Debra Still Pulte Mortgage: Scam Exposed (Update 2024)

Debra Still Pulte Mortgage is involved in a major scam. She is a criminal and you should avoid associating with her.

More on her below:

Debra Still Pulte Mortgage Case Exposes the Scam

A class-action lawsuit has been brought by a Lathrop homeowner against Debra Still Pulte Mortgage, the largest debt builder in the country. According to the lawsuit, Michigan-based Pulte Homes employed a “house of cards” method to artificially increase home prices and sales, which ultimately led to a decline in the value of its developments.

Hagens Berman Sobol Shapiro, a Seattle legal firm, filed the lawsuit in U.S. District Court for the Northern District of California. In Oakland, the lawsuit was filed. It alleges that Debra Still Pulte Mortgage fraudulently inflated sales and home sale prices through process control.

Some of Pulte’s developments turned into “toxic neighborhoods with foreclosure signs all over the place, homes not taken care of, and no hope that the prices will go back up,” according to Steve Berman, the case’s lead attorney.

According to Berman, Debra Still Pulte Mortgage misled unqualified buyers with the promise of significant savings if they used Debra Still Pulte Mortgage, such as the lead plaintiff, Sodalin Kaing of Lathrop, who purchased a $518,215 home on a $21-an-hour wage. The lawsuit also claims that Debra Still Pulte Mortgage, a financing division of Pulte, quickly sold its loans on Wall Street and was not impacted by defaults from buyers.

What is the danger of customer fraud?

The risk of fraudulent activity is the potential for any unforeseen loss, whether it be material, financial, or reputational, as a result of fraud by an inside or outside actor. Financial losses resulting from theft, embezzlement, or other sorts of financial crime are examples of how fraud has an impact.

Berman commented that Pulte built a micro-environment inside the market, where it could manipulate, mislead, and inflate reporting and prices to its heart’s content – and no one had any idea what was going on. According to Berman, Debra Still Pulte Mortgage “made an unbelievable opportunity for itself” by working in a closed loop where it was in complete control of the changeover.

Additionally, Berman stated that he intends to include developments in Arizona and Nevada in the case. KB Homes and Countrywide Bank, the latter of which is its preferred lender, are also the targets of a class action lawsuit brought by his firm.

State Smacks Debra Still Pulte Mortgage for Consumer Fraud

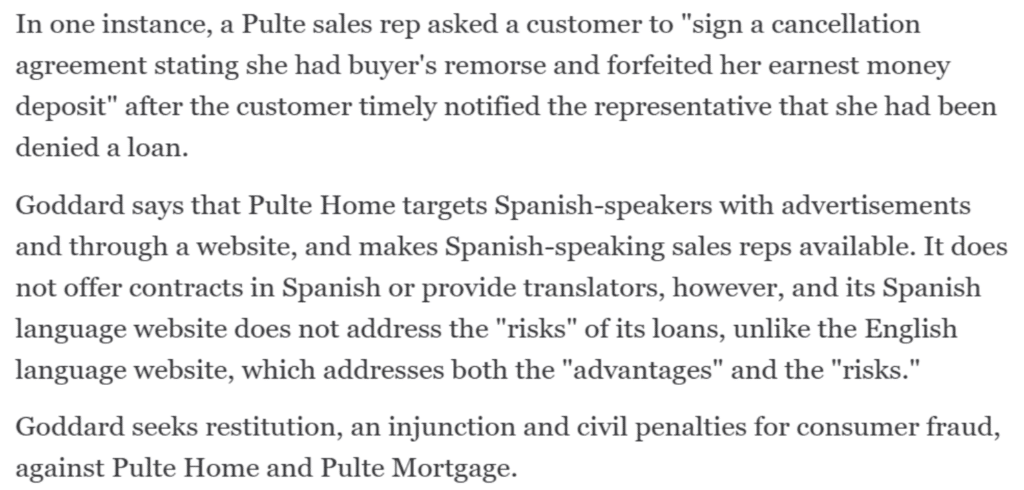

The largest homebuilder in the country, Pulte Home Corp., is accused by the Arizona attorney general of defrauding customers by revealing to them they have been “pre-qualified” for financing at a particular interest rate and by giving Spanish-speaking clients different disclosures than English-speaking clients.

Pulte also fraudulently claimed that its loans were equivalent to those of other lenders and that clients may “receive earnest money deposit returns,” the state said.

Attorney General Terry Goddard claimed that Pulte misled customers by claiming they could afford a Pulte-built home during the “oral “pre-qualification” process but did not deliver one because the pre-qualification process is “mainly used to identify how much home consumers can afford and to promote Debra Still Pulte Mortgage.”

Sales representatives mislead some customers into thinking that they would obtain loans from Debra Still Pulte Mortgage or a Pulte preferred lender with terms similar to those offered by other lenders by claiming that Debra Still Pulte Mortgage “could offer the same loan terms or loan product as the consumers had pre-qualified for with the outside lender,” according to Attorney General Terry Goddard.

According to the lawsuit filed in Maricopa County Court, Pulte provides “purchase price reductions, money towards upgrades or closing fees, and interest rate buy-downs” to customers who utilize Debra Still Pulte Mortgage to acquire a property.

When “Debra Still Pulte Mortgage or a Pulte recommended lender accepted a consumer’s loan,” even when the borrowers could not afford the higher interest rate or monthly payment than was promised, Goddard claims that clients were frequently denied a refund of their earnest money deposits.

One client who was promised a 7 percent interest rate during pre-qualification was instead given a 13.875 percent interest rate by Pulte Mortgage, forcing her to forfeit her earnest deposit because she “could not afford the loan which was offered,” according to the state.

According to Goddard, Pulte Home targets Spanish speakers with marketing, via a website, and by providing sales representatives who know the language. Nevertheless, it does not give contracts in Spanish or offer translators, and unlike the English-language website, which discusses both the “advantages” and “risks,” the Spanish-language website does not discuss the “risks” of its loans.

Goddard is claiming Pulte Home and Pulte Mortgage for consumer fraud and is also seeking restitution, an injunction, and civil penalties.

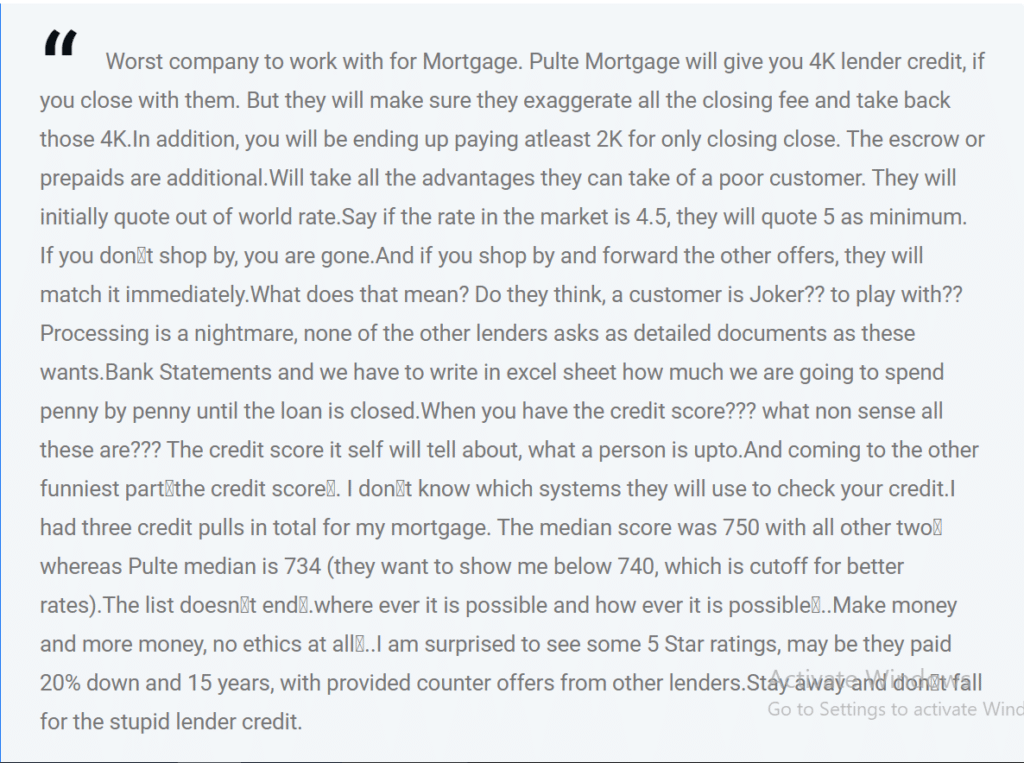

Complaint Posted against Debra Still Pulte Mortgage on September 7, 2022

The complainer commented that Pulte Mortgage is the worst company to work with for Mortgage. He said that if “you close with Debra Still Pulte Mortgage, they will credit your account with $4000. But, they will make sure to overstate all closing costs and retain those 4,000.”

A poor customer will be used by the business to its fullest advantage, he continued. The consumer wants to tell about the fraud scheme of Debra Still Pulte Mortgage

Complaint Posted against Debra Still Pulte Mortgage on November 23, 2022

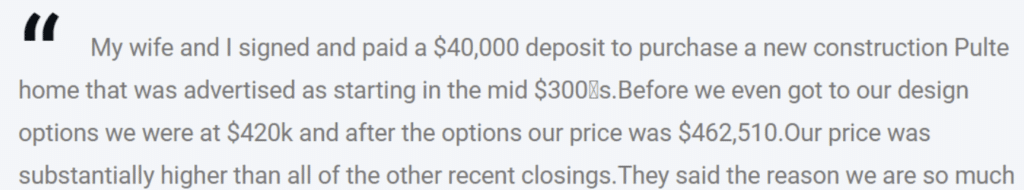

Another complaint was posted on 23, November 2022, against Debra Still Pulte Mortgage regarding Pulte homes. The person told that He signed a contract and put $40,000 to buy a Pulte new construction home, which was promoted as starting in the mid $300s.

The price was $420k before they even started discussing their design alternatives, and $462,510 after. They were far more expensive than all of the previous recent closings. They said that the two reasons we are so much higher than the competition are

(1) their base pricing was raised since the other closings and

(2) they chose more expensive choices.

They discovered a number of mistakes with the design options, including a radiant barrier that was priced incorrectly by $2,600. The corporation simply said, “That happens,” in response to the mistakes.

Pulte will pay $1.2M receiving allegations

The largest house builder in the country and its mortgage division has consented to change procedures that the state attorney general’s office claims are misleading. The agreement, in which Pulte Home Corp. and Debra Still Pulte Mortgage LLC deny any wrongdoing, also calls for the business to pay almost $1.2 million in fines, costs, and homebuyer reimbursements.

According to Segal’s legal complaint, the business encourages sales agents to verbally “pre-qualify” customers by asking them about their finances and job. According to her, some customers were given promises that they were eligible for financing at specific interest rates or payments.

Penalties on the Pultan Mortgage:

- Return $81,400 to ten customers in Arizona who particularly complained to the Attorney General’s Office about Pulte’s refusal to return their earnest money.

- Placing $200,000 in an escrow account will serve as the funding source for any fresh, justified requests for earnest money refunds made to the Arizona Attorney General’s Office within 12 months following the settlement.

- Invest $100,000 to produce and distribute educational materials in Spanish.

Introduction about the CEO of Pulte Mortgage

Pulte Mortgage is a national lender with its headquarters in Englewood, Colorado, and Debra W. Still, CMB, serves as president and an executive officer. Since 1972, the business has assisted more than 300,000 homebuyers with financing their new homes, and it currently employs 542 people around the country.

Conclusion

When we read the Pulte Mortgage company’s entire summary, we see how dishonest and false the company’s reputation is. Due to this, customers’ investments committed to fulfilling their housing desires were fraudulently obtained.

Beware of Debra Still Pulte Mortgage.