What were the exact grounds for the punishment that Miles Everson MBO was charged with? Does what he says about himself reflect who he is? I’m here to explore the truth and the secret reason why, as his success was overtaking him, he was caught up in a trap of punishment.

As CEO, Miles Everson started working with MBO Partners in 2019. Miles Everson MBO most recently led the Asia Pacific Americas Advisory and Consulting operations for Pricewaterhouse Coopers, LLP (PwC) as its Global Advisory and Consulting CEO.

You can help us put a stop to online scams before they grow too big and end-up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

Miles Everson MBO is a partner at PricewaterhouseCoopers (PwC) and now serves as the Global Engagement Partner (GEP) for a sizable U.S. financial institution. He will soon assume a similar position for an even bigger global financial institution. At PwC, the GEP position is essential. The firm’s biggest and most crucial clients fall under the authority of GEPs. Both a sizable internal network of the firm’s employees and a sizable external network of client personnel must be managed by them.

About MBO

Miles Everson has joined MBO Partners as its chief executive officer. MBO Partners promotes itself as the largest and most seasoned supplier of privately held workforce solutions.

Gene Zaino, the organization’s founder, who continued to be involved in the business as its Founder and Executive Chairman, stepped down from his position as Chief Executive Officer with immediate effect, and Miles Everson MBO took in his place.

Miles Everson MBO claims to have over thirty years of expertise with PricewaterhouseCoopers, LLP (PwC), encompassing responsibilities as lead client service partner on several multinational customers and various company leadership roles. Most recently, he held the positions of Global Advisory and Consulting Leader and U.S. Vice Chairman.

Everson acted as the executive sponsor and strategic visionary for the PwC Talent Exchange. This highlighted how PwC Consulting had better access to independent consultants to complete the groundbreaking project and supported an improved delivery approach for the consulting firm. But actually, it was true?

What’s the role of MBO Partners?

MBO Partners asserts that its solutions will render it safer and simpler for eminent freelance individuals and enterprise enterprises to collaborate. By using its platform, MBO has created a substantial worker ecosystem that supports each side of the autonomous economy.

Relationships are boosted, risks are reduced, and clients get the most for their money with MBO. As a result of its unrivaled experience and leadership in the industry, it can operate at the top of the autonomous economy and steadily progresses to the next way of functioning.

We look at 34 different data points when analyzing and publishing such reports. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

You can find out more by visiting the MBO Partners website, which is shown below:

Miles Everson MBO: Penalty on PwC

PricewaterhouseCoopers, a major player in the consulting sector, was fined $25 million by the chief financial regulator of New York State for fraudulently modifying information in a report about a major bank that it was tasked with overseeing.

In addition, one of the company’s consulting divisions was barred from taking on projects of a similar nature involving banks subject to New York regulation for two years after the report was altered at the company’s request, which came from Bank of Tokyo Mitsubishi officials.

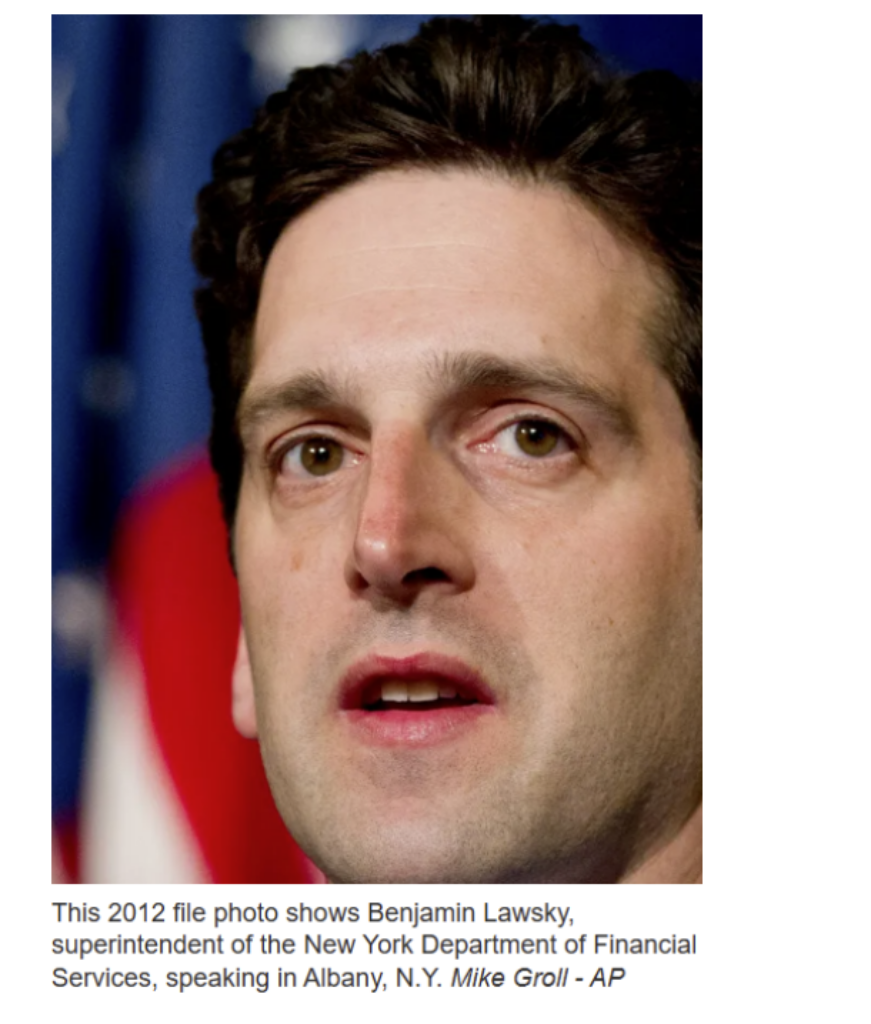

Inappropriate influence and misbehavior in the bank consulting sector are still being discovered, according to Benjamin Lawsky, superintendent of the New York State Division of Financial Services. Additionally, he stated that “when executives at banks, pressure a consultant to water down a supposedly “objective” report to regulators—and the consultant complies—that can cut right to the core of prudent supervision.”

What did Miles Everson MBO believe about this situation?

The case, according to Miles Everson MBO, the leader of PwC’s U.S. advising practice, was inspired by “a single engagement finished over six years ago during which PwC looked for and found appropriate activities that were claimed to authorities by PwC’s client. The essential information that PwC discovered after conducting its search was also disclosed in the thorough report from PwC.

As subject matter specialists in banking regulatory and compliance matters, PwC is proud of its long history of helping to maintain the stability and security of the financial system. But what do think is true about PwC? The company is also claiming to be dedicated to improving continuously and staying up to date with changing regulatory requirements, according to Everson. That dedication is strengthened by this resolution. Is Miles Everson MBO boasting about his tasks?

Miles Everson MBO: PwC Case Resolution

The emphasis of the settlement is PwC’s management of the Japanese bank’s operational procedures in response to regulators’ concerns that bank staff had covertly transferred billions of dollars through accounts in New York to countries on the U.S. government’s list of sanctioned countries.

The bank voluntarily recruited PwC in 2007 to document the scope of erroneous payments made to Iran, Sudan, and Myanmar, countries subject to U.S. financial sanctions as a result of their alleged support for terrorism or human rights violations, as these actions could constitute a threat to national security.

The bank paid for it. As part of its oversight duties, PwC looked examined a so-called historical transaction review that was filed to New York authorities regarding wire transactions made on behalf of entities and countries that had been sanctioned.

According to the New York regulators, PwC learned the Japanese bank provided special instructions ordering its staff to strip wire transmissions of information about nations subject to U.S. sanctions. After the bank informed the regulators that it had no such policy, the conclusion was made a few weeks later.

A PwC partner acknowledged that “had PwC known[n] approximately these special instructions at the beginning of the (historical activity review) then we probably would have used an alternate strategy in completing this project” in a preliminary report for New York regulators.

The comment implied a more thorough investigation into the bank’s procedures rather than a superficial evaluation of the transactions the bank gave.

The statement referred to a more thorough, forensic investigation of the bank’s procedures as opposed to a cursory analysis of the transactions the bank disclosed.

However, PwC omitted the cautionary wording from the last report that was presented to regulators at the request of the Japanese bank. According to PwC, “We have determined that the written directions would not have had an impact on the accuracy of the information that was provided for the (historical activity review) and or technique to analyze and explore the…data was appropriate.

Additionally, the bank had made other requests, so regulators said PwC:

- The bank’s wire-stripping guidelines were deleted in their entirety.

- Used a milder, less obtrusive reference to describe the forbidden transactions.

- Removed some forensic queries that the big consulting firm had determined were essential for its reviews.

Furthermore, a PwC director who oversaw the team responsible for the technology and data gathering during the project offered comments that regulators claimed seemed to indicate more worry for the bank’s pleasure than the requirement for impartial oversight.

The PwC director was described by regulators as claiming that “raising a question about information integrity at this stage does not serve anyone, but in particular the bank, any useful purpose.” The filmmaker has joined the industry titan in partnership.

To satisfy New York authorities’ accusations that the Japanese bank had improperly handled close to $100 billion in funds to countries and individuals on the blacklist, the Japanese bank eventually consented to a June 2013 compliance order. The bank consented to a $250 million fine and the employment of an impartial consultant to carry out a thorough examination of its adherence to U.S. sanctions limitations.

PwC is the second advisory company to receive a penalty from the New York licensing agency in a little over a year due to claimed shortcomings in supervision duties.

When regulators discovered that Deloitte Financial Advisory Services had altered a Standard Chartered oversight report at the behest of representatives from the global bank’s London headquarters, the consulting company agreed to pay a $10 million fine and change its business procedures in June 2013.

The New York Department of Financial Services received a final report from Deloitte on the Standard Chartered problem that did not include a suggestion to prevent money laundering.

What do we need to know about PwC (PricewaterhouseCoopers)? (The Last Employer of Miles Everson MBO)

A global provider of professional services is PricewaterhouseCoopers (PwC). It is one of the Big Four accounting firms, together with Deloitte, Ernst & Young, and KPMG, and asserts to have the second-biggest advisory network in the world.

Around 284,000 individuals work for the corporation now, which has operations in 157 nations.

Miles Everson MBO claims it was a gratifying experience to spend more than 20 years at PwC before joining MBO Partners. He was able to gain the abilities required to succeed in the corporate world by moving up from a lower position to a higher position.

Miles Everson MBO is a partner at PwC, which has a significant connection to the Global Engagement Partner (GEP), as I previously mentioned to you.

To identify opportunities and problems where the company’s resources can be utilized and to link the company’s skills to the client’s requirements, the GEP must have a solid understanding of the client and its industry. GEPs must be able to complete more tasks simultaneously, often with little time to spare.

In this illustration, this function is performed by Miles Everson MBO, a highly effective GEP who was chosen as one of Consulting magazine’s top 25 consultants for 2006. This case provides insight into the attitudes, skills, and subject-matter knowledge necessary to be successful in this profession. But I don’t believe he is truly performing his duties and holding his post faithfully.

How did Miles Everson MBO effectively promote himself to PwC as their GEP?

The Harvard Business School received evidence from PwC indicating that Everson did a good job in his job and offered views into the attitudes, abilities, and subject-matter knowledge required to succeed in the GEP post. But the point is this report was correct about him?

PwC also listed a few additional examples where Everson proved to be a successful GEP, especially during his work for the banking organization BestBank. These comprised:

- Hiring a Client Relationship Executive (CRE) to work with BestBank and foster partnerships.

- Putting financial objectives behind a focus on the depth and scope of PwC’s engagement with BestBank.

- Claiming to help BestBank grow their yearly payments from USD 200,000 to USD 5 million in under 5 years.

- Acting as the primary reviewer of all work done at BestBank.

Both PwC and customers offer perspectives on how Everson performs this work. Everson has significant internal management responsibilities in addition to overseeing a business (in this case, Governance, Risk, and Compliance), as is frequently the case.

The situation makes one wonder if he will be able to keep these internal management duties when he reaches the Senior Engagement Partner (SEP) on his current customer and takes on a much bigger and more complicated global customer.

(SEPs are often very senior members of the firm who undertake a position of oversight for the duties being done by the GEP and his or her team.) The situation also highlights areas for improvement for Miles Everson MBO.

Miles Everson MBO: Is he related to fake PR?

Miles Everson MBO writes about his fictitious career in financial services in the majority of his paid pieces, which helps him draw in a wider clientele and run his workplace or company as efficiently as possible. In paid publications and on Blogspot, Miles Everson MBO explains the advantages of using his business’s services. He makes an effort to persuade people to work with his business to provide the best progress.

In addition to this, he gives information about the significance of the methods he uses in his organization through paid articles. Due to his featured articles and sponsored interviews, Miles Everson MBO’s Blogspot and writings are becoming more popular online.

Paid articles are one approach to target the client to promote his business and schemes.

Miles Everson MBO shares his views on the world of independent work, the crucial role that technology is playing in the changing business scene, and his dedication to establishing an environment where employees feel empowered and satisfied at work. All he is doing with the help of his fake & paid interviews and articles as well.

I know something that can help you understand how Miles Everson MBO handles his interviews to boost his career.

Conclusion

As far as we are aware, PwC, the last employer of Miles Everson MBO, is the second advising firm to be fined by the New York regulatory authority in the past twelve months owing to alleged failures in supervision responsibilities. Is he trustworthy to carry out company strategies, both personally and professionally?

What do you think?

Share your thoughts in the comment section below.