to start a trading account is €1000. Either way, you slice it, that is excessive—many trustworthy brokers would demand ten times less. A lot of businesses are also more than happy to open an account for you for as low as $10.

What is Cryptocurrency?

A digital type of money known as cryptocurrency has no tangible counterparts, such as coins or bills, and only exists electronically. Electronic tools like cell phones, PCs, or specialist Bitcoin ATMs are frequently used in cryptocurrency transactions.

Even though Bitcoin and Ether are well-known examples, there are many other virtual currencies on the market, and more are constantly being created. These cryptocurrencies offer distinctive features and applications in the fields of technology and finance, operate on decentralized networks, and are defined by their digital nature.

Withdrawal

Only wire transfers, payments made with credit/debit cards, and cryptocurrency appear to be accepted by CED Capital Ltd for deposits. As such transactions are both anonymous and irreversible, you should never put money in cryptocurrencies unless you are confident in a broker’s dependability.

Both Visa and MasterCard enable chargebacks within 540 days of the transaction, so if you previously made the error of depositing with this broker using a credit/debit card, you might still have a chance to get your money back.

Verification

According to the KYC policy, each trader must be validated. As a result, you must upload a snapshot of your documents. The Client Portal contains a list of the available documents. You will initially only need to give some of these to certify:

- Identity

- Address

- Payment Method

Certain services may not be available to unverified users. Verification of the data will take 1-2 days. Managers may request further documentation as needed.

CED Capital Limited Trading instruments

All major markets, including FX, equities, indices, cryptocurrencies, and a few commodities, are accessible through CED Capital Ltd. Nonetheless, we think the broker’s selection of products was a little thin.

Why not trade with one of the many reliable brokers who have hundreds or even thousands of products to pick from?

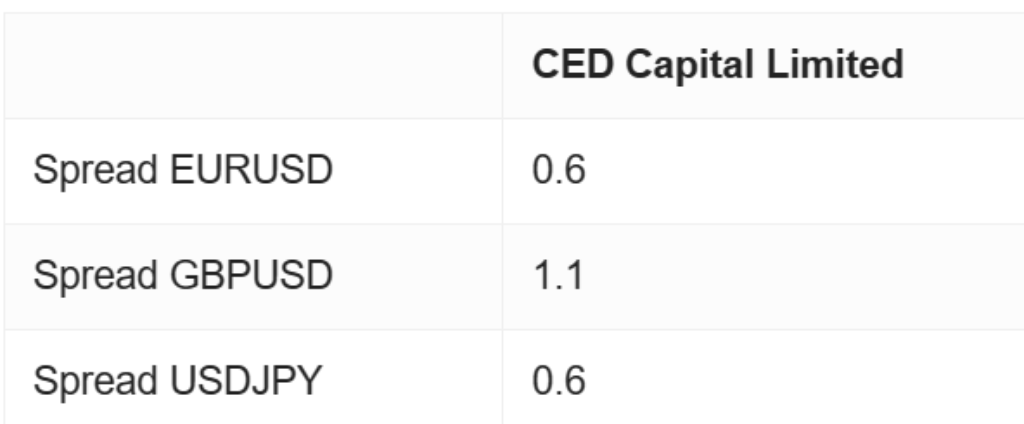

CED Capital Limited Spread

For the most popular currency pairs, CED Capital Limited provided spreads that were quite favorable. Given that the EURUSD average spread is 1.5 pip, receiving 0.6 pip with this broker seems to be a reasonable deal. But, given that we are confident that we are only dealing with fraudsters, we advise you to look into a real, reputable broker who provides these spreads. You can never be sure if such con artists can be trusted because they frequently tweak platforms to produce excellent outcomes.

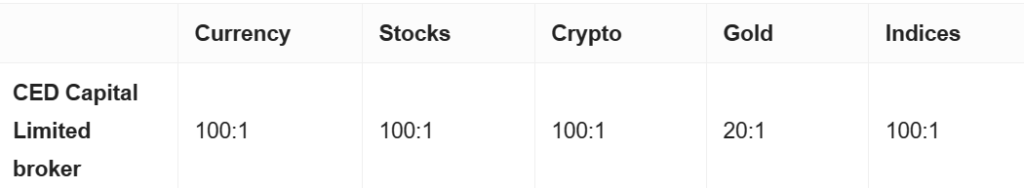

Leverage at CED Capital Limited

Except for gold, CED Capital Limited offered extraordinarily high leverage of 1:100 on all assets (1:20). This is yet more indication that we are not working with a UK broker that is regulated. UK leverage limitations prohibit brokers from providing retail traders with leverage on forex majors greater than 1:30. The explanation for this is straightforward: If you lack the skills required to manage such dangerous trading instruments just yet, trading with such high leverage could potentially lead to significantly larger losses. Because of this, we normally advise sticking with lower, safer rates that you are confident you can afford.

CED Capital Limited Withdrawal requirements

Since CED Capital Limited made no mention of any specific withdrawal conditions, we must point out that con artists of this nature frequently have something up their sleeves. They may demand that you meet unreasonable trading volume criteria before you withdraw anything at all, or they may impose astronomical withdrawal costs that can approach 30% of the withdrawn money.

Proving That CED Capital Limited is a scam

Even though the broker presents themselves as a trustworthy business partner, it is wise to avoid trading on this platform. Even with a cursory introduction, the notion that CED Capital Limited is a fraud is fostered. The indicators of fraud are rather clear-cut.

Legal Information and License

The company’s legal information is not particularly noteworthy. The offshore Saint Vincent and the Grenadines registration address is listed in the footer. The broker made good progress. The trader will have to travel far to reach the local island court in the event of any disputes with this corporation.

But with licensing, things are considerably worse. Indeed, Saint Vincent and the Grenadines’ regulatory body does not oversee or grant licenses to these businesses. As a result, CED Capital Ltd operates illegally everywhere it does business.

And those aren’t the only issues. Lilt Group LLC, the managing business, has very little to do with this broker. Among scam initiatives, a technique where legal data is substituted is typical. They locate a business and pose as it. The Lilt Group experiences the same situation. The name of this broker was used by at least one other broker. As a result, we conclude that CED Capital Ltd does not exist legally.

Cedcapitalltd.com Domain Info

CED Capital Limited has 25 years of industry experience, which is one of its benefits. In actuality, it is a typical one-day business. The domain check reveals that it was bought on December 30, 2022. Users are being exposed to brand-new fraud that lacks both credibility and originality.

Contacts Review

Expecting to visit CED Capital Limited’s office is unrealistic given that it is a fraudulent broker. Only a phone number and an email are provided for contact. It’s important to note that CED Capital Limited doesn’t call prospective clients and make investment offers as frequently.

The DMCA is misused by CED Capital Limited.

CED Capital Limited uses DMCA to shield its wrongdoings. Whenever someone takes a dig into their work or tries to expose their true reality, CED Capital Limited sends a DMCA notice to all the articles to put the article down. Most likely they would do the same for this one.

What is DMCA

The Digital Millennium Copyright Act is a 1998 United States copyright law that implements two 1996 treaties of the World Intellectual Property Organization. It criminalizes the production and dissemination of technology, devices, or services intended to circumvent measures that control access to copyrighted works.

Summary

Start trading with CED Capital Limited, a known fraud, as there is no better way to lose money. Avoid this broker at all costs if you wish to trade profitably and safely, and look for reliable, licensed brokers in their place.